Remove the “middle-income” tag!

View(s):

FILE PHOTO: People walk outside the International Monetary Fund headquarters building ahead of the IMF/World Bank spring meetings in Washington, U.S., April 8, 2019. REUTERS/Yuri Gripas/File Photo

Indian Finance Minister Nirmala Sitharaman has recommended to the IMF and the World Bank to tag Sri Lanka with “low-income status”, according to an April 24 report in India’s Business Standard newspaper. In other words, it means that Sri Lanka should be “downgraded” from its current “middle-income status” to low-income status.

After all, after Sri Lanka’s economy has been brought down due to today’s crisis, what is the use of wearing a ridiculous ‘middle-income’ tag, I thought. If we begin with the country’s post-war economic journey since 2009, the country had been under three consecutive political regimes over a period of 12 years. At the end of the war, it had an unparalleled economic and political atmosphere conducive to embark on a fast-track towards economic prosperity. Yet, this is where we have ended up – the most crisis-ridden economy in Asia!

Multi-faceted crisis

Sri Lanka is facing a multi-faceted crisis, all of which have emanated from its economic downturn. The economic crisis of Sri Lanka is no different to what we have seen in either Lebanon or Venezuela – foreign exchange shortage, supply shortages, inflation, unsustainable debt, and shrinking economic space.

The economic crisis has given birth to a social crisis and a political crisis, while it seems to have been caught up in a regional geopolitical crisis as well. All of these were seen developing over the past two years as the government kept denying the existence of an economic crisis. In this context, many are now wondering how things would turn out to be within the next couple of months, if not weeks!

As the government ultimately realised that it is the end of the road, it finally approached the IMF, after wasting two years and allowing the crisis to multiply. It was in the midst of the crisis that our big neighbour India, which has been silent so far, made a timely advancement of its financial support to Sri Lanka and intensified its active involvement in finding solutions to the Sri Lankan economic crisis.

It was in this context that India represented itself at Sri Lanka’s negotiations with the IMF and, recommended to the World Bank labeling the country with a “low-income tag”, which we surpassed 25 years ago! Since Sri Lanka is now in an unprecedented multi-faceted crisis that it never had before during the past 75 years, it is no surprise even to wear its quarter-century old low-income name tag again.

It was in this context that India represented itself at Sri Lanka’s negotiations with the IMF and, recommended to the World Bank labeling the country with a “low-income tag”, which we surpassed 25 years ago! Since Sri Lanka is now in an unprecedented multi-faceted crisis that it never had before during the past 75 years, it is no surprise even to wear its quarter-century old low-income name tag again.

The surprise however is that it was recommended by India. I am sure the news must have raised the eyebrows of many in Sri Lanka as well as in India, whichever angle we look at it. I won’t be amazed by the fact that India’s move could be analysed from many different angles. Neither am I interested in making any value judgements from any angles in this column today.

Rationale

India’s own rationale for the recommendation for downgrading Sri Lanka’s income status is that it would make it “easier” for the country to re-structure its foreign debt payment. In this respect, Sitharaman has further requested that Sri Lanka should be treated on par with other countries facing dire emergencies such as Ukraine, according to the report.

The IMF has recently approved an additional fund for Ukraine, amounting to US$1.4 billion under an emergency support programme known as the Rapid Financing Instrument (RFI), although such funding has nothing to do with the income tag. Prior to that, however, the IMF and the World Bank had established in 2020 a Debt Service Suspension Initiative (DSSI) after the pandemic in support of “poor countries” which need such a facility.

The DSSI has helped 48 out of 73 eligible countries when it expired at the end of 2021 allowing them to postpone their bilateral official debt. As we see below, however, Sri Lanka’s foreign debt trap is primarily due to its commercial borrowings which escalated within a short period of 12 years!

