Time for legislating ‘inflation targeting’

By Harsha de Silva

This is the last of my interventions in the money printing-inflation debate for the time being. I explain in detail what the problems are and what the solution is for the current high-inflation regime.

Central Bank response

The Central Bank of Sri Lanka [CBSL] has responded to the criticism that the current high inflation regime in Sri Lanka is caused primarily by its ‘irresponsible money printing’. CBSL has stated that it is not printing money irresponsibly and therefore is not responsible for the high inflation. The gist of the argument is that yes, the CBSL prints money which is called ‘reserve money’ [RM], but only to a target level, and not a cent more. The author explains that RM has two components; one, net domestic assets [NDA] which for the most part is reflected by CBSL holdings of government securities in the form of Treasury bills that is referred to as net credit to government [NCG] and the other, net foreign assets [NFA] which consists of CBSL holdings of foreign assets. Even though I disagree with the argument that the CBSL is not ‘irresponsible’ in their printing job, which I will discuss later, the manner in which it was written was most professional and due credit is given.

However instead of keeping the debate at a professional level however, the Governor has, once again attacked critics of economic policy as ‘terrorist sympathizers’ on ‘deliberate misinformation and negative publicity campaigns’ to ‘undermine the economy and thereby the country’ at a talk given at the Institute of Chartered Accountants [ICA] on February 21. [His presentation is available with the author and the ICA]. It must be noted that such repulsive and unwarranted accusations are not appreciated in a civilized society. It is hoped that at least in the future he would have the ability and courage to respond professionally instead of intimidating critics by placing their lives in danger.

Defining the problem: CBSL gets the basics wrong

Before attempts are made to address a problem, the problem itself must be understood. The Acting Director of Economic Research of CBSL speaking at a seminar organized by Kelaniya University on February 14 has defined inflation as “a sustained increase in the rate of increase in price levels” [presentation is with the author]. According to this definition, price levels have to increase at an increasing rate for there to be inflation. Suppose prices are rising at 10 percent period after period which is globally accepted as 10 percent inflation. But according to this definition, this is not inflation. Only if prices rise at say, 5 percent in period 1, 10 percent in period 2 and say 15 percent in period 3 there will be inflation. This is simply wrong.

|

Now to the problem

As per the globally accepted definition, current CCPI inflation in Sri Lanka is 24 percent and 21.6 percent using the CCPI[New]. The question then is why are we experiencing such a high rate? The critics are of the view that the CBSL is increasing the money supply by more than the demand for money which is in turn driving up prices. But, according to the CBSL, that is not so. It has been proudly reported by the CBSL that “The reserve money target for 2007 was set at the stringent growth rate of 11.7 per cent or, in value terms, an increase of Rs 27.7 billion to Rs 267.6 billion. However, the actual amount of reserve money as at end December 2007 was even below at Rs 264.4 billion”. The problem however is no one [except those at the CBSL] is interested in whether RM targets are met or not. What people in this country want is low inflation. But the CBSL says to achieve low inflation its RM targets have to be met. Ok, let us grant that for the time being. But then the question is, if the RM targets were met with ease, how did inflation which was targeted to be within a band of minimum 7 percent and maximum 11 percent at end February 2008 at the time the RM target was announced by the Governor [Monetary Policy Roadmap, 2 January 2007] turn out to be 24 percent?

CBSL explanation of inflation

is flawed

Facing an unexplainable situation the CBSL has resorted to take cover behind the all too common ‘inflation is cost-push’ argument. The CBSL technical piece states that “the recent movement in inflation in Sri Lanka is largely explained by supply side factors.” Now what are these ‘supply side factors’ one might ask. Well, they are your typical culprits; oil prices, Australian drought etc. The argument is higher costs are ‘pushing’ prices up as opposed to too much money ‘pulling’ prices up. On the face of it, the CBSL logic seems perfectly fine. But reading this together with the earlier statement that there is absolutely no ‘irresponsible money printing’ with RM targets being met comfortably means that the only reason for inflation in Sri Lanka are supply shocks, for the most part high oil and other commodity prices. This argument shields the CBSL from any criticism and more importantly from being accountable for soaring inflation.

