News

Soaring greenback makes importers weep

Prices of food stuff are set to go up. Pix by Indika Handuwala

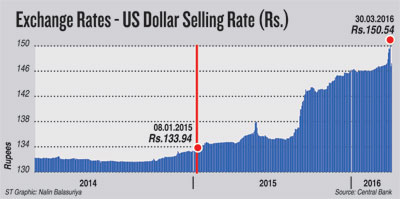

The greenback jumped to Rs. 150 last week, reaching its highest level in months since the government decided to float the rupee last September. The market recorded a spike of Rs. 3-4 to the dollar, causing concern amongst businesses and food importers.

Economists predict consumers will be hard hit in coming months if the dollar keeps rising and sends up prices of imported food even further.

Middle-income urban dwellers will be hit hardest, University of Colombo Professor of Economics Sirimal Abeyratne said. Rural folk who do not depend on the marketplace would not be greatly affected by the spike in the dollar. “It all depends on how much the population is dependent on the marketplace,” he explained.

Although there were expectations that the effect of the dollar’s rise could be countered through export gains this was not happening as our export sector was weak, he said.

The country’s business environment was not conducive for investment and investors were wary of putting money into Sri Lanka. “Not even local entrepreneurs want to invest,” Professor Abeyratne said.

The increase in the exchange rate would “definitely” be passed on to consumers in the coming months, National Chamber of Commerce President Tilak Godamana said.

He concurred with Professor Abeyratne that although it was argued an increasing dollar exchange rate would favour exports this was not happening because the country did not export enough. “Our exports have to grow, but it is simply not happening,” he said.

He said the cost of imports was soaring every day and importers were in a quandary, not knowing what to do. “They are looking up and down helplessly,” he said graphically.

He said even the prices of local products would not be spared as raw materials for production were imported.

He said even the prices of local products would not be spared as raw materials for production were imported.

Voicing another concern, Mr. Godamana said the government’s plan to increase Value Added Tax (VAT) on all food and services from 12 to 15 would push up the cost of living. Although the proposal has not yet been implemented, businesses were already gearing up to pass the increase to customers.

The Finance Ministry has given assurances that prices of essential items including dhal, sugar, sprats, tinned food, potatoes and onions would be exempted from the proposed increase but businesses said it was doubtful whether the government could contain the prices at fixed levels because of the rising dollar rate. “The cost of essential goods will also go up,” Mr. Godamana asserted.

Importers were in the dark about when the VAT would be implemented, he said: it was important for businesses to know the date so they could streamline their imports and prepare for the increase. “There is no direction,” Mr. Godamana complained.

Another worry for business was the plan to re-introduce the business turnover tax removed five years ago. “This will only dampen investor sentiments,” the Chamber of Commerce chief warned.

Mr. Godamana said imported consumer items also suffered from the increase from 5-7 per cent in port charges which sent up import prices. In addition, the Customs practice of converting the dollar rate a little above the actual rate prevailing at that time also sent up prices. “They fix a rate for a week and calculate at that price for a week irrespective of whether it goes down,” Mr. Godamana said.

On a positive note, Mr. Godamana said petroleum and petroleum products were cheaper because of the drop in fuel prices in the world market and the government should pass down this concession to customers.

An importer of essential food items in the Pettah market, David Trading Company, lamented that the rising dollar was causing much concern among importers of foodstuffs.

V. Venkatasalam, who is a member of the Chamber of Commerce, said importers faced losses with the use of usance credit, where there is a gap of time, sometimes 60-90 days, between issue and payment of bills.

“When we use credit we lose as we end up paying at the current rate to the dollar for goods bought three months ago [when the dollar was lower]. As we have already sold the goods we have no way of passing this to the customer. This is a great loss to us,” he said.