News

New Tax Act to cut indirect tax, PAYE exemptions for those earning less than Rs. 100,000 a month

The new Inland Revenue Act IRA, which came into effect on April 1, made changes to the Pay-As-You-Earn (PAYE) tax regime. Accordingly, employees earning between Rs.100,000 a month and Rs.1.2 million a year are exempt from PAYE tax. The tax on employment income would see a progressive increase from 4 per cent to 24 per for earnings over Rs.100,000 depending on one’s monthly income. This will mainly impact professionals working in certain specific fields, such as doctors and lawyers.

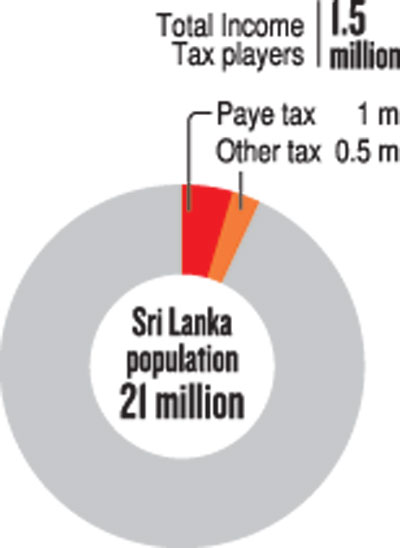

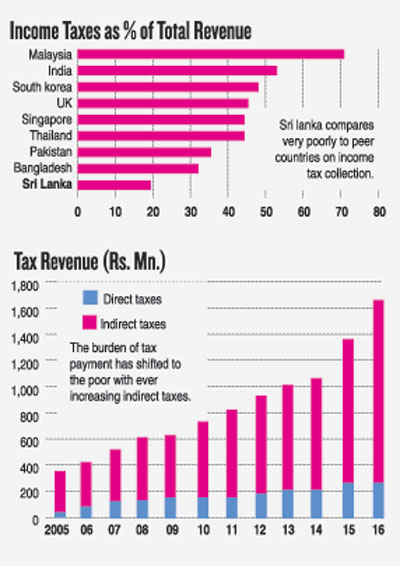

While exemptions have been given, the main aim of the IRA is to reduce the high dependency of government revenue to indirect taxes to 60 percent from the current 82 percent. Direct taxes currently account for just 18 per cent of Government revenue – one of the lowest in the region, and the aim is to increase this to 40 per cent within three years through the new Act, said the State Minister of Finance, Eran Wickramaratne.

For more than a decade, the Governments that came to power were content to raise indirect taxes without trying to widen the reach of the tax base through direct taxes, said the state minister. “We are trying to change this. The new taxes will apply mainly to the richest people in the country rather than ordinary citizens.”

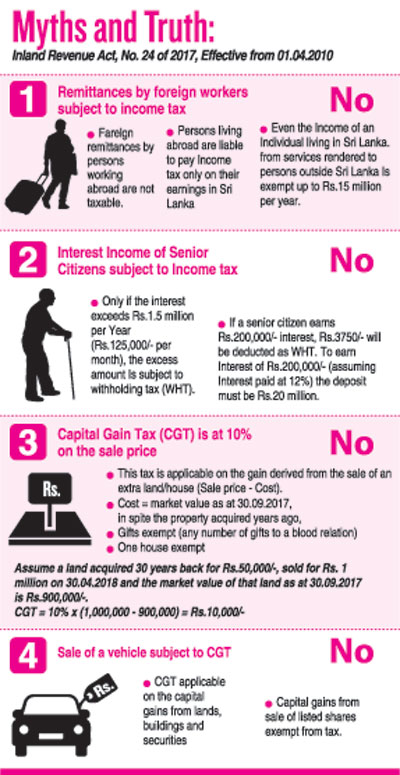

Mr. Wickramaratne told the Sunday Times that there were several misconceptions regarding the new taxes and people have been led to believe that it would impact negatively on the majority of Sri Lankans.

For example, some people think that the new Capital Gains Tax (CGT) is applicable to 10 per cent of the sale price of a person’s property. This is not so, the minister stressed.

The CGT excludes the principal place of residence of an individual, provided it has been owned continuously for the three years before disposal and lived in for at least two of those three years. A property or land gifted to blood relations is also exempt.

The CGT is applicable on the gain derived from the sale of additional property such as land, buildings or a house. The cost taken into account when calculating the tax is the market value of the property at September 30, 2017. If the value of a property or land on this date was Rs.900,000 and it were sold a year later for Rs.1 million, the “capital gain” on that property or land would be Rs.100,000. “The CGT is only 10 percent of that capital gain, and therefore, you would have to pay only Rs.10,000 as CGT. It is not on the value of the transaction. It is on the capital gain that you pay the CGT, and it is only 10 per cent,” Mr Wickramaratne elaborated. At 10 percent, Sri Lanka’s CGT is still one of the lowest among comparable countries in the region, he added.

Meanwhile, contrary to certain reports, the interest income of all senior citizens has not been taxed, noted Swarnamali Karunaratne, Deputy Commissioner General (DCG) of the Department of Inland Revenue. If senior citizens earn Rs.1.5 million interest a year from deposits or Rs.125,000 per month, all of it is tax free. If a larger sum is earned it is subject to a Withholding Tax (WHT).

For example, if a senior citizen earns Rs.200,000 interest, Rs. 3,750 will be deducted as WHT. To earn interest of Rs.200,000 (assuming interest is paid at 12 per cent), the deposit must be Rs.20 million.

Remittance tax doesn’t have to be paid by those who remit money to the country while working overseas. Persons living abroad are liable to pay income tax only on their earnings in Sri Lanka. Sri Lankan citizens who remit money to the country while working overseas will be exempt from taxes for up to Rs.15 million a year, Mrs. Karunaratne pointed out.

The IRA also introduced investment incentives. “Up until now, tax concessions were given based on the discretion of the minister, depending on the investor and the industry. But this will now be a rules based system,” Mr Wickramaratne remarked. Accordingly, anyone who invests between USD 3 million and 100 million will enjoy a tax holiday until the investor has recovered his full investment.

If the investment is more than USD 150 million, the investment incentive changes from 100 per cent to 150 percent.

An investor who chooses to invest in the war affected northern province will get additional investment relief. This is based on the Government’s aim of attracting more investment to areas which were devastated by the war.

The Government also stressed that there is no truth in the claim that every person above 18 years will be taxed. Tax is payable only if a person has a taxable income, whatever age they may be.

The objective of the Act is to simplify the taxation system and widen the tax base, Minister Wickramaratne said. Through the Act, the Government hopes to reduce some of the indirect taxes that have placed an unnecessary burden on the people, he added.