Oil at boiling point, for most economies!

View(s):It is again time for “oily talk”, because world oil prices are on the rise. We are caught up in between economics and politics of setting oil prices and spending on oil bills.

How we set the domestic oil price will determine who will pay for the oil bills. Well, we also have to cope with many oil blunders in the past; I am not surprised if we keep repeating the same.

It is important to examine the current oil market issue to see where we might slip and float and, how much we have to bear as individuals and as a nation.

World oil price volatility

Last week the world price of Brent crude oil surpassed US$70 per barrel, while many speculate it to go up further. A year ago, it was less than $50 per barrel and, four years ago it was more than $100 per barrel. Just before the US financial crisis, that is 10 years ago, it was $150 per barrel.

World oil prices are highly volatile. While oil price volatility causes panic in the world, in the past it has been at the source of several global economic crises as well.

There are number of short-term or long-term causes of oil price volatility, while, depending on the intensity of one or more of those factors, world oil prices fluctuate. The first is, of course, either demand or supply shocks. Major oil producing countries decide what would be the limits on oil supply causing the instability of oil prices. On the demand side, seasonal variation in oil consumption or the rapid income growth in big economies such as China and India could exert pressure on oil prices.

Secondly, geopolitical tensions cause oil trade disruptions which then affects prices. As at present, confusion over Iran’s nuclear deal with EU and US is said to have been a major factor underlying the current oil price hike. Thirdly, technological changes in oil industry and alternative energy technologies can affect oil prices. Fourthly, speculative attacks particularly through oil futures and options cause oil price volatility. Finally, changes in US dollar or tax policies or other policy changes among influential nations can also have some impact on world oil prices.

Producers, importers, traders

All the nations in the world are connected to the world oil industry either as oil producers, oil importers or oil traders. Sri Lanka is an oil-importing country; nevertheless, the country has a long-standing expectation to be an oil-producing country. Yet the country’s weak capacity in this particular industry, including the lack of investment funds, is a major bottleneck to realise this expectation.

By the way, Sri Lanka would have become an “oil-trading country” if we hadn’t nationalised the country’s oil business in the early 1960s. With this nationalisation programme, multinational oil companies re-located their businesses to Singapore so that Singapore became the major oil-trading hub in Asia.

Since then, it was our own choice to remain an oil-importing country. Even going beyond that, we choose to play with oil. Being a small oil-importing country, Sri Lanka does not have a free hand for a domestic pricing policy for oil; but that is exactly, what we have done in the past. By doing so, we have almost refused to believe that we are an oil-importing country. Consequently, Sri Lanka is in a fragile state of being highly vulnerable to world oil price volatility and oil shocks.

File picture of recent upgrading of the CPC's Sapugaskanda refinery.

Elections and local oil prices

In many other oil-importing countries with good and transparent practices, domestic oil price reflects its world price so that there is no “third party” to pay for your petrol or diesel.

Ideally, Sri Lanka’s domestic oil prices should be connected to the world oil prices, but we have attached it to the country’s election cycles. Just before the elections in December 2014, the government reduced the prices of petrol and diesel.

After the elections, it was a different government. Going by an election promise, 92-octane petrol price was slashed from Rs. 150 to 117 and, auto diesel from Rs. 111 to 95. Thanks to the low world market prices, the reduction in oil price could be accommodated easily, but not for long.

In 2017 the world oil prices began rising. Sri Lanka had to pay more to buy oil from the world market, but continued to sell in the domestic market at the same lower price. According to the Annual Report 2017 of the CB, average import price of a crude oil barrel increased from $46.30 in 2016 to $57.79 in 2017. But then someone else pays for your petrol and diesel.

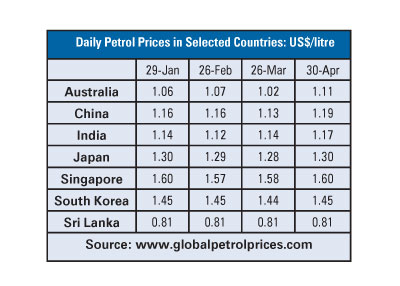

Sri Lanka’s oil prices are one of the lowest in the world, except for oil-producing nations. The world average price of petrol at the end of April was $1.15, but in Sri Lanka it was $0.81. The second feature is that most of the countries in the world let the domestic price to be responsive to the world price movements. But in Sri Lanka $0.81 per petrol litre has been there for the past three years.

Fuel burdens in 2018

Although oil appears to be cheaper to the Sri Lankan consumer, it is not at all cheap for Sri Lanka as a nation. The country’s oil burden is much greater than many other countries. According to last year’s data, Sri Lanka has spent 30 per cent of its export earnings to buy oil. As oil prices begin to rise now in 2018, the country will have to spend more this year. This increased burden is due to be felt on two main financial accounts of the country.

The first is the external finance account. The country will need increased foreign exchange earnings to pay for higher oil prices. We are already faced with a deeper problem there due to years of sluggish performance in export earnings and foreign investment flows.

Besides, we need even more foreign exchange income to pay for the maturing foreign debt starting from this year. According to the CB’s 2017 data, Sri Lanka has already spent $4.6 billion for debt repayment last year, which was nearly 24 per cent of the country’s export earnings from both goods and services.

The second is the internal finance account. The country will need more tax income to cover the losses of the state-owned Ceylon Petroleum Corporation. This means that the government’s fiscal operations will be under pressure too.

Already in 2017, according to the CB, the government had also spent Rs. 1213 billion as debt repayment, which was two-thirds of the government’s total revenue. This means that, if the government is spending on meeting the losses from oil sales, its fiscal implications will multiply the country’s budgetary problem as well as debt problem.

Way out

Before we talk about the way forward, we have now come to a point of trying to find a way out of this quagmire! The easiest and urgent way out is a cost-reflective oil pricing. Being an oil-importing country, Sri Lanka does not have a free hand to decide on its local oil prices. If that is the case, then the domestic price should reflect the world prices as it does in most of the other oil-importing countries.

Thus the way forward involves reforms in much more complex areas of the oil industry that would come under state-owned enterprises’ reforms agenda.

(The writer is a Professor of Economics at Colombo University. He can be contacted at sirimal@econ.cmb.ac.lk)

This column was written before Thursday’s decision to resort to the fuel pricing formula