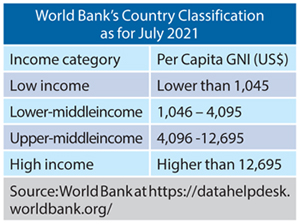

Sri Lanka was elevated from its “low-income” category to “lower middle-income” category in 1997, and then to the “upper middle-income” category in 2018. As economic growth slowed down in 2019, Sri Lanka was unable to maintain its upper middle-income status. As a result, the country was downgraded back to its lower middle-income status the following year.

With $3,582 per capita income in 2020, Sri Lanka was still in the lower middle-income category; India’s recommendation is to push it down to the low-income category with income level below $1,045. For whatever justification that can be put forward, this recommendation can be implemented with two possibilities only, if it was not at all impossible: The first is that Sri Lanka must revise its own historical national accounts practices reducing its economic status to the “low-income” country standards.

With $3,582 per capita income in 2020, Sri Lanka was still in the lower middle-income category; India’s recommendation is to push it down to the low-income category with income level below $1,045. For whatever justification that can be put forward, this recommendation can be implemented with two possibilities only, if it was not at all impossible: The first is that Sri Lanka must revise its own historical national accounts practices reducing its economic status to the “low-income” country standards.

If not, the second option is that the World Bank must revise its historical country classification system resulting in the same outcome – of course, not only for Sri Lanka, but for a whole list of countries worldwide. It is obvious that the recommendation is not as simple as it appears to be, where its application is concerned.

Exports and tourism

In support of her recommendation, Sitharaman is said to have argued that due to Sri Lanka’s dependence on the tourism sector, the shock to the country’s economy was largely exogenous in nature and caused by the COVID-19 pandemic. The point is correct, but the overall picture shows Sri Lanka’s failure to strengthen its foreign exchange buffer against external shocks rather than its dependence on tourism income. This buffer is nothing other than export growth!

Export growth requires investment, so that it all depends on the policy and regulatory reforms and the creation of an enabling business environment. In the absence of export growth, tourism and worker remittances continue to cushion the growing current account deficit; in the same way, in the absence of adequate foreign direct investment flows, government’s foreign borrowings continue to cushion the financial account. To make matters even worse, since 2007 Sri Lanka also started commercial foreign borrowing through International Sovereign Bonds (ISBs) and Sri Lanka Development Bonds (SLDBs), while attracting foreign lenders to the government security market as well.

At the time that the pandemic hit the economy, both tourism income and worker remittances collapsed, while the repayment of maturing foreign commercial borrowings had already begun bunching up every year in billions of dollars; Sri Lanka has actually been caught up in a “commercial debt trap” which it didn’t have about 10 years ago.

Problem

There is an important fundamental economic puzzle to be sorted out. Even without export growth and investment expansion, Sri Lanka was able to advance its per capita income achieving “upper middle-income” status by 2018; so what is the problem with that?

A short economic answer is that the increase in per capita income was based on a “debt-financed non-tradable sector growth” which would not last long. It is a “temporary growth pushed through government spending” which would cause budget deficits and further borrowings. What was missing here is the “growth through trade expansion” which would sustain itself with export growth and investment growth.

The problem with the countries which pursue temporary growth pushed through government spending is that they would end up with both the budget deficit and the balance of payments deficit as well as the public debt issue; Sri Lanka is a classic example of this nature. In contrast, the countries which pursue growth through trade expansion will end up with not only a comfortable export growth, but also a sound budgetary management.

By the way, with rapidly shrinking production activities and a fast-depreciating rupee-dollar exchange rate, there is a possibility that Sri Lanka’s per capita income would decline and the country would get closer to India’s recommendation; it may be avoided by accelerating our inflation rate further!

(The writer is a Professor of Economics at the University of Colombo and can be reached at sirimal@econ.cmb.ac.lk and follow on Twitter @SirimalAshoka).

Hitad.lk has you covered with quality used or brand new cars for sale that are budget friendly yet reliable! Now is the time to sell your old ride for something more attractive to today's modern automotive market demands. Browse through our selection of affordable options now on Hitad.lk before deciding on what will work best for you!