|

18th October 1998 |

Front Page| |

Contents

|

||

|

Mind your businessby business BugHaving a ballThe Government has said, time and again that the ban on alcohol and tobacco advertising will go ahead from 1999, despite protest from the industry. So, some in the beer industry have taken the offensive in the form an advertising blitz, as would have been evident from the billboards and the ads on TV. Most of them have doubled their advertising expenditure for the remaining months of this year, knowing very well that they wouldn’t be able to repeat this next year. “Might as well go out with a bang” they say... Battered lion seeks Tiger helpFrom beer to airlines, both of which carry the same majestic animal as their trademark. The crash of the latter’s aircraft has virtually crippled the domestic aviation industry and rivals in the field are also feeling the pinch as well. So, feelers were sent out to the striped kind. “Will we be shot down if we fly”, was the polite query. And the answer was ‘No, if you don’t carry soldiers’ was the reply that was received, we hear. Green moles provide infoWho said the greens were inactive while being in the opposing ranks? Now they are collecting “data” on the boys at the board that invests, helped by the green-coloured moles in that organisation. And, judging from the “evidence” being received, there are many moles and the greens are dreaming of a commission of inquiry if and when they return to power...

Stock Market at a glance

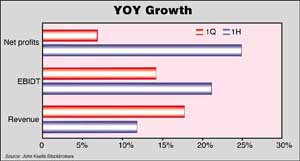

Financial stocks take a beatingRevenues from the Banking and Finance sector has declined during first quarter of financial year 1999, while the other major sectors have shown a revenue increase year-on-year. The onset of the Asian crisis and the subsequent lethargy in the capital market, have contributed to the decline in revenue in the Banking and Finance sector, a John Keells special report on corporate earnings said. Commercial banks fared well, but financial institutions like Asia Capital saw a large revenue decline, while the high capitalised DFCC Bank has seen a 5.5 per cent dip. The absence of capital gains due to the lethargy in the equity markets has contributed to Asia Capital’s decline. Overall, corporate revenues for the first half 1998 has shown an 18 per cent increase year-on-year (YoY), while revenues for first quarter of financial year 1999 has risen to 12 per cent, the report says. The report analyses the interim results of 48 of the most traded companies

on the Colombo Stock Financial stocks have been a loser in both 1Q FFY 99 and 1H FY98. Lower spreads due to a fall in interest rates and higher provisions for diminution of equity portfolios has contributed to the decline. Diversified Holdings sector takes the lead in 1Q FY99 revenues, showing 31.5 per cent growth. John Keells Holdings tops the list, with a 64.7 per cent revenue growths. Earnings Before Interest Depreciation and Tax (EBIDT) for 1Q FY99 shows a 14 per cent increase, and 21 per cent for 1H FY98 companies. Interestingly, the plantation sector which shows a 22 per cent increase for the 1H FY98 shows a negative growth for 1Q FY99. Declining tea prices due to the rouble crisis is expected to exert downward pressure in EBIDT for the rest of the year. In keeping with revenue trends, the financial sector has shown a negative EBIDT growth for 1Q FY99 and a marginal 5 per cent growth for 1H FY98. Despite a poor performance by some development banks and other financial institutions the 1H FY98 figures have been propelled by a 25 per cent growth from Commercial Bank, 26 per cent growth from Sampath Bank, and 21.8 per cent growth from Hatton National Bank. Interest costs have grown by 9.6 per cent for 1Q FY99 for the non-banking companies, while 1H FY98 figures show a decline by 14.7 per cent. Falling interest rates and debt repayments have been the main reasons for this fall. Colombo Dockyard, Lanka Lubricants and Ceylon Tobacco have all shown significant declines in interest exposure due to repayment of debt. Net profits for 1Q FY99 have shown a mediocre 7 per cent growth, dragged down by the financial and plantations sectors. Though the diversified holdings sector recorded a 32 per cent growth, propelled by a 35 per cent growth from John Keells Holdings, overall growth remained subdued. However, the sample aggregate for first half results show an improved 25 per cent growth in net profits led mainly by the manufacturing sector companies. The report states that Sri Lanka has the most conservative gearing levels in the Asian region. The sample reveals an extremely healthy level of gearing at 21 per cent for 1Q companies and 20 per cent for 1H companies. This compares favourably with averages of 75.8 per cent for first quarter and 24.9 per cent for first half for Indian companies. Hence, any adverse movements in interest rates in the country would have a minimal effect on corporate balance sheets. The aggregate Price to Book Value (PBV) for the sample is 0.9, indicating that most companies are trading at price levels below the book values. The large decline of the Colombo bourse over the last four months has resulted in this scenario. Based on the analysis, JK are of the view that the downside potential of the market is limited. Even though an over-valued Sri Lankan rupee, slow-down of exports and falling GDP figures are concerns, conservative gearing levels and attractive PBV ratios should act as a hedge for most companies. A downgrading of earnings in the Banking and Finance and Plantation sector has seen JK revise corporate earnings growth for FY99 from their original estimates of 22 per cent to 17 per cent.

