|

5th July 1998 |

Front Page| |

Contents

|

||

|

Mind your businessby Business BugElusive BossThe boys who were perky not so long ago are a subdued lot these days, after the flak they took over the deal that handed over a stake of the bird of paradise to the Arabs. But the most interesting news of all is that the boss himself has gone on long leave - two months, to be precise. Some seem to think that it is leave prior to retirement, but others disagree. Whatever it is "where is he, what is he doing" is on everybody's lips these days, at the perky place.... Rewards comingRemember the nonagenarian son of the soil who inspired a banking revolution? He was rather unceremoniously despatched from the bank he 'set' up, but the enterprising man didn't take 'no' for an answer. It has been a long wait for the banking license for his latest venture. But, at long last, the Big Bank that oversees them all is likely to give the greenlight soon, we hear.... Colombo's ChanceOld Blighty held its last tea auctions last week and the tea trade here is all agog. With a little help from the powers that be, they feel Colombo could be the next major tea trade centre in the world. It's up to the authorities to grab this chance and make the most of it, those in the trade say....

Central Bank to issue five year bonds by year endBy Mel GunasekeraThe Central Bank of Sri Lanka will issue a four and five year treasury bond by the year end in a bid to boost the long term debt market, financial sources said. In an attempt to test market reaction, for the first time last week, the CB issued three and four year treasury bonds concurrently. This is the first time the CB auctioned two types of bonds within a day. "The three and four year bond auction would run concurrently till August 15 and in turn would help the market to construct its own yield curve," a senior CB public debt department official said. The first auction included Rs. 750mn in 3-year bonds and Rs. 500 mn in 4-year bonds, he said. "Depending on the market reaction to the three and four year bonds, we hope to go for longer maturities by the end of this year," he said. Most investors are guided by the short-term money market; they tend to shy away from long term instruments. However, a stable exchange rate and stability in the short term money markets would lure investors towards long term treasury bonds, he said. Analysts say long term bonds would provide the private sector with medium-term benchmark interest rates and provide a risk free yield curve beyond the one-year treasury bills. Thus the government is able to make its medium-term debt instruments more market oriented, analysts said. Last week, the 4-year bond carried 12. 93 per cent interest while the 3-year bond carried 13.01 per cent. The high interest rate for the three year bond could be that people are aware of the government efforts to consolidate its fiscal activities and control the budget deficit over a medium term, to bring down inflation to lower levels, analysts said. "If inflation is low, then people demand a less interest rate. Since this was the first auction for this series, there could be a correction in future auctions," one analyst said. Adding. "We should not jump to conclusions till we see the market reactions for the next few auctions". The Sri Lankan government intends to borrow Rs. 82 bn this year, through treasury bonds and rupee loans. However, the composition of the borrowings has changed, and the government is increasing borrowing from treasury bonds as against from rupee loans, the CB official said. He said, of the Rs. 82 bn, Rs. 32 mn would be borrowed through bonds and Rs. 50 bn in rupee loans. Todate, we have raised about Rs. 31.5 bn rupee loans and Rs. 15.3 bn bonds totalling Rs. 46.8 bn. Another Rs. 35.2 remains to be raised during this year. Of this, Rs. 19 bn would come from rupee loans and the remainder Rs. 16.2 bn in treasury bonds, he said. The government turned towards treasury bonds last March, in an attempt to finance their long-term capital expenditure projects. Todate, the government has depended on treasury bills, government loans and other guilt edged securities to finance its operations. This has created a mismatch, as short-term borrowings cannot be used to fund long-term projects. Short term borrowings mean the CB has to re-issue the bills several times and pay the interest rate prevailing at that time. "If your borrowing requirement is large you are exposed to either high or low rate of interest. We want to minimise that risk by spreading the maturities in short, medium and long term," CB officials said. He said the government would not issue new treasury bills in the future, but instead re-issue existing bills once they reach maturity. In 1997, the government retired Rs. 10 bn worth of T bills and the outstanding T bills declined to Rs. 115bn. CB officials were optimistic that the figure would decrease when privatisation proceeds find their way to the state coffers this year. The financial sector welcomed CB decision to develop the long-term debt market. "It's a positive step towards raising capital for long term infrastructure projects. You can't finance long term projects with short-term funds. It's a healthy start," Mangala Boyagoda AGM Treasury DFCC Bank said.

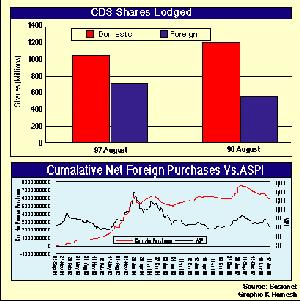

Diminishing foreign presence in the local stock market

As the above chart shows, the coefficient of correlation between ASPI and cumulative net foreign purchases is 0.82. Since of late foreigners have been net sellers, this is reflected in the ownership of CDS (Central Depository System) lodged shares. Foreign shares have been steadily eroding for the last 12 months to its current level of 544.6 mn share (as at end June1998) June this year saw the highest foreign outflow for a month ever, which amounted to Rs. 530.8 mn. The second highest was an outflow of Rs 507 mn during March 1994. Since August last year, the total foreign outflow amounted to Rs 1.96 bn. During this period, it has been a continuous outflow on a monthly basis, except during March 1998.

