Columns

The people’s friendly budget could undermine economic stability and growth

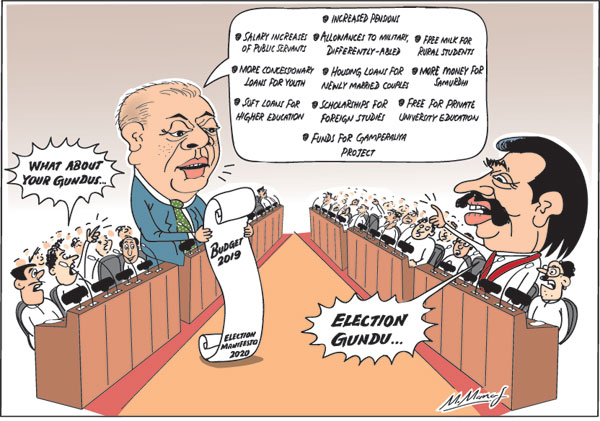

View(s):Lee Kwan Yu characterised Sri Lanka’s elections as an auction of non-existent resources. Sri Lanka’s budgets are the promises to give those non-existent resources.

Sir Ivor Jennings observed that “truckling to the multitude” is a feature of electoral politics. This is clearly seen in Sri Lanka’s budgets that tend to placate the electorate by extravagant promises that are beyond the means and resources of the Government.

Sir Ivor Jennings observed that “truckling to the multitude” is a feature of electoral politics. This is clearly seen in Sri Lanka’s budgets that tend to placate the electorate by extravagant promises that are beyond the means and resources of the Government.

Budgets, especially those in election years, tend to promise a host of extravagant expenditures, which lead to large fiscal deficits, which, in turn, destabilise the economy. The 2019 budget, whose expenditure of Rs. 3,149 billion exceeds its revenue of Rs. 2,464 billion is no exception.

Serious flaw

The derailing of the fiscal consolidation process is the most serious flaw of the 2019 Budget. The fiscal deficit target of 4 percent of GDP is expected to increase to 4.4 percent of GDP. Even this may not be achieved if there are revenue shortfalls and especially expenditure overruns.

The Finance Minister disclosed that the 2018 fiscal deficit target of 4.5 percent of GDP had not been met. It has increased to 5.3 percent of GDP. The consequences of this increase in fiscal deficit will have adverse repercussions on economic stability, debt repayment capacity and the country’s economic growth.

Sri Lankan budgets, especially those preceding elections, are characterised by financial extravagance rather than financial prudence and far-sightedness. Increases in salaries, employment in the public sector and social welfare benefits that are meant to enhance the Government’s popularity and support at the forthcoming elections increase public expenditure beyond its revenue resources. Dr. W.A. Wijewardena has described this as “the pitfall of election budgets” (Daily FT March 4th).

Sri Lankan budgets, especially those preceding elections, are characterised by financial extravagance rather than financial prudence and far-sightedness. Increases in salaries, employment in the public sector and social welfare benefits that are meant to enhance the Government’s popularity and support at the forthcoming elections increase public expenditure beyond its revenue resources. Dr. W.A. Wijewardena has described this as “the pitfall of election budgets” (Daily FT March 4th).

Winning elections

If ‘election budgets’ are what win elections, then the country would not have had the frequent changes of governments. Yet, extravagant expenditures erode economic stability for this elusive electoral victory.

Whatever the Government’s budget promises, the opposition can always make more extravagant promises and lead the country to further fiscal and economic difficulties when its turn begins. This has been the pattern of financial management of governments.

Budget proposals

The 2019 budget, delayed owing to the constitutional coup of October 26 and the subsequent chaos, was presented last Tuesday. It was replete with welfare payments, salary increases and populist expenditure. Indeed the budget was akin to an election manifesto of a country whose electorate, like Oliver Twist, asks for more

Expenditure proposals

The expenditure proposals of the budget included, as expected, salary increases for public servants, increases in pensions and allowances to military. It promised payments to differently-abled persons, free milk for rural students, housing loans for newly married couples, Soft loans for higher education, scholarships for foreign studies, fees for private university education. Twenty four percent of budgetary expenditure was for education, health and infrastructure.

Samurdhi

The budget allocated more money for Samurdhi, which the Finance Minister himself described as a politicized programme where the recipients were not the deserving poor. Studies have shown that those receiving Samurdhi benefits are not the intended beneficiaries. The deserving poor are hardly recipients.

Furthermore, a large expenditure is on the Samurdhi staff and its administration. Despite this waste of resources, the 2019 Budget has allocated a significantly larger amount for this programme.

Key projects

Funds for the Gamperaliya project are expected to improve the socio-economic conditions of villages and Enterprise Sri Lanka is expected to enhance entrepreneurship among youth.

These expenditures could be justified, provided the funds are received by the intended beneficiaries, intended objectives are achieved and they enhance production of goods and services. On the other hand, the pertinent issue is whether the country’s public finances could expend that much of resources on these mostly welfare oriented programmes. The Government’s contention, however, is that these policies are aimed at empowering the people and nurturing the poor, apart from catering to the basic educational, health and livelihood requirements of the population.

Fiscal outturn

The government’s estimated revenue for 2019 is Rs. 2,464 billion, while expenditure for the year is estimated at Rs. 3,149 billion. The government’s target is to keep the budget deficit at 4.4 percent of GDP. There are real possibilities that, like last year, the fiscal deficit would increase owing to expenditure overruns, in particular, as the Government seeks popularity during the run-up to the election.

Fiscal consolidation

It is of utmost importance for the revenue enhancing fiscal consolidation that has been put in place is continued and that at least the revised fiscal deficit of 4.4 percent of GDP is achieved in 2019. Any deviation from this target would erode international confidence, flout conditions for the expected new Extended Fund Facility and destabilise the economy. This is the most important fiscal objective for the economy that the government must achieve.

Concluding reflections

The political milieu of the country is hardly conducive to prudent management of public finances. The persistent large fiscal deficits have led the country into an enormous debt burden and debt servicing absorbed nearly the entirety of revenue. This, in turn, distorts public expenditure and development expenditure.

It is in such a context of public finances that there have been further extravagant spending. Despite his professional training, Finance Minister Mangala Samaraweera has not been able to cut the suit according to the cloth.

Clearly we are continuing to live beyond our means. We are still in the mode that the Cambridge economist Joan Robinson described in the 1950s as: “A people who want to taste the fruit before planting the tree and nurturing it”.

Leave a Reply

Post Comment