Com centres or con centres?By Mel GunasekeraThe liberalisation of the domestic telecommunications industry is witnessing an alarming growth of telecommunication defaulters, with communication bureaus being one of the biggest offenders. Other high-risk defaulters include overseas recruitment agencies and small travel agencies, telecom operators complained. The lack of streamlined and efficient legal process and an independent credit information bureau is hampering their efforts to track errant customers. The increasing bad debts are also eating into their expected revenue, while jeopardizing the viability of the project, the operators said. While bad debts amount to four per cent of Sri Lanka Telecom (SLT) revenue, for private operators like Suntel the figure is as high as 10 per cent. Communication Bureaus buy telephone lines (from all operators) and sell voice and facsimile services to customers on a cash basis. As the capital outlay is minimal, this business is seen as an easy way of making money. In reality, the owners of these centres use the daily proceeds for short-term investment in other businesses and are therefore unable to effect payment on time. This practice stems from the culture established by SLT, where credit could invariably be extended from 12-18 months without any threat of penalty or disconnection. The telecom industry has identified this segment into two categories: customers who intend to default from the very outset and customers who pay up when threatened with legal action. Industry investigation reveal that errant communication bureaus usually rent a premise for a short period, run their operation and then vacate without prior notice leaving a host of debts behind. In many instances, telecom operators have difficulty in identifying customers operating such businesses, as they buy their telephone under their own name and not in the name of the business. Thus, telecom operators are only able to identify the nature of business by manually scanning the average traffic revenues of individual customers for obvious deviations from established norms. While there is minimum risk attached to the debts of established corporate entities, telecom operators have observed that a large number do extend their settlement patterns thus increasing the operators overdue debt, while adversely affecting their cash flows. Recovering bad debts through legal recourse has begun. But the process is very long and in many instances when summons are served, the customer is not found at the address available with the operator. It also takes about three months from the date of filing the plaint for a case to be called up, in addition to long intervals between hearings. Industry estimates the legal process would take anything from 18-36 months before a case is concluded. Suntel’s current estimates indicate that only 35 per cent of its debts are successfully collected through litigation. “This is naturally not a unique problem for telecom operators’ defaulters but a problem that should be addressed by Sri Lankan authorities in general,” Suntel Managing Director, Jan Campbell said. He called for the legal time for cases of this nature to be streamlined and shortened. Consideration should also be given to establish an independent legal unit to handle these kind of legal cases. Unless all operators work and assist each other in an attempt to curtail bad debts, the subscribers will continue to default each operator in turn, he said addressing a public hearing organised by the Telecommunications Regulatory Commission of Sri Lanka. In developed markets, anonymous and independent creditworthiness data bases are available for the companies who wish to run a credit check on a potential/existing customer. The present Credit Information Bureau in Sri Lanka is only accessible to banks and financial institutions. Sri Lanka lacks the services of such a credit bureau for non-financial institutions. Interestingly, each telecom operator maintains his own list of defaulters, but there is no common system where other operators have access to the list. Industry sources say that a common pool will not be a reality for a while, until the three operators solve the basic problem of interconnection.

