|

21st March 1999 |

Front Page| |

Will plantations grow this year?By NDBS StockbrokersTea accounts for 2.2% of our GDPSri Lanka did manage to improve its tea crop to 280mn kgs in '98, from

the 270mn kgs achieved last year, with the global production for '98 being

yet another record unmatched earlier (2,810 mn kgs in '98 & 2,757mn.

kgs in '97 - FAO Statistics). Tea production seems to be on a steady rise,

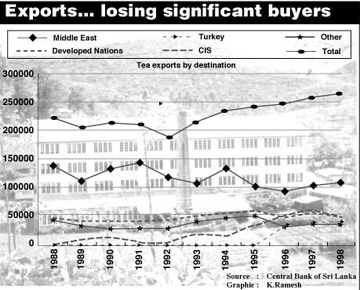

but The entire credit for last year's performance must be bestowed on the low-grown tea producer dominated by the private sector, a sector that has strengthened the country's tea production base. It has been the excess crop harvested in these areas that has helped to attain these high levels of production, and expected to continue to do so in the future as well. The liquoring varieties had failed to contribute in any way towards increase in crop for '98. High growns did not achieve the '97 levels and recorded a crop loss of 5%. Production from medium grown sorts too had failed to obtain the desired results and dropped by 9%. The decline in the crop was primarily due to the drought experienced in the Western sectors of the country during the 1Q '98. It is the low- grown sector that remained the main prop by increasing production by 10% from last year's levels, accounting for 53% of total production (against 49% recorded in 1997). PricesColombo has remained rather a volatile market for tea and had staged wildly variable prices at times. The last time the bubble burst in 1984 tea was sold at US$ 3.01 per kg (see graph of tea prices in US$). It is very unlikely that these prices could be reached at a future point of time. Although Sri Lankan prices are not directly pegged to the US$, they will benefit from any rupee devaluation (12% in '98) as 90% of the country's tea production is exported. Despite a sudden crash in tea prices commencing from about the 2Q '98 the total average of all tea sold in '98 is 12% above the prices fetched in '97. In 1998, high-grown prices suffered the most with startling drop of 22%. medium varieties down by 25%, and low-growns suffered a drop of approx. 17% which occurred between August and December '98 after the Russian crisis. Note that high-growns fell starting in March, which actually reflected global demand and supply conditions particularly an increase in production in Kenya. Tea averages for January 1999 showed a decline of 17% in relation to January 1998 prices. Liquoring teas such as high and medium growns have each declined by 20% and the low growns by 14% on last January levels. Prices in Colombo continue to tumble, reaching a new low on March 2 '98 (latest available auction prices). What is most disturbing is that although volumes amounting to approx. 6 mn kgs were offered for sale during the months of January and February, only approx. 78% was sold from the auctions. The balance being withdrawn for want of suitable bids. Most of this was low-grown tea and under these circumstances the averages registered at these auctions may not reflect the true position in the industry. Also concerns are mounting on the ongoing large sales which are to occur frequently in the future, and even though Colombo has handled large sales earlier, with favourable results, this time the trade seems to have over-reacted by having too many such sales within short periods of time. The final outcome has proved contrary to expectations. While we have shown the above prices in Rupee terms (since RPC costs are Rupee denominated), prices in dollar terms actually show greater adverse movements, and present levels are around 18.6% and 37.8% below the '97 and '98 levels respectively. The recent steep falls in January and February are mainly weather related as a few flush months have contributed towards a large volume of low quality tea. If the weather improves, namely the rainfall level subsides and the plantation areas experience some dry winds, quality along with prices can be expected to improve, though still stay well below '98 levels. World pricesSince 1977 there appears to be a distinct 6 - 7 year cycle for tea prices The peak for the apparent cycle 1991/1997 was experienced in 1997-98. While there seems little correlation between price and production we believe the cycles are primarily demand related. Prices rose steeply in 1997 and can be mainly attributed to the advent of Kenya as a strong producer, which in turn actually created an increase in demand. Over the years Indian tea prices have been considerably higher than both world and Sri Lankan averages since India exports only the very high quality teas such as Darjeeling's and Assam teas, and domestically consumes the lower end of the market. From 1995 onwards, with the entry of CIS in a big way, Sri Lankan prices shot up surpassing both Indian and world average prices. This situation reversed during the second half of '98 with the absence of CIS at our auctions. Even though India is likely to be a net importer in the future it is likely that high quality teas still will be exported and lower sorts imported for domestic consumption. Indian competitionThe new free trade agreement signed in December with plans to grant concessions such as zero duty imports to Sri Lankan tea exporters would prove to be direct threat to the Indian industry due to the relatively low tax rates in Sri Lanka which may encourage the Indian companies to buy from Sri Lanka while ignoring the country's own producers. But the opening up of its import policy for re-export and domestic consumption should provide a positive marketing window for Sri Lankan teas. With the existing Rupee Rouble agreement between India and Russia, India has an added advantage over our teas and we still may be able to retain CIS as a main buyer indirectly in the event Sri Lanka is excluded from the negative list, even though India will benefit from value addition element if the Indo-Sri Lanka Trade Pact materializes. At the moment there is an ongoing debate as to the inclusion of tea and rubber into either countries' negative list. By and large it is likely that more time will be needed for both parties to come to an amicable agreement, which at the moment is under heavy scrutiny by both governments. Tea exports for the year 1998 reached a highest ever, 271.2mn. kgs. improving on the previous highest figure of 268.5mn kgs recorded in 1997. The quantity gains is a nominal 1%, but the average FOB value per kilo has increased 17%, ie. from Rs. 158.38 in 1997 to Rs. 185.34 in 1998. This has resulted in total export earnings in 1998 increasing to Rs. 50bn from Rs. 42bn in 1997. Most interesting is the Dollar earnings of 779mn against 663mn in 1997. The prime destination was the CIS, which absorbed 43.9mn kgs. accounting for 16% of all exports in '98. This is lower than the 54.8mn kgs shipped to the CIS in 1997. A matter of concern is the declining trend of value added exports which, in 1996 accounted for 46.8% .of total tea exports, but by 1997 dropped to 44.7% and to 41.1% in 1998. CIS...trouble with the RoubleWith the passing of the 1999 Budget in Russia in February this year critics say inflation will double or more with the Rouble already dropping below the planned 21.5 per Dollar. The IMF meanwhile is looking at Russia's economic reforms and development over last year to carry out talks on a programme of credits for 1999. It is estimated that 95% of teas to Russia is in the form of value added products of which 70% is directly from India. Russian buyers have restored their buying at the auctions but it has been mainly the lower