Columns

Will “People’s Budget” achieve fiscal consolidation, rational objectives and realistic expectations?

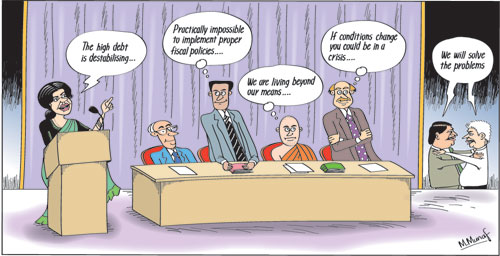

View(s):Paramount issues in the minds of economists are whether the 2017 budget would decrease the fiscal deficit, increase revenue, contain wasteful expenditure, increase developmental expenditure and contain public debt to a sustainable level. These are prerequisites for macroeconomic stability and sustainable economic development.

While these are the rational objectives of economists, are they realistic expectations? The Finance Minister’s characterisation of the budget as a “People’s Budget” evokes fears that its expenditure proposals would far outweigh revenue and not achieve the fiscal deficit target of 4.7 per cent of GDP. On the other hand, pronouncements by the Prime Minister indicate that new revenue proposals, including new taxes, will increase government revenue and reduce the fiscal deficit.

While these are the rational objectives of economists, are they realistic expectations? The Finance Minister’s characterisation of the budget as a “People’s Budget” evokes fears that its expenditure proposals would far outweigh revenue and not achieve the fiscal deficit target of 4.7 per cent of GDP. On the other hand, pronouncements by the Prime Minister indicate that new revenue proposals, including new taxes, will increase government revenue and reduce the fiscal deficit.

Rational expectation

The finest budget outcome would be if the budget has pragmatic taxation measures to increase government revenue to about 15 per cent of GDP so that there is adequate fiscal space for much needed development expenditure, while the fiscal deficit is reduced to less than 5 per cent of GDP.

SLEA analyses

SLEA analyses

The technical sessions of the Sri Lanka Economics Association’s (SLEA) Annual Sessions analysed and elaborated on the need for fiscal reforms, the sustainability of the domestic and foreign debt, the development of an investment conducive policy environment and needed reforms in trade policies to enhance exports to bring down the trade deficit. Have the ideas, suggestions and proposals of economists been taken into account in formulating the 2017 Budget?

Chief economist

The Chief Economist and Assistant Governor of the Central Bank, Mr. K.M. Mahinda Siriwardana pointed out that while the fiscal weaknesses and the need for corrective measures were generally recognised, the implementation of practical measures that address the fiscal concerns are difficult in the current domestic and global context. He demonstrated that fiscal weaknesses have grown as seen in high recurrent expenditure, gradual decline in revenue collection, large budget deficits, “relatively high debt burden”, constraints in investment expenditure and lacklustre performance of state owned enterprises.

Siriwardana emphasised that Sri Lanka can no longer live beyond its means and corrective action was needed. However he made the pertinent observation that identifying the fiscal weaknesses was the least painful task; implementing practical reforms to remedy the identified corrective measures were difficult. This is the country’s predicament.

Debt sustainability

Is the country’s debt sustainable or are we in a debt crisis or heading towards one? This was the theme of a technical session at which Dr. Dushni Weerakoon, Deputy Director of the Institute of Policy Studies presented a paper titled “Are we in a debt crisis?” She analysed the debt profile to point out that while there was no hard and fast rule to measure debt sustainability, the country’s foreign and domestic debt was too high to ensure macroeconomic stability and that a high level of debt erodes macroeconomic stability that is a prerequisite for strong and sustained growth.

High levels of debt Dr. Weerakoon said increases uncertainty, results in high and volatile inflation, uncertainty in taxation and the crowding out of private investment. Growth could also be undermined by unviable fiscal policy. A large public debt could create a balance of payments crisis that leads to currency depreciation.

Dr. Weerakoon said that although there were certain improvements in the debt situation, such as the debt to GDP ratio declining and the maturity of the debt moving towards medium and long term debt and the domestic debt proportion increasing, the concessional foreign debt has decreased. Debt sustainability is an issue of growing concern especially as the concessional foreign debt is decreasing.

International experience

Professor Frank Westermann of the University of Osnabruck in Germany showed that in comparison with the international and German experience Sri Lanka’s debt was not unsustainable, but if local and global conditions change, then the country could head towards debt unsustainability.

Beyond our means

Rev. Professor W. Wimalaratana, Head of the Department of Economics of the University of Colombo analysed the country’s expenditure to demonstrate very convincingly that the country was living beyond her means. And that was at the root of the fiscal and balance of payments problem.

There were large gaps between revenue and expenditure, exports and imports, expenditure and savings, investment and savings. Expenditure over the years, he demonstrated was much higher than revenue, imports were much higher than exports. Revenue was inadequate to even service the debt.

Professor Sirimal Abeyratne of the University of Colombo who was the discussant said that papers presented made it clear that the debt situation and its servicing costs were a severe constraint to the country’s economic development. He stressed that the fiscal deficit has to be brought down immediately to contain the country’s high debt and ensure economic stability.

Summary

The SLAE Annual Sessions demonstrated an unusual consensus among economists that fiscal consolidation was imperative for economic stability and sustained high economic growth. The collection of much higher tax revenues were imperative to reduce the fiscal deficit and enable the government to have enough fiscal space for much higher public investment that would generate sustained high economic growth. Fiscal consolidation also requires the reduction of unproductive and wasteful expenditure.

The government’s high debt burden and heavy debt servicing costs were a severe strain on the public finances. Further deterioration in debt would lead the country to a debt crisis. The country was living beyond her means and this was the root cause for the twin fiscal and trade deficits. Containing aggregate demand through fiscal and monetary policies that work in tandem was essential to contain aggregate demand.

In conclusion

Regrettably economic rationality is not politically expedient. Politicians pander to the masses to gain popularity at the expense of long term economic interests.

This has led to the economic crisis we are currently facing. It is only when either the political leadership has the courage to eschew political gain for economic rationality that rational economic decision making is possible. The other difficult path is to educate the masses on economic rationality and shed their civic ignorance to enable rational economic decision making. Has the 2017 Budget taken the right steps towards achieving fiscal consolidation to ensure sustained high economic growth?

Leave a Reply

Post Comment