News

Court steps in over risky palm oil import

View(s):On court orders, 24 containers of unrefined palm oil imported two years ago are being held back at Customs over concerns the oil could be harmful to health if released onto the market. The 400,000kg of palm oil reportedly has up to a 20 per cent concentration of free fatty acid (FFA), four times more than is allowed under a Food and Import Control Act. The Act says unrefined or crude palm oil may contain up to 5 per cent of FFA while refined bleached and deodorised (RBD) palm olien must not contain more than 0.1 per cent of FFA.

On October 21, the Court of Appeal issued a stay order to Customs to refrain from releasing the goods following public interest litigation instigated by Nagananda Kodituwakku, an attorney-at-law. Mr. Kodituwakku argues that there is irrefutable evidence that the palm oil shipment contains FFA at levels injurious to health and so the shipment should not be released. He also claims the crude palm oil, which arrived in Colombo as far back as May 2016, could have oxidised, making the end product mutagenic and carcinogenic.

On October 21, the Court of Appeal issued a stay order to Customs to refrain from releasing the goods following public interest litigation instigated by Nagananda Kodituwakku, an attorney-at-law. Mr. Kodituwakku argues that there is irrefutable evidence that the palm oil shipment contains FFA at levels injurious to health and so the shipment should not be released. He also claims the crude palm oil, which arrived in Colombo as far back as May 2016, could have oxidised, making the end product mutagenic and carcinogenic.

The importer, Sena Mills Refinery Private Ltd, counters that once the crude palm fatty acid (as it is labelled now), is refined, the oil released to the market as RBD palm olein would contain only 0.1 per cent FFA. The importer had asked the Court of Appeal to release the consignment, stating that a classification ruling on the consignment by the Nomenclature and Classification Committee of the World Customs Organisation cleared the way for its entry into the country.

The Court of Appeal, however, dismissed the case with costs, stating Customs was well within the law to detain the consignment as there were reasons to believe the commodity was adulterated. Sena Mills Chairman, Ishan Karunasena alleges that a Customs officer investigating the shipment was conniving with Mr. Kodituwattu, the petitioner, to harm him.

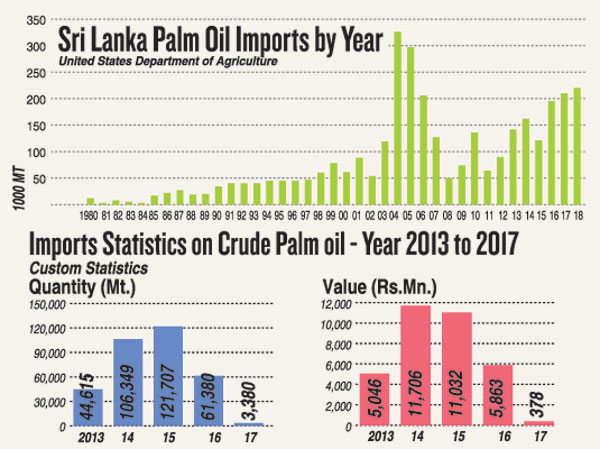

Mr. Kodituwakku claims palm oil importers were adopting various ruses to avoid paying tax on oil imports ever since the tax was raised to Rs. 150 a kilo in 2016. Sena Mills, it is alleged, had imported the crude palm fatty acid under a different code that entails a smaller tax.

A previous public litigation petition filed by the National Movement for Consumer Rights Protection (NMCRP) Chairman Ranjith Vithanage was taken up on October 11 but was dismissed when Mr. Vithanage chose to withdraw the case. Mr. Kodituwakku, who was representing NMCRP, claims Mr. Vithanage did so under pressure from Sena Mills.

Mr. Vithanage, however, alleges Mr. Kodituwakku forced him into filing an action, saying that at the next hearing he would walk up and reveal all the facts of the case.“I am out of the case but will be present to clear my name,” Mr. Vithanage said. After the case was withdrawn and Customs was preparing to release the palm oil shipment Mr. Kodituwakku went ahead and filed a subsequent case at the Supreme Court on October 21, preventing the cargo from being released.

The case will be taken up again on December 10