Where have all the quotas gone?Investigations are being carried out to ascertain the overshipment of 17,112 quota dozens that has been shipped erroneously either by forging documents or by indicating wrong category numbers, apparel industry sources said. Initial inquiries have revealed that 12,000 dozens visas were obtained under a different category, but once shipped to the USA they were recorded under the ‘hot’ category 634. The reasons for this could be either an error on the part of USA officials or the exporters have changed the visas after obtaining them through internal manipulation. There are also around 2,900 quota dozens where no visas have been issued by the Sri Lankan government but debited in the US customs either by forgery or error. There are around 40,000 quota dozens on hand. We have to deduct the overshipment of 17,000 dozens from the total quantity or face a further embargo, a Textile Quota Board (TQB) official said. Apparel exporters of jackets to the USA (made under cat 334/634) are up in arms against the TQB embargo on the export of their products. The problem arose as there was an overshipment of 92,534 dozens under the 334/634 category in 1997. The movement of cat 634 was rather slow during mid last year. The TQB opened the category in December last year resulting in the demand for quotas exceeding. As a result, 92,534 dozens from the 1998 quota year was utilised in 1997. Business Times learns that the TQB officials requested a 10 per cent cut in this quota category, but the apparel trade instead opted for a 30 per cent differment of quotas; i.e. 15% to be shipped after September 1st and the balance after December 15th. The 30% shift left only 40,000 dozens available for the interim period. But when the Sri Lankan authorities called for figures from USA, they found that around 17,112 dozens could not be accounted for, which amounted to around 60% of quotas at hand.

Master Divers seek water-tight guaranteesMaster Divers the salvaging agents for the damaged vessel ‘Leerot’ is requesting a bank guarantee/bond 80 per cent to the value of the commercial invoice from each consignee to release the containers. The request came after Master Divers had a meeting recently with the parties concerned, including the main line operators, ports authority officials and representatives from leading insurance companies. However, no firm decision on this matter has been taken until a detailed survey is carried out to ascertain the damage, shipping sources said. The bank guarantee will only be required on cargo in good condition. All containers salvaged by Master Divers will be released subject to the bank guarantee.

Liberalising the capital accountThe argument was that a country which had restrictions on capi tal transfers did not attract adequate foreign investments. The conventional wisdom was that with the liberalisation of the capital account, capital would flow in and foreign investments would far outweigh the possibilities of capital outflows. The experiences of several Latin American countries as well as South East Asian countries were quoted in support of this argument. With hindsight it now appears that this conventional wisdom was not necessarily correct. In the light of the financial crisis of South East Asian countries the liberalisation of the capital account is seen as a serious flaw in their economic policies. International investors and speculators weakened the financial position of the South East Asian countries by subsequently withdrawing their capital. The capital outflows were of such a magnitude that it rocked the financial foundations of these countries. In the context of these happenings, it is now said that the capital account should not be liberalised fully. That there should be some restrictions such as a limit to sudden outflows and a requirement for capital inflows to remain in a country for a stipulated minimum period. Unfortunately all these qualifications have come after the event. Meanwhile countries which liberalised their capital account have suffered enormously. Till recently it was fashionable to espouse the liberalisation of the capital account. Till recently the multi-lateral agencies espoused the case for Sri Lanka to liberalise the capital account. Most Sri Lankan economists had argued that Sri Lanka should not liberalise its capital account despite international pressures to the contrary. Sri Lankan economists argued that the time was not ripe to liberalise the capital account as the country’s economy was not adequately stable to withstand sudden movements of capital. Besides this there was an important consideration arising from the security situation. Had the country a fully liberalised capital account, when the security situation deteriorated, capital outflows could have been large. Other significant considerations were the country’s continuous trade deficit, the high rate of inflation and the depreciation of the currency. These three factors make the outflow of capital a real possibility. Unless inflation is controlled to minimal proportions, it is attractive to hold foreign exchange outside the country. A high rate of inflation coupled with a depreciation of the currency makes such capital outflows attractive. Speculators could by their own actions fuel both inflation and the depreciation of the currency and gain from capital outflows at predetermined times. This was a real danger. It is fortunate that Sri Lanka did not get into the type of financial crisis which the liberalised economies got themselves into. The important lesson is that economic policy decisions on the basis of theoretical arguments without consideration of the specific characteristics of a country’s economy could lead countries to serious difficulties. Unfortunately it appears that the multi-lateral agencies do not pay adequate attention to the specific circumstances of a country. These circumstances include not only the economic fundamentals but also the socio-political environments in which developing countries operate. The social and political instability of developing countries could have as much an impact as economic factors. These must be brought into the calculus when determining vital economic policies. The Asian experience in liberalising the capital account once again offers an important lesson to policy makers that they should view economic policies within the proper context of a country’s conditions. It appears that after the recent events multi-lateral agencies themselves have changed their position regarding the liberalisation of the capital account. In retrospect, Sri Lanka has followed the correct policy in not liberalising the capital account. While the country may seek to do so in the future, it must do so only when the conditions are opportune and there is strong evidence that such a liberalisation of the capital account poses no serious threat of destabilising the economy.