Vanik issues credit card in BangladeshVanik Bangladesh Ltd. launched Bangladesh's first domestic credit card, the 'Vanik Card' last week. "It was a soft launch and we hope to officially launch it in August this year," Vanik CEO Justin Meegoda told The Sunday Times Business. Vanik is the first Sri Lankan company to launch its own credit card overseas. Golden Key Credit Card Ltd., who has experience in launching its own domestic credit card, provided technical support for the credit card venture. "We decided to go with Golden Key, as we did not have the technical expertise to launch such a project. It also gives an opportunity to another Sri Lankan company to break into the Bangladesh market," Mr. Meegoda said. Initially, the card is limited to domestic use but Mr. Meegoda did not rule out a possible tie-up with VISA/Mastercard in the future. Vanik is targeting 500 merchants in Dhaka in time for the official launch. Since the soft opening last week, 350 merchants have signed up, Meegoda said. The company expects to sign up 1000 customers by year-end. The Vanik card offers two types of credit limits. One, on a full secured basis, where a customer can deposit money in a fixed deposit account with Vanik and draw credit up to 80 per cent. The other method is aimed at high-income bracket individuals, corporate clients, and certain category of professionals. The credit limit would depend on their monthly disposal income, Mr. Meegoda said. At present, Visa and Mastercard through ANZ Grindlays, Standard Chartered Bank and National Bank (a domestic bank) service the Bangladesh credit card market. However, Dhaka merchants allege the membership is restricted to the respective bank's clients and client servicing is poor. In 1997, Vanik was granted Central Bank approval to commence merchant banking and stock brokering operations in Bangladesh, making it the first Sri Lankan institution to start stock brokering operations in a foreign country. For this purpose, Vanik entered into a joint venture named Vanik Bangladesh Ltd. Vanik Sri Lanka owns a 40 per cent stake and the management control of the Bangladesh operation. Mr. Meegoda said Vanik has been given multi national status in Bangladesh, despite commencing operations recently. "We are fairly well known through our commercial operations, and we decided to go for a credit card because we felt there was a need for a domestic card of this nature". "We have no plans to launch our own credit card in Sri Lanka, but our associate bank, Pan Asia intends to issue their own card in association with VISA/Mastercard in the near future".

Lanka Payphones on rocky road to mergerLanka Payphones Ltd. (LPL) has been asked to submit necessary information to qualify for a listing by itself, if the CSE and the SEC are to give the greenlight for them to go ahead with the proposed merger with Lambretta (Ceylon) Ltd. Lambretta, a listed company on the CSE, announced last week that it is to be re-structured through a reverse takeover by LPL. The new company would be called LPL Holdings Ltd. Market sources say LPL is attempting to get a backdoor listing on the CSE through Lambretta, without going through the set procedures. "Considering the cost of going for a listing and the bearish market condition at present, it's a sure way of getting a listing," a broker said. The memorandum and articles of association of Lambretta would be changed to include the end clause as being in the business of manufacturer, dealers, exporters, importers, distributors and providers of telephones and telecommunications services. Lambretta has been running at a loss for several years, with more liabilities than assets. The financial year 1996/97 saw no operations, market sources said. The liabilities exceeded the assets by Rs. 9.4 mn while the accumulated loss amounted to Rs. 15.47 mn in the financial year 1996/97. During the last financial year ending March 31 1998, Lambretta made no turnover and made a loss of Rs. 150,853. The company has no assets, but net current liabilities amounted to Rs. 51,983 and long term liabilities to the value of Rs. 9.37 mn. Lambretta was mainly involved in manufacturing, importing and exporting motorbikes. The company also owns a 99 per cent stake in Lamco Ltd and 82 per cent in Quest Advertising Services Ltd. According to 1997 annual report, there are 518 shareholders, of whom the major shareholder owns 39 per cent while the rest of the capital is widely distributed.

