Columns

Fiscal consolidation derailed by increased expenditure

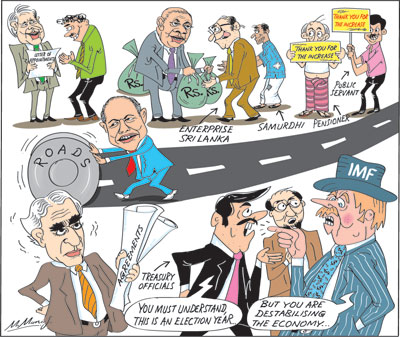

View(s): Although the government’s strategy was to reduce the fiscal deficit and thereby the outstanding debt to a sustainable level over the medium term, the current spending spree of the government is likely to derail the fiscal consolidation process, destabilise the economy and slow economic growth.

Although the government’s strategy was to reduce the fiscal deficit and thereby the outstanding debt to a sustainable level over the medium term, the current spending spree of the government is likely to derail the fiscal consolidation process, destabilise the economy and slow economic growth.

Fiscal slippage

In as much as 2015–the first year of the coalition government– was one of fiscal slippage, the final year is also likely to be a deviation from its avowed intent of fiscal consolidation. This year’s fiscal deficit is likely to be above the target of 4.8 percent of GDP due to increased public expenditure.

There may also be revenue shortfalls due to the setback to the economy after the Easter Sunday bomb blasts and the consequent economic slowdown. The increased fiscal deficit would undermine economic stability and medium term economic growth.

Populist expenditure

The government’s populist expenditure in the runup to the forthcoming elections is likely to expand the fiscal deficit to over 5 percent of the GDP. This would destabilise the economy and affect medium term economic growth. This fiscal slippage is inevitable in the current political context when the government’s preoccupation is to gain votes in the forthcoming elections by what Sir Ivor Jennings called ruckling to the multitude”.

Fiscal consolidation

Fiscal consolidation

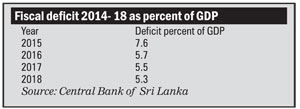

The government committed itself to a programme of fiscal consolidation in 2016 after the fiscal deficit reached as much as 7.6 percent of GDP in 2015 owing to increased expenditure after the election of the President in January and before the parliamentary election in August that year. A fiscal deficit of this magnitude was unsustainable. Consequently the government committed itself to progressively reduce the deficit and bring down the fiscal deficit to 3.5 percent of GDP in 2020.

Significant progress was achieved in 2016 and 2017 by increased revenue collection that brought down the fiscal deficit to 5.7 percent of GDP in 2016 and 5.5 percent in 2017. It was reduced further to 5.3 percent in 2018.

The objective was to bring down the fiscal deficit to 4.8 percent this year. However this year’s fiscal deficit is likely to exceed the target of 4.8 percent of GDP owing to expenditure overruns and revenue shortfalls. And the fiscal deficit target of 3.5 percent of GDP in 2020 is also unachievable as next year is the year of parliamentary elections when further populist expenditures are likely.

The process of fiscal consolidation from 2016 to 2018 is indeed a significant achievement though it fell short of the original targets. The likely expenditure overruns this year as well as the revenue shortfalls are likely to increase the fiscal deficit to over 5 percent of GDP. In the first quarter of this year the fiscal deficit was 6 percent of GDP.

Increased expenditure

Although the fiscal deficit was expected to be contained at 4.8 percent of GDP last year this was not realised for several reasons, including the political anarchy in the latter part of the year. Consequently, the fiscal deficit increased to 5.3 percent of GDP last year. The expectation was that the fiscal deficit would be brought down to 4 percent in 2019 and that the target of 3.5 percent of GDP would be reached by 2020. This is not realisable in the current run up to elections.

Additional expenditure

Additional expenditure

The increased expenditure on salaries, pensions, employment of unemployed graduates, increased Samurdhi payments and increased salaries and pensions to public servants are likely to increase public expenditure significantly. Enterprise Sri Lanka and loan concessions, among other additional expenditures are likely to increase government expenditure. On the other hand, the slow growth of the economy, the impact of the dip in tourism and lesser import duties are likely to result in a shortfall in revenue that would increase the deficit beyond the budget target of 4 percent of GDP. There have been salary increases and enhanced allowances. Several supplementary estimates have also been passed. The April bomb blasts and new concerns in security will entail higher public expenditure. Compensation for victims of the April violence is a further additional public expenditure.

Revenue

There is also the possibility of some measures of tax relief that would expand the fiscal deficit by decreasing revenue. The fall in imports would also result in lower revenue from imports. Furthermore, the depreciation of the rupee is increasing the rupee cost of debt servicing that would also impact adversely on the fiscal outturn. These expenditure overruns and revenue shortfalls would increase this year’s fiscal deficit. The treasury has already admitted a significant shortfall in revenue collection in the first half of the year.

Concluding reflections

Fiscal discipline is difficult to expect in the current political context. The populist budget and subsequent actions of the government has implemented a large number of subsidies, populist programmes, increased employment in public services and salary and pension increases. Salary increases, increased public employment, enhanced welfare measures and reduction of taxes on consumer items and other items that could gain popularity could result in overruns in expenditure and reduction in revenues. These would derail the much needed fiscal consolidation.

The large expenditure on populist measures would increase the fiscal deficit unless there are countervailing expenditure controls and new taxation measures. This is unlikely. There is also the possibility of some measures of tax relief that would expand the fiscal deficit by decreasing revenue.

The increased fiscal deficit will undermine economic stability in several ways. Much of an economy’s stability and performance rests on containing the fiscal deficit as a large deficit generates inflationary pressures, increases the public debt, distorts public expenditure, reduces export competitiveness and increases the trade deficit.

These destabilising features of large fiscal deficit are not understood by the public that holds the erroneous view that government has unlimited funds to give the public. Consequently governments seeking re-election are profligate in their spending. This irresponsibility is a conspicuous feature of the country’s political economy.

An election year is a severe constraint to fiscal consolidation that is crucial for economic stability and economic growth. Political compulsions could drive the country to the brink of a fiscal cliff.

Leave a Reply

Post Comment