News

Lankan name smarts as pepper traders cheat importers

Claims from overseas that Sri Lankan pepper is substandard are bedevilling the Government’s election pledge to obtain a fair price on world markets for local cultivators.

Local black pepper: Sought-after worldwide because of its rich piperine content. Pic by Indika Handuwala

Talks are underway to convince importing countries to continue buying black pepper from Sri Lanka at the agreed price of Rs. 450 a kilogram.

Along with that, traders are being prevented from mixing substandard pepper with Sri Lankan pepper for the export market, the Ministry of Trade’s Commerce Department’s Acting Director-General, Ananda Dharmapriya, said. To help secure local exports the government last December removed import concessions for spices destined for re-export.

Our main buyer, India, which takes 70 percent of exported black pepper, has charged that Sri Lanka has failed to maintain the quality of its produce and that inferior pepper is being sent there.

Sri Lankan black pepper is the most sought-after in the world because of its rich piperine content.

Local traders have been mixing imported black pepper from Vietnam with local pepper to boost earnings.

The price of pepper has slid as low as Rs. 370 a kilo since last year following India’s decision, urged by Kerala pepper traders, to abandon the maximum import price (MIP) of black pepper negotiated by both governments.

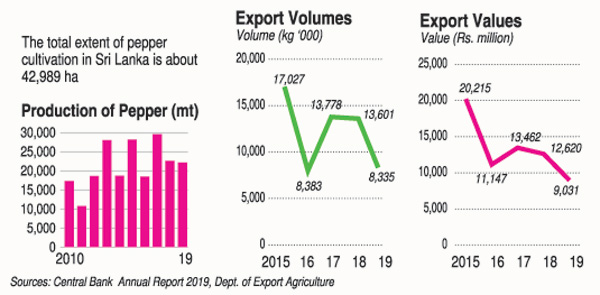

In 2018, the last year for which figures are available, the total production of Sri Lankan black pepper was 20,135 tonnes (metric tonnes). As local consumption was estimated at 10,000 tonnes and exports at 16,660 tonnes – together amounting to far more than the total produced – it is believed that 6,650 tonnes came from pepper imported from Vietnam, China, Singapore and the United Arab Emirates.

This imported produce has been re-exported labelled “Sri Lanka” as the country of origin, damaging the country’s reputation.

The Commerce Department, in an effort to arrest the slide in price and reputation, has placed a strict monitoring system in place to stop imports of black pepper. Currently, around 18,000 metric tons is locally harvested. “We are monitoring the volume and exports daily,” Mr. Dharmapriya said.

He expressed optimism that talks with the Indian government would be fruitful and that the MIP could be regained.

“The circumstances leading to the lifting of the MIP now does not exist. India should re-impose the MIP,” he said.

Experts say the government should follow stringent standards set by high-end markets such as the European Union and the United States and export pepper to those markets.

Meanwhile, a note of optimism was sounded by the Department of Export Agriculture, which said the price of black pepper is on the rise in the local market.

Black pepper is being bought for Rs. 600-625 by local industries involved in the making of black pepper oil and oleoresin, the department’s Director-General, Dr. A.P. Heenkanda, said. Oleoresin is a chemical widely used in pharmaceutical products, and Dr, Heenkanda said with two pharmaceutical companies already in production and four in the pipeline, due to start operations early next year, the demand for oleoresin will increase.

To meet the increased demand, the World Bank is offering loans to farmers involved in value-added products. Farmers will be encouraged to use sophisticated machinery in the drying and processing of the produce. A 50 percent subsidy for the cost of machinery is obtainable from the government.