end teas of the market Iraq..negotiations are under wayUnder the Oil-for-Food programme Sri Lanka is allocated a 2.5mn kg supply (At Rs. 85/- per kg.) which is mainly off grade teas, and delivery expected to be scheduled in May this year. Given the relatively low quantities offered under this tender it is expected that Iraq will soon open a fresh tender in April. Also it is understood that Vietnam has received a much larger order than Sri Lanka totalling 5mn kgs and India approx. a million kgs. Given the political situation in Iraq vis-a-vis conforming to UN resolutions, the country is still a long way from importing the average 20mn kgs pa. from Sri Lanka, as it did during the years '88 to '91 from Pakistan; another large buyer is said to be the largest importer in West Asia, taking about 40% of the region's consumption. Sri Lanka's tea exports to Pakistan was 10% in 1988 and this figure dropped to 1.5% in 1997 due to expiry of the preferential duty rates accorded to Sri Lanka tea which made Pakistan to return to Kenya whose teas are much cheaper. With the currency devaluation (40% against the Dollar) in Iran in February there is a possibility that future buying from the Colombo auctions might be reduced. Egypt, also another large importer of tea, will be increasing its buying from Kenya due to a preferential trade and tariff agreement signed between East African nations. This will reduce the import duties of the supplying nation to approx. 5%, whereas countries like ours get charged 20% - 30%. As depicted above the selected plantation companies had recorded profits for the 4Q '98, but all RPCs did not achieve the profits recorded in 4Q '97 which was a very good quarter due to spiraling tea prices. The worst affected RPC's are Kotagala, Kelani Valley, Hapugastenna, Udapussellawa, Madulsima and Balangoda who recorded losses in 4Q '98 but will remain profitable for the financial year due to high margins achieved by these companies in the beginning of 1998 when the tea prices were at its peak. Most RPCs recording negative profits are those saddled with a substantial amount of bought leaf compared to RPCs which have minimum bought-leaf operations (e.g. Maskeliya). Tea Small holder Factories Limited, a 100% bought leaf operation in the low-grown sector recorded a marginal Rs. 11mn NPAT for the 4Q '98 as against Rs. 25mn achieved in 4Q '97. With these factories having to purchase the green leaf on a formula stipulated by the government (i.e. 68% of the previous weeks auction NSA) the company's margins have eroded with the sliding of the low- grown tea prices. The upward trend in prices contribute towards impressive profits while declining prices adversely affect company profitability. Estate level profitabilityThe table at right shows the expected estate level profitability of the RPCs for the month of January 1998. The calculations are based on elevational NSA, and production levels for each RPC, the published COPs. It must be noted that these are estate level profits, before interest and management fees and that the higher the revenue, the higher the management fee. Future outlookAs vast changes are taking place in the world's major economies and Sri Lanka in return will get caught up in an entanglement of international repercussions, observations by sector specialists indicate that the tea industry is undergoing a turbulent period. This is detrimental for plantation companies who are now used to the high margins from tea and to add to their current problems the rubber sector which is in a worst dilemma, will result in overall margins achieved by the RPCs to be marginal or negative. A brief look at rubberRubber prices dropped to a low ebb with prices declining from Rs.75 to Rs. 43 last year, adversely affecting the liquidity position in the RPCs who now are said to be looking at measures to curtail long term expenditure for short term survival in the industry. Due to the prevailing low prices fetched for rubber, which will have serious effects on the long term viability of the natural rubber industry in Sri Lanka, appeals are currently being made to the Plantation Ministry for some relief to safeguard the industry in the form of moratoriums on lease rentals, GST exemption from major inputs and investment relief on capital expenditure incurred on replanting. The future for rubber prices still remains bleak as demand for natural rubber (particularly from Asia) is still poor, with no signs of an immediate turnaround. TeaRPCs could still salvage themselves from the effects of poor prices provided labour costs remain constant, productivity increases by attaining better yields and replanting higher grades of tea. Also it is observed that most plantation companies have utilised the ADB line of credit facilities for replanting, infilling and factory upgrading. Also RPC's have an added disadvantage of not being able to claim GST charged on inputs, which has increased to cost of production of tea by approx. Rs.2/kg. With local labour costs being the highest in the world, it is unfortunate that inspite of steady increase in wages efficiency has dropped. A price wage formula settlement would have been the best under these conditions. ConcernsManaging Agent's fee which is an operating cost based on turnover and operating profits reduces the attributable profit further (approx. 20%-30% of PBT). We believe the fee itself shows to what extent the Managing Agent is willing to reinvest in the company to enhance the value of the shareholder's wealth and survive in the long term. We feel investors should look at plantations that are owned and managed by quality managers and take out minimal fees. Sri Lanka is not directly competing with Kenya since our teas command a premium price therefore quality is a vital factor. Recently there have been instances due to weather and inefficiencies in the production process where the quality has taken a beating which cannot command a premium price. Also if Sri Lanka is to satisfy large quantity buyers in the long term, we need to replant and infill more in order to consistently satisfy quantities while greater adherence will have to be made to quality in the production process. WeatherAlso weather patterns have changed considerably during the past decade, and a proper assessment of the actual situation becomes difficult. The tea world had faced situations of over production earlier on several occasions, and there have been instances where production had to be physically curtailed to bring about stability in the prices. An agricultural product such as tea is subservient to the vagaries of nature, as predicted by the FAO; an over production situation makes the immediate future for tea look rather murky. The spurt in tea prices, in particular, has made Sri Lanka rely more heavily on commodity exports, leading it once more down a path that export-oriented industrialisation had sought to move away from. However the difference this time, hopefully, is the value added element. Also, improved marketing efforts, increased productivity and quality enhancement will play an important role in helping our country to diversify its exports successfully. We feel that tea prices which reached the top of the cycle at the start of last year will stabilise again around mid July to about Rs. 120 per kg. With the falling demand and competitive pressure on tea and rubber prices causing earnings of listed RPC to fall, we see only limited upside in share prices over the short term. We maintain a neutral position in the plantation sector, but there are good buying opportunities on a selected basis.

