Columns

2015: Year of political gains and economic slippages

View(s): This year will go down in history as the year when the country rejected an autocratic form of government to return to a more democratic consensual and participatory form of governance. In that process of political change, the economy has slowed down and economic fundamentals have deteriorated. This year of significant political gains was one of economic setbacks.

This year will go down in history as the year when the country rejected an autocratic form of government to return to a more democratic consensual and participatory form of governance. In that process of political change, the economy has slowed down and economic fundamentals have deteriorated. This year of significant political gains was one of economic setbacks.

Political gains

In 2015 the country averted the continuation of an arbitrary family nepotism and regained a democratic form of government. The restoration of law and order and the rule of law, freedom of expression and the democratic right to oppose the government in a peaceful manner are huge gains, Perfection in these cannot be expected in a short period. The country is once again on a democratic road to development.

These political gains are ends in themselves, as well as essential prerequisites for economic development in the long run. Good governance would encourage foreign investment and have beneficial implications for exports and foreign investment. However these favourable developments in governance must be complemented with good economic management and much needed reforms.

These do not come about autonomously. There must be conscious efforts to improve economic fundamentals by policies that are well designed and effectively implemented. It is essential to undertake a wide range of reforms that enhance the economic capacity of the country and create an investment friendly climate and incentives for investment.

Economy slows down

Elections in 2014 and 2015 have not been a favourable backdrop for undertaking economic reforms and rational fiscal policies. Consequently the economy has had severe setbacks and deterioration in macro economic fundamentals. Adjusting to a democratic regime has slowed down the economy.

Democratic freedoms and electoral politics often make it difficult to implement good economic policies. Interest groups interpret economic policies and reforms as detrimental to their interests. Such opposition is difficult to fend in a democratic system where the opposition seeks immediate popularity rather than have a long term interest in the economy. In such a political milieu, the government itself adopts economic policies that are of immediate popularity that are not in the long term interests of the economy.

Economy weakens

Economy weakens

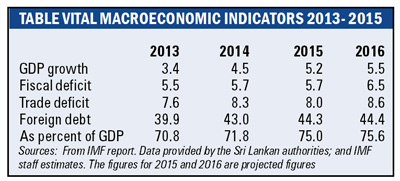

In contrast to its political achievements, 2015 was a lost year for the economy. Macroeconomic indicators deteriorated significantly. Fiscal and trade deficits increased and the country is facing a serious balance of payments problem. Foreign exchange reserves are low and foreign debt is increasing.

The 2016 budget and its many amendments and uncertainties have sent mixed signals to the business and investor community. The mismanagement of economic policies that have weakened the fiscal, trade and balance of payments situations are not conducive to economic growth.

The deterioration in macroeconomic indicators is reaching crisis proportions. The depreciation of the Rupee from around Rs 130 to a US dollar to nearly 145 is indicative of this economic deterioration.

Fiscal deterioration

Large fiscal deficits in 2014 and 2015 have weakened the economy. The repercussions are seen in the widening trade deficit, deteriorating balance of payments and increasing debt.

The original budget proposals were expected to result in a fiscal deficit of 5.9 per cent according to the 2016 budget. That was only slightly below the 6 per cent expected for 2015. The changes to the budget would increase the deficit that is likely to be around 6.5 per cent of GDP in 2016. If new taxation measures are not introduced during the course of 2016, the deficit could balloon to as much as 7percent of GDP.

Foreign debt

This high fiscal deficit is increasing domestic and foreign debt that is already at an unsustainable level. The foreign debt that was US$ 39.9 billion in 2013 increased to US$ 43.0 billion in 2014 and US$ 44.3 billion in 2015. Though estimates place the 2016 foreign debt to be only a tad higher at US$ 44 billion, the current fiscal situation indicates a much higher figure. This means fresh foreign borrowing at high rates of interest and severe foreign and total debt servicing burden.

The recent budget and post budget changes have not addressed these problems adequately. Further changes in the budget could compound not only the fiscal problem, but intensify the debt and balance of payments problems as well. The inability to contain the fiscal deficit and aggregate demand is increasing the trade deficit and straining the balance of payments that is in dire straits in a context of inadequate and declining foreign reserves.

Trade deficit

The increasing trade deficit that is likely to be around 8.5 billion at the end of the year is causing balance of payments difficulties. This together with repayment of foreign debt obligations and outflow of foreign investment funds has eroded foreign reserves to a dangerous level.

Balance of payments

The balance of payments deficit of US$ 4.2 billion in the first nine months of this year, compared to a surplus of US$ 2 billion in the same period last year. This deterioration in the balance of payments by US$ 6 billion is indicative of the serious balance of payments problem.

External reserves

External reserves are at a dangerous level. According to the Central Bank, the country’s gross official reserves were at US$ 6.8 billion as at end September this year that was equivalent to 4.2 months of imports, with total foreign assets amounting to US$ 8.4 billion, equivalent to 5.2 months of imports. Gross official reserves are estimated to have strengthened to around US$ 8 billion by November 3rd with the receipt of US$ 1.5 billion from the ninth International Sovereign Bond.

However this does not reflect a comfortable level of reserves as repayments of capital and interest obligations for the next year are estimated at over US$ 4 billion. This is a precarious situation requiring immediate corrective measures.

Imperatives

It is imperative for the government to adopt economic policies that would arrest the deterioration in the macro economic conditions that would destabilise the economy. Remedial fiscal, monetary, external trade and financial policies must be adopted soon to resolve these macroeconomic imbalances to ensure economic stability. Despite the political environment that is not conducive to the adoption of rational and pragmatic economic policies, the government must be resolved to follow policies to resolve the current economic crisis.

Leave a Reply

Post Comment