Sri Lanka real estate market set to face under-supply of apartment stock

In a recent webinar hosted by the Research Intelligence Unit (RIU), the consensus opinion was that the industry had performed with fortitude and resilience during the past year despite the extraordinary challenges faced by the economy. Moreover, the panel of experts concluded that in the next 2-3 years, Sri Lanka will actually face an under-supply of apartments and other real estate assets due to a combination of factors that will effectively drive it towards becoming a sellers’ market.

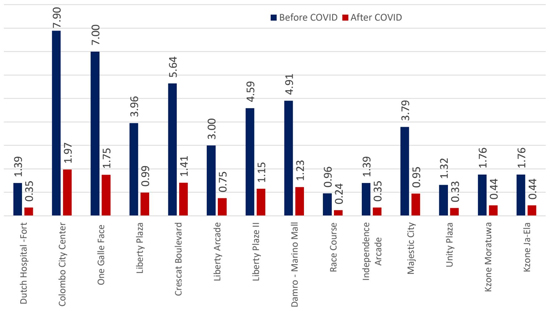

Retail mall pricing (US$ / Sq. ft / Month) before COVID vs after COVID

Source: RIU Real Estate Market Annual Report 2021

The word to the wise was that the current time is opportune for investment. Historically low interest rates spurred the market in 2020 to improve the absorption rates of the existing stock of apartments in Colombo. At the same time, the interest levels from the diaspora remains at an all-time high and the expectation is that with the airports opening, the inflow of buyers will be significant. In the context of a weakening rupee, the market is now more attractive than ever for those earning in the greenback or pound sterling as well as most other currencies.

These factors combined with the new reality faced by developers, whose costs have hiked due to new import restrictions and the overall currency depreciation effect, means that developers will be hard pressed to provide the next generation of apartments projects at prices that resemble the current market. Hence, the possibility of under-supply is real.

RIU’s webinar on the Sri Lankan Real Estate Market, titled “Resilience to Resurgence” was hosted in partnership with the International Chamber of Commerce (ICC) and British Sri Lanka & Maldives Forum for Business & Trade (BSLMFBT). The event was held on January 19.

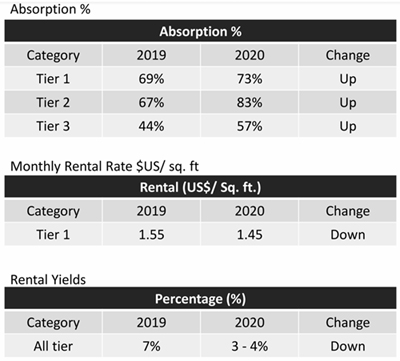

After an introduction and welcome address by William Rezel, Associate Director of RIU in London, and Managing Director of the BSLMFBT – Dr. Anil D. Priyanka Baddevithana, RIU’s Onila Wickramasinghe presented insights taken from the upcoming RIU Real Estate Market Annual Report 2021. This presentation covered general economic conditions in the country, real estate market pricing fluctuations, investment potential in property development, and absorption or occupancy rates. Luxury and semi-luxury residential apartment properties and grade A and B commercial properties were particularly focused on in the RIU market update as well as the retail mall market and bare land market in Colombo.

RIU’s Founding Director Roshan Madawela took over from William to moderate the discussion with the invited panellists. Resilience in the residential property market was initially discussed with Minoli Wickramasinghe, Director of Capital Trust Holdings and Sanjay Wijemanne, Deputy General Manager, Retail & SME Banking of Hatton National Bank who provided thoughts on the current interest rates and some insights on other steps that the government is actioning in order to revitalise the industry.

Apartment absorption, monthly rental and

rental yields 2019 vs 2020

Source: RIU Real Estate Market Annual Report 2021

Ranjith Gunatilleke, Managing Director of Sanken and Presantha Jayamaha, President of the American Chamber of Commerce (AMCHAM) in Sri Lanka then discussed the Easter Bombing and the pandemic’s implications on Foreign Direct Investment (FDI) for real estate. FDIs have also been at historical lows over 2019 and 2020 as compared to the previous 7-8 years with countries like Bangladesh overtaking Sri Lanka in the amounts of FDI being secured.

Anand Swaminathan, Director of Envartis Digital / Milanity Singapore, added to the conversation about how rapid technological advancements gradually increases the consumer expectation of smart technology integration in their daily lifestyles to make living more comfortable and simpler. The integration and adoption is highly seen in emerging economies like China and India. However, notwithstanding the availability of solutions and know-how, execution of such technology into residential investment has been holding up due to financial constraints and initial impacts on the cost of property.

Mr. Sanjay Wijemanne, enlightened the audience on the evolution of the banking systems in terms of ease of funding of investments from the diaspora overseas with growing acceptance of credible financial documents and certification of income streamlines and the progression in technology for sound creditworthiness evaluations, inclusive of other measures.

The effects and predictions due to historically low interest rates were discussed by Ms. Minoli Wickramasinghe, where rational insights were shared and forecasts have been made for the domestic residential real estate markets to surge and recover comparatively faster than commercial markets. This is owed to gradual increase in demand for tangible assets and the pandemic normalising remote work where applicable.

Mr. Ranjith Gunatilleke also shared his views and reasonings on the forecasts for a possibility of supply constraints in the residential real estate market with the prevailing market conditions.

The panelists further shared their thoughts on potential government regulations to revitalize the industry along with policies to protect buyers from developer insolvency. The key area of focus was on possible tax reforms to stimulate investment volumes alongside the concerns on bureaucracy for approvals.

Overall, the discussions by the panelists did set an optimistic tone for the year with great scope for the real estate market to rebound driven by potential acceleration in demand for residential investments. Favourable policy tools like the introduction of REITS, continual improvements in absorption rates, release of pent up demand from the diaspora, currency depreciation and the impending hike in construction costs will all combine to drive growth towards a sellers’ market once again.