Are environmental regulations a constraint?At a recent ceremony at which the Hayleys Group of Companies re-ceived the award for the topmost company in the country, its Chairman, Sunil Mendis, mentioned that there were four constraints to private sector development. The first three constraints were the exchange rate, smuggling and labour laws and holidays. Interestingly, the fourth constraint he mentioned was the environmental regulations. He was of the view that the environmental regulations were too stringent and unsuitable for Sri Lanka at this stage of economic development. Is this the position of most industrialists'? Are environmental regulations in fact a constraint to more rapid industrial development and economic growth? Although there was no specific reference to particular regulations in specific sectors, it is likely that one of the issues uppermost in the minds of the industrial community is the environmental concerns which may be impeding the growth of new energy sources. It appears that every source of technology that is mooted is shot down owing to objections by environmentalists. The inability to expand our energy supplies would indeed be a serious constraint. As we pointed out recently in these columns the country needs to expand energy resources by about 10 per cent per year and double energy supplies in about seven years. Small hydro-projects and other environment friendly sources are not likely to meet this large requirement. There is little escape from the need for coal power projects which are economic and could supply significant amounts of energy. These are precisely some of the projects which environmentalists object to. However their objections are often based on mis-information. It is true that there is a certain amount of environmental pollution that is inevitable with coal power projects. Yet the technology has changed and if the coal power projects use white coal, then the pollution would be minimal and sustainable by the environment. The option available to the country is to use technologies which are least polluting. It cannot be without enhancing power supplies nor face a power crisis with small generators polluting the atmosphere even more. The concern of industrialists about environmental regulations should not extend to the position of saying that our imperatives of economic growth justify our polluting the environment now and cleaning it up later. Such an approach is extremely costly and irresponsible. Costly because a number of studies done in Sri Lanka as well as in other countries have demonstrated very clearly that the cleaning up of pollution can be exceedingly costly, almost unbearable. Apart from this it is also true that many forms of pollution are irreversible. Environmental degradation can sometimes never be reversed and the environment restored to its earlier condition. Therefore, passing on the cost of environmental pollution and degradation to future generations who must bear it is indeed irresponsible. It is also becoming increasingly clear that good environmental regulations would be an asset rather than a constraint. Exporters know that international markets are increasingly requiring the compliance of environmental standards for the import of commodities, particularly from third world countries. If we are not able to meet those standards, we would not be able to export many of our products. Therefore far from being a constraint, the compliance with regulations would make good business sense. In fact the international standards may be even higher than those stipulated by our own environmental regulations. Therefore industrialists, particularly those who are catering to the export market, would do well to produce their goods in an environmentally friendly manner. There is also good news to manufacturers and industrialists in that international technology is fast becoming less and less polluting. Since a country like ours is a borrower of technology, the environmentally friendly technology would be available. Besides, unlike earlier when less polluting technology was more expensive, the only available technology may well be pollution-free. This means that industrialists do not have to make a special effort to enable compliance with environmental regulations, at least with respect to some aspects of manufacturing. What is particularly essential at this point in time is for Sri Lankan industrialists to have a dialogue with the authorities implementing environmental regulations. It must be made clear that environmental regulations are not meant to stifle industrial development. It is only the means by which good environmental codes are built into the business plan and technologies so as to ensure that industrial production does not leave a huge environmental cost, which the whole community must bear. The regulators of the environment must be practical and pragmatic and support industrialists in enabling them to expand their production through the correct technologies. On the other hand, the excessive and ideological positions of ecologists

and environmentalists must be curbed to ensure that their concerns are

not ones which deter vitally important economic growth sectors. Industrial

growth with least harm to the environment must be the national goal. This

is what sustainable development is all about. Best returns come from propertyGold: an investment losing value here tooBy GamBlurrrrOnce again, we have the services of Assistant General Manager, Treasury Mr. Mangala Boyagoda to continue our topic on savings. Today he speaks to us about tangible and non-tangible investments. Q: What are tangible investments? A: Tangible investments are plant and machinery, vehicles, land and buildings, gold, silver, and other metals. When your return is less than inflation, most people go and invest in land and buildings. Property values are going up due to population expansion and limited land space. This is the best return on investment. However, you must invest depending on your portfolio. If your portfolio is Rs. 100, you cant put the entire money into land, it's a risk. You must decide which component of the portfolio you are going to invest. Q: What about gold? A: Yes, people also use gold as a form of tangible investment. Personally I feel that gold is losing value. World gold prices have remained stable over the past few years, even the local gold prices declined after the recent liberalisation. Gold is a traditional form of investment for the ladies. However, it is essential that they check the secondary market before turning to gold as a form of investment. Q: What are non-tangible investments? A: Non-tangible means treasury bills, Central Bank securities, government loans, commercial paper, debentures, government bonds, corporate bonds, unit trusts and shares. Non-tangible investments are short, medium and long term. The market in Sri Lanka is growing and people are moving away from tangible investments and against borrowing from commercial banks. Non-tangible investments can be categorised into two groups; government and corporate. Q: Corporate investments….? A: . People are gradually moving away from the bank deposits to treasury bills to get better return. When the corporate come to the market, they face a high intermediary cost in this country Banks also face a problem of high intermediary costs. For instance, when the banker gives you 10 per cent interest, it costs him Rs. 11.86 and he lends it to the corporate at 15 per cent. The cost for the borrower is not 15 per cent, as there is an additional intermediary cost of 5.82 per cent tax to the government. This means the bank profit is limited to 3.64 per cent. Of this profit, 2.18 per cent goes towards the government. This neither the banker nor the borrower can get it. The only alternative is disintimedation through securatisation. That's why non-tangible assets are growing.

More Business * When banks bring gifts… * Bonanza for gem and jewellery trade * Whirlpool products from Singer * SUN Radio now over the air in Lanka * Why they come again and again to Intercon * Customer care for frontliners * Another award for Sampath Bank

Front Page| News/Comment| Editorial/Opinion| Plus | Sports | Mirror Magazine |

|

|

Please send your comments and suggestions on this web site to |

|