RPC Revenue (Rs.) Est. Cop 98 TotalBogawantalawa Plantations Ltd. 111,109,699 112.24 106,444,465 4,656,234 Balangoda Plantations Ltd. 104,970,653 107.77 100,785,477 4,185,176 Maskeliya Plantations Ltd. 103.445.870 94.86 77,706,328 25,739,542 Agarapathna Plantations Ltd. 88.059,205 100.80 76,195,022 11,864,183 Watawala Plantations Ltd. 88,836,409 100.38 71,298,571 15,537,838 Malwatta Valley Plantations Ltd. 86,104,782 90.83 67,852,401 18,252,380 Hapugastenna Plantations Ltd. 76,083,432 102.75 69,848,794 6,234,638 Kelani Plantations Ltd. 70,603,620 107.06 60,827,843 9,755,774 Mathurata Plantations Ltd. 65,798,919 103.18 57,224,763 8,574,156 Namunukula Plantations Ltd. 63,397,366 115.32 63,205,509 191,856, Kotagala Plantations Ltd. 62,116,853 110.57 57,180,872 4,935,981 Kahawatta Plantations Ltd. 60,962,581 137.39 79,266,474 -18,303,893 Elpitiya Plantations Ltd. 58,442,279 109.41 58,934,395 -192,116 Pussellawa Plantations Ltd. 52,054,755 107.80 42,271,614 9,783,141 Madulsima Plantations Ltd. 47,469,177 93.61 36,510,053 10,959,124 Horana Plantations Ltd. 47,310,938 110.00 40,197,410 7,113,528 Talawakelle Plantations Ltd. 85,407,440 119.00 82,188,225 3,218,615 Udapussellawa Plantations Ltd. 44,566,032 101.16 37,534,338 7,031,693 Kegalle Plantations Ltd. 29,035,923 93.67 22,615,525 6,420,399 Agalawatta Plantations Ltd. 20,557,817 121.00 19,427,639 1,130,178 Elkaduwa Plantations Ltd. 6,157,519 138.20 8,404,876 -2,247,358

