Sri Lanka is on the door-step of a public debt-driven economic crisis

“The Queen’s Question and the Fatal Conceit: In spring 2009, Queen Elizabeth visited the Economics Department of the London School of Economics to discuss the financial crisis. She asked a simple question: Why did no one see it coming?” The response, delivered by letter some months later, was that there had been “a failure to understand the risk to the system as a whole”. But the truth is worse than that. The dominant strain of academic economics, and policymaking orthodoxy not only failed to see the crisis coming but asserted that bitter policy and increased financial sophistication had made the financial crisis far less likely than in the past.” Quoted from book: “Between debt and the Devil” 2016 by Adair Turner p.241. Princeton University Press, UK.”

Many Sri Lankan economists not only see the incoming financial crisis, but also proposed crisis preventive solutions regularly in the Sunday Times. Crisis preventive measures are in the hands of policymaking political orthodoxy.

Many Sri Lankan economists not only see the incoming financial crisis, but also proposed crisis preventive solutions regularly in the Sunday Times. Crisis preventive measures are in the hands of policymaking political orthodoxy.

The overall size of the Sri Lankan economy is about US$75 billion in terms of GDP estimation while the volume of public debt has reached $81.2 billion or almost 100 per cent of GDP at the end of 2015. Out of the total debt, foreign debt burden is around $49.2 billion or absorbing almost 34 per cent of export earnings for annual foreign debt repayment while total debt repayment is equalled to the government annual revenue in 2015. During the last regime, borrowing from foreign capital markets at exorbitant rates of interest and shorter repayment periods resulted in extra debt burden while utilising those funds lavishly for White-Elephant-Type projects. Ultimately, almost all the macroeconomic indicators deteriorated significantly, excessive public debt-based fiscal deficit financing followed by external trade and Balance of Payment (BOP) deficits, lowering foreign exchange reserves and exchange rate depreciation in addition to continuous borrowing from foreign capital markets. Neglected fiscal consolidation has compounded into an overall public debt-driven recessionary situation starting from the BOP crisis to a debt-trap and dragging the whole economy into multiple crisis proportions.

Sri Lanka, at present, is on the door-step of public debt-driven recession, debt-trap and very soon heading for the first omen of the BOP crisis. Considering the disastrous situation, the government has requested for an IMF-Structural Adjustment Facility (SAF), a bailout loan to wipeout the BOP deficit and patch up the external reserve problem. At this juncture, an IMF loan facility is urgently needed owing to the critical nature of the BOP condition. The facility is a temporary injection and many other steps are needed to recover the economy from its crisis situation.

Magnitude of the Macroeconomic Instability

Following macroeconomic indicators, imply that the Sri Lankan economy is almost on the door-step of public debt-driven economic crisis situation. The overall macroeconomic instability and related cyclical multiple crises affected an economic slowdown particularly a large fiscal deficit, excessive public debt and debt servicing burden, widening trade deficit, a large BOP deficit and rising capital outflows that have paved the way for aggravating economic instability. The following fundamental macroeconomic indicators highlight red signals:

Decades’-long cumulative, compounding effects of successive budgetary deficit and annually declining revenue base (18.6 per cent to 12.3 per cent of GDP; between 2000 to 2014) together with annually increasing but compulsory, huge expenditure pattern (25.4 per cent to 18.3 per cent of GDP; between 2000 to 2014) coupled with losses in public sector institutions (9.5 per cent to 12.8 per cent of GDP; between 2000 to 2014). Anticipated fiscal deficit is almost 100 per cent than the revenue in year 2016.

Fiscal deficit –driven consistent public borrowing, accumulating huge debt burden, and the burden of related debt servicing cost almost absorbing the entirety of revenue and compelled to “debt-driven” borrowing every year. Presently, total debt volume is around 101.5 per cent (Foreign debt is 61.5 per cent of GDP in 2015) and debt servicing cost is almost 15 per cent of GDP. As a result, Sri Lanka has to borrow and settle old debts and therefore, it appears that the country is caught in a serious debt-trap.

Moreover, the situation has created a distorted public resources allocation that has driven away from economic stability, worsening growth process and weakening the overall economy. Outcome is further reduction of the Treasury revenue base and an increase in compulsory expenditure volume ultimately pushing towards a severe liquidity crisis.

Inadequate resources for development of fruitful capital projects and a worsening productive capacity has resulted in low volumes in the export market supply. The outcome is a further widening of the external trade deficit together with a BOP crisis.

BOP crisis is result of the depreciating foreign exchange rates, rising capital outflows and declining reserves, together with unbearable multiple social and economic difficulties, political dissent, rioting, protests, strikes and demand for wage increases, which are finally transformed into multiple economic crises.

