Columns

Prospect of higher balance of payments surplus this year despite slow growth

View(s): There is a prospect of a significant decrease in the trade deficit this year owing to a continued growth in exports and a reduction in import expenditure. The reduced trade deficit could result in a higher balance of payments surplus that would strengthen foreign reserves and reduce the country’s external financial vulnerability somewhat.

There is a prospect of a significant decrease in the trade deficit this year owing to a continued growth in exports and a reduction in import expenditure. The reduced trade deficit could result in a higher balance of payments surplus that would strengthen foreign reserves and reduce the country’s external financial vulnerability somewhat.Expectation

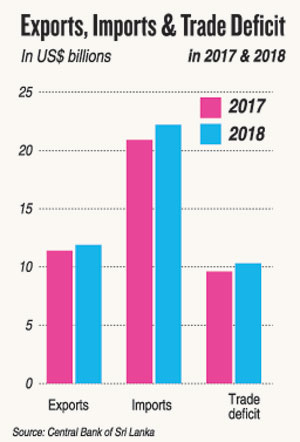

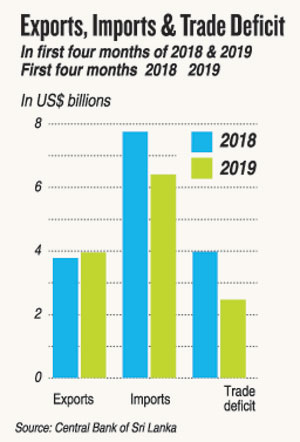

This expectation is owing to the trade deficit decreasing to US$ 2.46 billion in the first four months of this year, compared to a trade deficit of US$ 3.98 billion during the same period last year. If this trend of growth in exports and reduction in imports continue, the trade deficit could dip to around US$ 8 billion compared to last year’s deficit of US$ 10.3 billion.

Reversal

Reversal

This reduction in the trade deficit owing to a reduction in imports and a continued increase in exports is a reversal of the trend in recent years, when despite an increase in exports, the trade deficit increased, owing to a larger increase in imports. In contrast, in the first four months of this year, there has been a reduction in imports while exports have continued to increase.

Slow growth

Paradoxically, the slower growth of the economy this year has been a reason for lesser imports. While earnings from tourism are decreasing, it is also reducing imports as tourist expenditure has a high import content. Lower growth in other sectors too, such as construction, is also reducing imports.

Imports

According to the Central Bank, expenditure on imports declined this year due to policy measures adopted by the Central Bank and the government. All three categories of imports — consumer, intermediate and investment goods — decreased. Lower international fuel prices were significant in reducing intermediate imports.

Consequently imports in the first four months fell from last year’s US$ 7.76 billion to US$ 6.41 billion this year. This was an important reason for the trade deficit decreasing to only US$ 2.47 billion in the first four months, compared to a deficit of US$ 3.98 billion in the same period last year.

BOP surplus

BOP surplus

If the trade deficit is contained at around US$ 8 billion, there is a possibility of achieving a balance of payments surplus of about US$ 3 billion this year. This would strengthen the foreign reserves somewhat and reduce the country’s external financial vulnerability.

However, the BOP could be weakened by lesser earnings from tourism, decreased workers’ remittances lower foreign investments and capital outflows. Hopefully, despite these adverse capital flows, the reduction in the trade deficit to about US$ 8 billion may be sufficient to achieve a BOP surplus of around US$ 3 billion.

Threat

The most serious threat to the trade balance and balance of payments is US policy towards Iran. If there are further embargoes on Iranian oil exports or tensions build up in the Persian Gulf area, international oil prices could skyrocket to levels unbearable to Sri Lanka. Hopefully, the government has contingency plans to procure oil supplies and avert such a calamity.

Summary

The reduction in the trade deficit to US$ 2.45 billion in the first four months was achieved owing to a reduction in imports and a continued increase in exports. This trend will hopefully continue into the remaining eight months of the year to achieve a trade deficit of around US$ 8 billion.

The possibility of achieving a higher BOP surplus also depends on workers’ remittances not falling much as earnings from tourism and foreign investments and capital flows are expected to decline. Therefore, there must be careful monitoring of the trade balance to ensure that imports are restrained. Monetary and fiscal policies must ensure that imports don’t increase.

Conclusion

It is vital for Sri Lanka’s debt-ridden economy to have a significant balance of payments surplus to ease debt repayment. Without such a surplus we will be continuing to borrow to repay debt obligations and increasing our foreign debt, as has been happening.

Therefore, it is of utmost importance that this declining trend in imports continues in the next eight months to reduce the trade deficit to around US$ 8 billion that could improve the balance of payments to achieve a significant surplus. This is especially important as the insecure conditions in the country and geopolitical factors are likely to decrease tourist earnings, foreign investments and workers’ remittances that are significant foreign exchange earnings.

The Government must be vigilant to ensure that imports are contained while the export growth momentum is accelerated to reduce the trade deficit and achieve a significant balance of payments surplus.

Postscript

The latest statistics released by the Central Bank indicate that the trade deficit narrowed significantly in May 2019 in comparison to the corresponding month in 2018 due to the continued increase in exports and a reduction in imports.

During the first five months of 2019, the trade deficit contracted further by US$ 1.6 billion to US$ 3.28 billion. This increases the possibility of a trade deficit of US$ 8 billion.

Leave a Reply

Post Comment