IMF Chief defends fund’s policiesMichel Camdessus, Managing Director of the International Monetary Fund has rejected criticisms of the IMF in dealing with the international financial crisis in an interview with Richard Lambert and Stephen Filder of the London Financial Times published in that paper. Camdessus has been accused of being too rigid in imposing constraints on the economies of troubled countries, and of “trying to impose yesterday’s solutions on today’s problems”, says the interviewer. Mr. Camdessus rejects this charge and insists that the Fund programmes

are working in South Korea and Thailand which he says have re-built their

reserves, cracked inflation and restored their exchange There is a question mark over Indonesia, but that he ascribes to politics and argues that the IMF programme, itself is working well. As for Russia, Camdessus says that the programme was fine and what went wrong was its implementation. The interviewers asked the Managing Director whether this was a crisis for global capitalism. “Absolutely not,” says Mr. Camdessus. “There is a financial crisis going on in certain parts of the world but there is also a very powerful unanimty of support behind the basic tenets of capitalism” he told the interviewers. He expressed confidence in the basic health of the world’s biggest economies so much so that he rejects proposals for European countries to pump demand through public spending; rather, he suggests, they should keep a tighter rein on their budget deficits. He was asked: “So how come things look so much worse today than they did in early spring?” Mr. Camdessus points his finger at the political leaders of Russia and Japan. He said he had warned Yeltsin earlier this year that Russia could not rely on monetary policy alone to fight off the Asian contagion; it had to deal urgently with its financial imbalances; it also had to tackle the dramatic weakness of its banking system and it had to attack cronyism and corruption. But, says Camdessus, Russia failed to respond adequately and it made “the dreadful mistake” of “debt reconstruction” of attempting a confiscatory debt reconstruction which sent shivers around the financial world. On Japan Mr. Camdessus says: “Here also the panorama has changed dramatically: Far from helping the East Asian countries to recover, the collapsing Japanese economy has dragged back its neighbours. On the world economy as a whole the Managing Director acknowledges that the world economy is likely to grow at only 2 per cent in 1998 - roughly half the level the Fund was predicting a year ago. Mr. Camdessus invited more criticisms. “Give me more criticisms”, he said. The interviewers asked him about the charge that the IMF should have restricted itself to its traditional mission - balance of payments, monetary control and so on rather than getting stuck into the micro-management of national economies. His answer was that in the East Asian countries we have balance of payments surpluses, inflation below target and exchange rates more or less where they should be, at least in Korea and Thailand. But such measures are not nearly enough to rest over sustainable growth. You also need he said to strengthen the banking system to fight corruption and monoplies and deal with other economic inefficiencies. As regards rigidity, Mr. Camdessus concedes, says Lambert and Filder, that the IMF, may have been a few weeks too slow to react to market changes but “we have shown flexibiliy in adapting our programmes not only to the difficulties that were being experienced by the countries directly but also for the changing climate internationally.” When the interviewers asked whether he was saying that the Fund did not make mistakes, the manging director said, “no no I do not pretend to be infallible”. Mr Camdessus says he does not know how things could have turned better in Asia in view of the instruments that were in place and the degree of international cooperation available to help these countries. The managing director thinks that there are some lessons to be learnt for the IMF and the international community. They include the need for better data on short term capital flows and central bank reserves, improved standards for auditing and bankruptcy procedures and quicker ways of involving the private sector in crisis prevention. There are few tools, he argues, to encourage speedy debt overhangs that have been a feature of every financial crisis since Mexico’s in late 1994. But, he says, there are a few ideas under consideration. One such would be to authorise the IMF to call a short term debt freeze to allow debtors and creditors time to negotiate debt reorganistions. It transpired at the interview that the IMF remains committed to capital account liberalisation, although in a cautious kind of way say the interviewers. Mr. Camdessus has words of warning for Malaysia’s Prime Minister Mahathir Mohamed who has imposed capital controls as part of a bid to shore up the economy. Camdessus says that there could be short term positive results in terms of exchange appreciation and of some apparent stability. But measures of this kind, he feels, discourage foreign investors. Finally, says the managing director, they lead to isolation which in a globalised world is not the way to maximise the growth of an economy. The interview also touched on the situation in Latin America which the interviewers state “has now moved into the eye of the storm. As regards funding in general, the managing director says that the IMF is not having to ration its money among troubled countries and it has enough resources in hand to do its job, provided the Congress of the US does its job as invited by the president and approve the IMF funding. We continue to do our job, knowing pretty well that if the need arises our membership will help us in order to continue.”