|

Regional inflation is mostly

under 5 percent

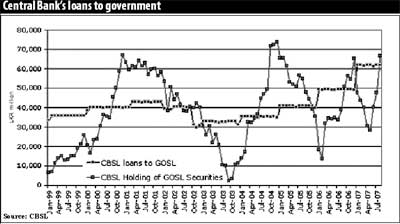

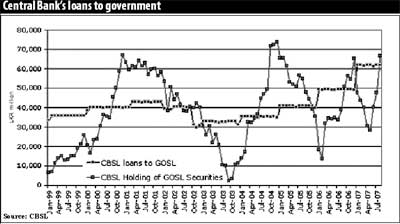

But wait a minute. We are not the only country in this region that face same input prices. What kind of inflation are people in those countries facing? Thailand, Malaysia, Singapore, Philippines, China, India and Cambodia registered inflation around or below 5 percent at the end of 2007. Only Bangladesh and Vietnam had higher levels and that too only slightly over 10 percent. If so, why is Sri Lanka such an outlier? It seems obvious that the countries that have low inflation even after facing high oil and commodity prices are doing something different to ours. What is their magic? As reported in another newspaper last Sunday, the Deputy Governor of the Reserve Bank of India [RBI] at a recent seminar had given away their secret. She had said that they “reached an agreement with the government to stop funding the budget deficit by taking up Treasury Securities on tap or tender.” In other words the RBI does not print money ‘irresponsibly’. In contrast the graph shows [the step-wise line] how the CBSL loans to the government had come down in the 2002 and 2003 period and once again gone up since 2004.

Where is the confusion?

Be that as it may, let us come back to the issue of CBSL printing only the ‘right amount of reserve money’ as mentioned. What is this right amount of money? How is it set? Annually the CBSL sets a target for RM taking in to consideration a number of factors that would impact the real demand for money; particularly economic growth.

At the launch of the Monetary Policy Roadmap for 2007, Governor Cabraal announced that the Rs 267.6 billion target was based, inter alia, on the forecast of GDP growth of 7.5 percent for the year. Now, what was the outcome for 2007? Did the economy expand by 7.5 percent? The latest estimates indicate that the economy grew only by 6.7 percent. That is a significant decrease form the forecast. If so, one would expect the real demand for money would also have been less by a significant amount. The question is, did the CBSL account for the slowdown in economic growth and revise the RM targets downwards? No such revision took place even when it was known early on in the year that the economy was not going to achieve the optimistic growth targets. Thus the natural question is if the RM target which was met ‘comfortably’ simply way too high? The answer is obvious.

Reserve money puzzle:

Accountants vs. Economists

The foregoing was only a technical problem; that if using a 5 iron [original RM target] would take the ball way past the green and out-of-bounds [high inflation] it is better to use a pitching wedge [lower-revised RM target] to get the ball on the green [forecast inflation]. Any accountant [immaterial of playing golf or not] would understand this [no disrespect for my many accountant friends]. But unfortunately the problem we are facing is not an accounting one, but rather an economics one.

The correct amount of RM in an economy at a given time depends on whether it is determined in the market, based on real demand for money, or administratively planned by a central bank. This is where the problem gets a bit complex. The ‘right amount’ of RM also very much depends on the exchange rate regime. Suppose a country has a fixed exchange rate or a currency board instead of a central bank [like Hong Kong for example], then the RM level is determined solely by market forces as per the holdings of foreign assets. Now suppose a country has a free floating exchange rate where it’s central bank administratively [exogenous to be technically correct] sets the level of RM. Here the central bank does not influence the exchange rate. Every economist agrees with this position; that central banks cannot at any given time control RM and the exchange rate. The problem starts when politically motivated central banks actually attempt to influence both RM as well as the exchange rate. This is inconsistent and cannot be maintained. We have seen it happen many times in the past including in 2001 when we pretty much ran out of reserves and had to ‘free float’ the currency, which however has since changed back to a ‘managed float’ since December 2006 due to heavy CBSL intervention notwithstanding CBSL denials.

Sterilized intervention

The theory is a bit complex, but, let us consider a simple example. Suppose there is depreciation pressure on the Rupee due to lower real demand for the currency, but the government wants none of it. Now the CBSL intervenes to sell USD and purchase Rupees to hold the currency from depreciating. In this transaction the amount of reserve money, or RM will fall [lower net foreign assets; NFA]. But remember that the CBSL has an ‘administratively planned’ RM level and therefore, it must replenish the lost reserves [NFA] by increasing net domestic assets [NDA] even though the CBSL knows it is beyond the actual demand in the market place indicated by the original depreciation pressure.

This NDA increase, or in other words the increase its Treasury bill holding of the CBSL which will appear as an increase in the net credit to government [NCG] is ‘excessive’ money printed ‘irresponsibly’ which will lead to inflation.

