Columns

Failing to contain fiscal deficit will undermine economy

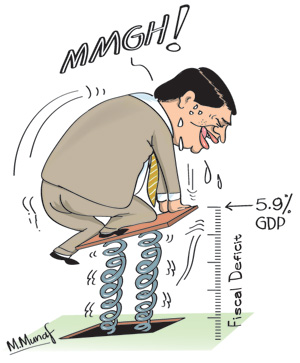

View(s):The most serious deficiency of the 2016 Budget is its failure to contain the fiscal deficit. The inability to contain the fiscal deficit below five per cent of GDP would destabilise the economy, undermine the investment climate and retard economic growth and development. It weakens the investment climate and threatens economic growth.

The Prime Minister’s Economic Policy statement that preceded the budget had raised hopes among economists that this most fundamental economic problem would be addressed by the 2016 Budget. Instead the budgeted figures estimated the fiscal deficit to be only slightly less than the six per cent expected for 2015. This is a serious weakness in the budget.

The Prime Minister’s Economic Policy statement that preceded the budget had raised hopes among economists that this most fundamental economic problem would be addressed by the 2016 Budget. Instead the budgeted figures estimated the fiscal deficit to be only slightly less than the six per cent expected for 2015. This is a serious weakness in the budget.

Expectations receding

Changes in the budget proposals during the budget debate make it unlikely that the deficit would be contained even at the estimated 5.9 per cent of GDP. The prospects of achieving even this fiscal deficit are receding as tax experts have shown that some of the taxation proposals in the budget will not yield as much revenue as expected.

Likely changes in several budget proposals that are being contemplated would reduce revenue collection and increase expenditure. These include further reductions in prices by reducing tariffs, continuing car permits for MPs and the promise of one million rupees for doctors in lieu of car permits. Senior public servants too may get such a bonanza. Further benefits to various sections of the population and reductions in tariffs and increased expenditure on subsidies would increase public expenditure. These would increase the deficit beyond six per cent of GDP.

PMs perspective

PMs perspective

The Prime Minister’s objective of lessening the fiscal deficit to 3.5 percent of GDP in 2020 is hardly realisable with this approach of extravagant expenditure and inadequate revenues. The budget has also not shown signs of progress towards achieving another of the objectives of the PM’s statement that the proportion of indirect taxes would be reduced to 40 per cent from 60 per cent of total revenue and that indirect taxes would be decreased to 60 per cent from its current 80 per cent. Instead the reliance on indirect taxes was increased to about 85 per cent of GDP with direct taxes bringing in only 15 per cent, according to tax experts.

One does not expect the PM’s goal to be achieved in this budget, but the direction it has taken is in contra direction to it. Be that may, although increases in direct taxation is generally considered a move towards a more regressive tax system, if the indirect taxes fall on commodities consumed by the rich and not on basic commodities, then it would not be regressive. However there is no evidence that this is happening to any significant extent. For instance the higher exemption limit on income taxes and lesser tax rate is not progressive.

Past deficits

Given a fiscal history of the actual outturn of the budget deficit being always higher than the budgeted figure, there is reason to believe that in 2016 too the deficit would be higher than the estimated 5.9 per cent. Flaws in this year’s budget pointed out by experts as well as opposition members during the budget debate makes it quite evident that revenue collection would be less than estimated. Consequently, the 5.9 per cent of GDP fiscal target next year is likely to be exceeded.

Pragmatic options

Once the heat and political emotions of the budget debate are over the government must devise means by which revenue could be increased in 2016. Although this is not a good fiscal practice, as it flouts the principle of public accountability, it is a pragmatic option that most governments have resorted to in our political circumstances.

There are possibilities of revisions in taxation measures and increasing government revenues by higher tariffs on motor cars of higher value and consumer articles for which there are domestic substitutes. Losses in state enterprises that are badly managed could be brought down by lesser pollicisation, improving their management and cutting wasteful expenditure. Privatisation of some business enterprises could increase revenue.

The government must also look into ways and means by which the large and increasing defence expenditure could be brought down. Such measures would be needed to bring down the deficit next year to less than 5.9 per cent.

Importance of containing fiscal deficit

The importance of containing the fiscal deficit to a manageable proportion is not readily understood. Fiscal deficits over the years have been the main reason for the serious economic crisis that the country is facing today. The large fiscal deficits are the root cause of the huge public debt and the enormous debt servicing costs that have absorbed the entirety of government revenue and led to further borrowing. This is why the fiscal deficit must be brought down progressively over the next five years.

Containing the fiscal deficit is vital as high fiscal deficits have serious repercussions on the economy. Besides increasing the public debt and foreign borrowing, they lead to higher trade deficits, generate inflationary pressures, increase the cost of living and cause severe hardships, especially to the lower end of wage earners and fixed income receivers. The increase in costs of living leads to demands for higher wages and industrial unrest.

Wage increases add to the costs of production and erode the country’s competitiveness in international markets. This necessitates the depreciation of the rupee to remain competitive with other countries that have lower rates of inflation. Otherwise, the lesser export earnings would increase the trade deficit and strain the balance of payments, as is happening currently. Then again, depreciation of the currency to restore export competitiveness leads to further inflation and increased hardships for people.

Conclusion

Fiscal deficits announced in budgets have been political gimmicks than realistic fiscal expectations. However the economy is in dire straits and fiscal consolidation is imperative for economic stability and growth. It is imperative that the fiscal deficit is lower than the 5.9 per cent of GDP estimated in the budget. Even though it appears that the deficit would be higher owing to revisions on both taxation and expenditure proposals, there is no option but to bring the deficit down to 5 per cent or less of GDP by curtailing expenditure and new taxation proposals on the lines suggested here.

Leave a Reply

Post Comment