The ongoing economic instability has resulted in speedy capital outflows due to risk, loss of confidence and creditworthiness. Already, capital outflows have begun: for example outflow of share market investment ($40 million in 2015 and $16 million within the first two months in 2016), bond and stock market investments ($1100 million in 2015). According to estimates informal outflow of foreign exchange was around $5 billion in 2015. It is believed that the worker remittances leakages are around $3 to 4 billion during the last 14 months. Furthermore, the major source of capital inflow being official borrowing may become expensive with a high cost of LIBOR plus and shorter periods considering the prevailing risk and instability.

Under these circumstances, recent exchange control relaxations for NRFC, RFC, RNNFC and FEEA is unjustifiable and may result in further outflows even though foreign exchange is earned within Sri Lanka. The prevailing conditions are unbearable and disastrous.

Evasion of fiscal responsibility

Usually a budget has spelt out a major short term annual economic development plans which reflects the use of government taxes and spending, to alter macroeconomic outcomes in a country. It is totally an income transfer mechanism that resulted in growth of GDP and enhancing the living standards of the people. Fiscal Management (Responsibility) Act No 3 of 2003 has provided basic premises of the underlying responsible fiscal management qualities, which are not at all followed thereafter, even in 2016 budget.

In addition the Prime Minister has presented a medium-term economic development policy statement, which proposes ambitious targets aimed at bringing down the budgetary deficit to 3.5 per cent of GDP by 2020. Although the PM’s medium term plan is not a well structured action-oriented pragmatic policy statement, budget 2016 has not provided the initial steps for bringing down the fiscal deficit from 7 per cent to 3.5 per cent by 2020. Budget 2016 is a blueprint of previous years’ style, as demanded by interested groups that was ultimately compelled to be redrafted and approved with traditional ways and means of budgetary gap-filling strategies.

Disgusting fiscal trend and public debts

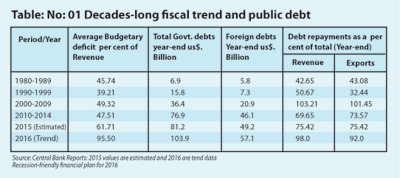

Past records indicate that the disgusting fiscal trend and the debt problem are not new but they have been worsened during 2010 to 2014. Table No: 01 shows the relationship between revenue and debt repayment trend with accumulated debts. The actual public sector fiscal deficit could be doubled when considering the overall public institution losses. In 2014, public debt repayment has reached the level of Govt. revenue, or absorbed 34 per cent of export earnings, which is the root cause of BOP difficulties. External trade deficit is around $9.2 billion in 2015 and it will go beyond $0 billion level in 2016. Thereafter, foreign exchange needed to settle the debt obligation would be through further external borrowing in addition to inflow of remittances and earnings from services.

Recession-friendly financial plan for 2016

The budget has proposed hasty about-turn proposals to the existing systems, as wholesale proposals and revisions and removal of decades-long subsidies and concessions, enjoyed by the public. The new budget has failed to explain the ongoing dangerous economic situation, and placed before the House the serious liquidity position of the government that prevailed at the end of 2014. On the other hand, the new government has a mandate and taken responsibility of rescuing the country out of its economic crisis, instill good governance and rebuild the bankrupt economy, which are not adequately explained in the budget speech.

As a result, islandwide protests, trade union actions, campaigns are been launched against the budget proposals in addition to opposition party protests. Ultimately, the approved budget resulted in a further widening of the fiscal gap from Rs. 1349 to 1788 billion and increased borrowing limits, pushing the country for debt-driven crisis situation.

Adverse international conditions in 2016

The Sri Lankan economy has been described as trade dependent, a small market economy with limited resources. Presently, the international economic environment is not at all favorable for Sri Lanka in 2016. There are many formidable challenges, economically and politically in all export markets. The developing political disturbances and financial difficulties in Middle East and Russian countries affects tea exports and worker’s remittances while China’s turbulent economic condition may result in a decline in investments and expected relief from Chinese-debt may not be available.

Overall exports declined around 4.6 per cent while imports decreased by 1.2 per cent in 2015. Furthermore, a decline in the foreign exchange rate makes imports expensive apart from increasing volumes and import prices. Presently, the value of export earnings is around 54 per cent of total import bills and remittances help to offset the balance. It appears that the inward remittances dependency is no longer sustainable when considering the Middle East turbulent political conditions in 2016. Under the prevailing global circumstances, it is expected that the Sri Lankan economy would synchronize adversely and ultimately resort to a worsening of the BOP crisis in 2016.

First Demon is BOP crisis

Increasing trade deficit, repayment of foreign debt obligation, and outflow of foreign investment funds and declining remittances, poor level of inflow of FDI and colossal import bills-settlements are causing the BOP crisis. According to estimates, the BOP deficit may go up to $3.6 billion in 2015. On the other hand, eroding credit worthiness and enhancing high cost of borrowing together with short-term matured debt repayments would make a disastrous 2016. The BOP crisis could convert into an economic recession while other external and internal miseries would line-up one by one, similar to the Greek situation.