Miller Award for WatawalaProf. John Miller will be visiting Sri Lanka from March 28 to April 1. He is a past President of the Confederation of Asian and Pacific Accountants, Prof. Swinburne University of Technology and the Director, School of Management Swinburne University, Melbourne, Australia. Prof. Miller has an unusual depth of experience having been a practising Chartered Accountant and Chairman of a diverse range of companies - a CEO in accounting, in the Public Sector and in Academia. He has extensive international experience in UK, Canada and the Asia Pacific Region. During his visit Prof. Miller will present the "Prof. John Miller AO Award" which is a special award made to special people on special occasions for outstanding services to the Accounting profession in the South Asian Region and for the accounting profession in one's country. Prof. Miller will make his first award in the South Asian Region to Lakshman R. Watawala, a past President of The Institute of Chartered Accounts of Sri Lanka and a past President of the South Asian Federation of Accountants and Founder President Association of Accounting Technicians of Sri Lanka. This presentation will be made on March 30 at the ICASL. Prof. Miller will also conduct a seminar on March 29 on Masters Programs in Business Administration, International Business, Management, Organisation Dynamics and Enterprise Innovation. He will also speak on PhD's and professional doctorates in Business Administration.

Dow Jones & Co newswires for Reuter customersLondon - Reuters and Dow Jones & Company have signed an agreement which will dramatically increase the availability of Dow Jones Newswires to Reuters customers in the financial markets world-wide.The contract allows Reuters customers in most markets to subscribe to Dow Jones Newswires as an optional service. This means that financial markets professionals will, for the first time, be able to subscribe to the full Reuters and Dow Jones news services integrated on a single screen. Before this new agreement, a selection of Dow Jones news was available to Reuters customers in North America only. Peter Job, Reuter's chief executive, said: "This agreement creates a great convergence in the world of financial markets news. We believe our customers will relish the ability to view the Dow Jones and Reuters services seamlessly integrated. We are very pleased to be able to work closely with Dow Jones."