That is why the inflation rate and the level of NCG have a very strong correlation. As for the author of the technical piece who seemed to think the relationship between inflation and the NCG was spurious and seemed quite confused, it might be better to go back to basic statistics and rerun the models with lags to see that the change in the NCG and the CCPI inflation has a large positive correlation with a coefficient of at least 0.54. The correlation is even stronger with the SLCPI at 0.75.

Back to the problem

So the structure of the problem is now fairly obvious. The CBSL is attempting to control money supply by using reserve money as the operating target which is out of sync with the actual requirement for money, based on the real demand for money. At the same time, the CBSL is intervening in the foreign exchange market to hold the par value of the Rupee.

Thereafter it is sterilizing the losses in NFA by printing money to keep to what is obviously an incorrect reserve money target.

These attempts to influence both exchange rates and RM within a framework of being captive to the government to monetize its deficits [as seen in the graph earlier] are simply untenable and the result is the high inflation we are now experiencing. This piece is not only about the problem, but also about solutions? So, what is the solution?

Inflation targeting as an option

This is where inflation targeting comes in. Inflation targeting [IT] is a policy where a central bank publicly announces a numerical target or a band for inflation to be reached over the medium term for which it takes full responsibility. This is very different to current CBSL policy of taking credit for meeting their reserve money target but not taking any responsibility for out of control inflation. ‘Invented’ in New Zealand in 1989/90 IT is a rule-based regime where the central bank will conduct monetary policy to hit the ‘thick point’ target by utilizing tools available to it; particularly very short term interest rates. IT has become a ‘hit’ with countries that suffered high inflation but wanted to truly [as opposed to pretending to] bring inflation under control. Today there are over 25 countries that have adopted IT and early research point towards solid success.

IT works; read all about it in the new JDE

The best empirical evidence thus far comes from a brand new article by Goncalves and Salles in the January 2008 issue of the Journal of Development Economics where they consider the evidence of IT in a number of developing countries. Their conclusion is “compared to non-targeters, developing countries adopting [an] IT regime not only experienced greater drops in inflation, but also in growth volatility, thus corroborating the view that the regime's ‘constrained flexibility’ to deal with adverse shocks delivered concrete welfare gains”. Comparing Brazil, Chile, Columbia, Czech Republic, Hungary, Israel, Mexico, Peru, Philippines, Poland, South Africa, Thailand and South Korea who had moved on to IT regimes by 2001, with a similar set of countries without an IT regime, the authors find that the IT group was able to bring down inflation by 11.4 percentage points during the study period whereas the non-IT group was only able to reduce inflation by 6.5 percentage points.

What about IT in Sri Lanka?

There have been numerous calls for official shift of monetary policy to inflation targeting in Sri Lanka as well. Neil Dias Karunaratne, in an article in the Sri Lanka Economic Journal of June/December 2006 explains in detail how the CBSL could move towards such an IT regime. Even Governor Cabraal in his 2 January 2008 announcement of the Monetary Policy Roadmap had stated that inflation targeting could possibly be an option for the Central Bank to consider at “some stage in the future.”

Where from here?

First of all the new spokespeople at the CBSL must get their definition of inflation right; the recent one is a terrible embarrassment to economists both in and out of the CBSL. Thereafter they must somehow understand that the mere meeting of some accounting target of reserve money makes absolutely no sense in a regime where they are attempting to influence both a RM target and the par value of the Rupee. At a more technical level they should also realize that the RM levels are out of sync with the real demand for money due to wrong assumptions.

Equally important is the need to understand the difference between one-off increases in prices due to oil prices, Australian droughts or other supply-side factors and properly defined inflation. They must have the courage to take responsibility for inflation and do what needs to be done as is the case with every well governed nation.

Legislation and the

constitution council

Inflation targeting is now a must; not a luxury to be enjoyed at some undefined point in the future. It must be legislated along with complete instrumental independence of the CBSL with the Governor accountable for meeting the IT. In such a scenario fiscal discipline will be forced on the treasury and the Fiscal Management [Responsibility] Act will become automatically operational.

Granted it cannot be done overnight, but there is no better time to start than now. Reactivating the Constitutional Council to appoint the members to the Monetary Board could be the starting point. Otherwise the calls for abolition of the CBSL in favour of a currency board will become more vociferous.

The writer is Lead Economist

of LIRNEasia.

|