McDonalds to please pallet and walletBy Amanthi JayasuriyaMcDonalds Restaurants (MCD) which opened it’s first outlet in Sri Lanka earlier this week has plans to further invest 10 million US dollars in the country in the next four to five years. The first MCD restaurant comes with an initial investment of 2 million US dollars. “The menu should please equally all palates and all wallets, “said McDonalds licencee for Sri Lanka, Rusi Pestonjee. Mr. Pestonjee said 65% of the food products are imported at present while the restaurant has also plans to localize meat and vegetable products in the near future. The first step towards localizing products will be with the introduction of chicken products in the near future. Inspite of having only one restaurant open McDonalds has already been busy developing and working with local suppliers. As a result companies such as Ceylon Agro Industries, (Prima) will supply the buns and bakery products to the outlet, while Newdale Dairies have been contracted to supply the specific mixes for the famous McDonald’s thick shakes and Sundaes. The restaurant also gives very special attention to ensure that all meats used are prepared to HALAL specifications. Restaurant officials say, since there are existing local importers in the market, they hope to develop this, thereby giving a boost to the Sri Lankan economy. The restaurant so far employs 140. All crew members are Sri Lankan..while a nine months’ training was primarily conducted in Australia. All employees have undergone extensive McDonalds training over several months , which ensures that all management and staff are completely familiar with the McDonald’s infrastructure and the way the restaurant operates. “ We hope to recruit youngsters over 18 years of age and give them the freedom to do another job if they wish and continue working or study while working since the hours are very flexible,” said a restaurant manager. Salaries in all Mc- DonaldsRestaurants are based on local wage structures and are competitive within the market place. Company officials say when McDonalds opens restaurants in a new country, the jobs it creates stimulate the national economy and broaden the local tax base.Besides the new jobs directly linked with McDonalds restaurants, the company indirectly supports other segments of a country’s workforce by hiring local construction firms and purchasing from local suppliers, local farmers and local distributors. The company, which has nearly 25,000 restaurants worldwide, hopes to open up another outlet in the Greater Colombo area in the near future.

More Business * Venture capital: a people's business * The Origins of the Asian currency Crisis * Sugar production: no big increase * Half year performance of plantation companies * ISO 9000 family of 20 standards cut down to four * Seminars on 'How to export' * Major revolution in IT * Celltel to provide exclusive cellular services to Vanik * Lions to set up model village * Digital thunder at Epsi show * New chief executive for Citibank N. A.

Front Page| News/Comment| Editorial/Opinion| Plus | Sports | Mirror Magazine |

|

|

Please send your comments and suggestions on this web site to |

|

Exchange

(CSE) for the period ending June 30th 1998.

Exchange

(CSE) for the period ending June 30th 1998.  rates

to something close to normality.

rates

to something close to normality.