Business briefs...Lauda Air voted "Best Airline"Winner of the "Reisen" magazine readers' poll and the "British Customer Survey"Lauda Air emerged the overall winner in this year's readers' poll organised by the Austrian Travel Magazine, "Reisen". Lauda Air took first place in the best airline category, as well as achieving top marks for food and beverages, service and value for money. Lauda Air is also the most-booked airline, decided "Reisen" readers in the survey, which was evaluated by the market research institute OGM. And that's not all - in the latest customer survey carried out by the British Australia Specialist Austravel, Lauda Air ranked first for standard of seat comfort and quality of in-flight catering and took second place in the overall ratings for world's best Airline.Lauda Air in Colombo is represented by Jetwing Air (Pvt.) Ltd., an associate member of the Jetwing family and will operate one weekly flight from Colombo to Malpensar, Italy during the Summer '99 season. Dubai shopping festivalEmirates Holidays, the largest wholesale tour operator in the Gulf and Middle East, has released attractively priced programmes to the Dubai Shopping Festival from March 18th-April 14th for residents in Sri Lanka.Its key advantage is the guarantee of hotel accommodation during a month when more than two million visitors are expected in Dubai and hotel rooms are hard to secure.Emirates Holidays clients are also entitled to use Emirates' special visa entry processing service. Emirates Holiday's DSF programmes, are now available through travel agents in Sri Lanka or from the Emirates office in Colombo. Delta rewards top agentsDelta Air Lines had a successful Agents Awards Night at the California Grill, Galadari Hotel on March 6, which was well attended by the leading travel agents in Colombo. Recognition for these awards was based on revenue performance for the year January to December 1998. Mr. Helmut Maassen, Regional Manager, South Asia gave away the awards to the agents. The top five agents who received awards were American Express Travel Related Services, Gabo Travels (Pvt) Ltd., George Steuarts Travel International Ltd., Mackinnon Travels Ltd. and Thomas Cook Overseas Ltd. The next five agents were BOC Travels (Pvt) Ltd., Ceyline Travels (Pvt) Ltd., Hemas Travels (Pte.) Ltd., Superlink Travels (Pvt) Ltd., and VMS Travels (Pvt) Ltd. Mr. S. Skandakumar, Managing Director of George Steuart & Co, Ltd., the General Sales Agent for Delta Air Lines in Colombo drew the lucky winner of an air ticket. Ms. Shamala Cooray of Gabo Travels (Pvt) Ltd., won a confirmed return ticket Bombay-New York-Bombay. 'Home Plus' to go islandwide'Home Plus' the popular housing loan scheme launched by The Finace Company (TFC) in September last year is to be offered islandwide from March 1999. The scheme which covered the cost of land, building construction as well as the cost of furnishings and appliances, was test marketed in Colombo over the past six months. The 'Home Plus' housing loan package, provides house builders with 110 per cent of the Bill of Quantity (BOQ) value to ensure unhindered progress during construction while leaving a surplus to provide for furnishing on completion. Ran Mal wins another awardRan Mal Holiday Resort (Pvt) Ltd. Managing Director Ranjith Perera and other directors will be in New Delhi in April to collect the much coveted "International Gold Star Award" from the India International Friendship Society. The award will be presented by a senior Indian Minister. This is not the first instance Ran Mal has won an award. In 1988 they were awarded the "Good Kitchen America Award" at a ceremony held at the Sheraton Hotel in New York. In 1995 and '96 Ran Mal won Enterpreneur of the Year awards in the Western Province Services Section. Exhibition

|

||

|

Return to the Bussiness Contents

Front Page| News/Comment| Editorial/Opinion| Plus | Sports | Mirror Magazine |

|

|

Please send your comments and suggestions on this web site to |

|

unfortunately

the sources for its disposal appear to be fast shrinking.

unfortunately

the sources for its disposal appear to be fast shrinking. Executive

Officer with effect from March1.

Executive

Officer with effect from March1.