At this juncture, the government’s move towards IMF for SAF is a sensible decision although it will be subject to stringent conditions. The IMF facility will help to settle outstanding import bills and ease the BOP deficit temporarily but the danger remains. IMF funds are needed to be used prudently and wisely in a productive manner.

Way Forward-Policy Strategies

All these years Sri Lanka has been paying a heavy economic toll catering to populist voter sentiments and electoral politics. In tackling the current economic crisis situation, authorities have applied conventional demand side fiscal and monetary through both quantitative and qualitative policy strategies and failed sustaining the economy. At the moment, consensual politics and political agreement is essential for implementing supply side, economic recovery policies for avoiding incoming public debt-driven economic recession.

There are two types of such supply side empirically sustainable policy prescriptions; firstly, inward-oriented and secondly, outward-oriented together with intra-connected relational employment-investment and good governance strategies. The following supply-side policy strategies are needed to be customised to suit Sri Lanka to maintain effectiveness and outcomes.

Inward-oriented supply-side policy strategies:

Fiscal gap minimizing policy initiatives: Basically three areas: (a). Increasing government revenue, particularly increasing tax base, administration, avoiding tax exemptions, tax evasions, manipulations and introduce tax reforms, restructuring to yield a higher revenue. The share of indirect tax volume needs restructuring without burdening the poor and lower classes of society. Revenue may be improved, at least at 23 per cent to 25 per cent of the GDP by 2020. (b)Reduction of expenditure, reduce waste, malpractices and uneconomical expenses in the whole state sector while increasing investment for education, TVET, research and health in order to enhance the supply capacity; and (c) Public sector reforms in administrative services, public enterprises and regulatory systems.

Economising development project implementation: New and ongoing projects continued only on their positive rate of return, benefits over cost, output and outcomes and ability to make earnings on foreign exchange. Megapolis, mega housing development, rural village projects, large scale infrastructure and even Colombo Port City, Lotus Tower projects may be re-scrutinised and take action to make them economy-friendly. Most essentially, investment on education, TVET, knowledge based technical and agricultural training projects need to be strengthened aiming at utilisation of workforce for enhancing productivity and inward remittances.

Exploring economy-friendly projects: Limit foreign debt financing for projects contributing multiple benefits and favourable outcomes to the economy together with enhancing jobs, resource mobilisation and earning and saving capacity of foreign exchange. New project implementation only if it generates beneficial outcomes and financially viable to the Treasury.

Primary concern on agriculture and industry output: The supply-side backbones of the economy are agriculture and industry, which are providing employment, resource utilization, economy-wide output and outcomes, foreign exchange, food security and indirect benefits to the nation.

First priority to export trade supply side: Medium term targeted structural plan for enhancing commercial scale export agricultural commodities, industrial export and import replacing industries, transshipment businesses, value added activities, tourism and all sorts of foreign exchange earning services is the sustainable solution to averting the BOP crisis.

Imperative economic-supply-supportive factors: Implementation of investor friendly non economic-factors are essential, especially in maintaining rule of law, law and order.

Outward-oriented supply side policy strategies

Second generation trade liberalisation measures: Sri Lanka needs to implement second generation trade liberalisation measures. Showing government commitment to market-led economy is a powerful supply side policy strategy, enhancing civic values and good governance and generating long term sustainable economic recovery.

FDI instead of foreign borrowings: Building foreign investor friendly environment through market-led-privatisations, ensuring equity-rights, deregulation, and property rights are FDI-friendly policy measures. Debt restructuring and wining relief: Wining the creditor’s support for corporate debt restructuring, relief and forgiveness through creditor-specific diplomatic policy initiatives are effective supply side strategies in addition to reducing burden to the Treasury. Under the corporative debt-restructuring method, it is required to forgo collateral or share of equity for building partnership initiatives with the creditors.

Wining international relation and diplomacy: Application of country specific diplomatic relations, especially with large creditors is an essential strategy wining the debt relief and concessions in addition to strengthening the export markets. Wining GSP Plus and fish product export to EU and USA markets and arranging export country-specific bilateral and multilateral product-based trading relations would help to expand the export supply capacity.

Needed Policy Direction

The emerging public debt-driven economic crisis and BOP crisis require the tightening of fiscal and monetary policies blended with supply side strategies, both inward and outward orientation with immediate effect. Government moves towards a IMF-SAF loan facility to bridge the BOP difficulties could be a blessing for implementation of financial consolidation and mostly required reforms in order to resolve the looming economic crisis. However, success depends on the consensual political agreement and cooperation among political decision makers.

(The writer is a freelance economic consultant since retiring from public service in 2006. He could be reached at palithaeka@yahoo.com <mailto:palithaeka@yahoo.com> )