Columns

Daunting economic problems facing new government

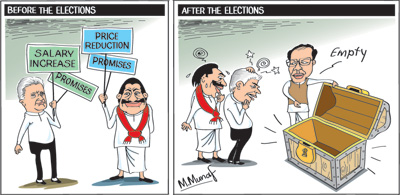

View(s):Whoever forms the next government would have to face daunting economic problems. However, most of the 21 political parties that are vying to form a government may not be aware of the magnitude of the economic problems or have an idea about how they could be resolved. What matters, however, are the economic policies of main parties which are likely to form the government. Their extravagant election promises of salary increases, more public employment and increased social expenditures too do not indicate realistic and pragmatic economic strategies. These promises would aggravate the fundamental weaknesses of the economy.

The next government has to address urgent and pressing financial problems as soon as it assumes office to tide over financial difficulties that have mounted recently and keep government finances on an even keel during the remaining few months of the year. After that policies have to be formulated for resolving fundamental macroeconomic problems to ensure economic stability.

The next government has to address urgent and pressing financial problems as soon as it assumes office to tide over financial difficulties that have mounted recently and keep government finances on an even keel during the remaining few months of the year. After that policies have to be formulated for resolving fundamental macroeconomic problems to ensure economic stability.

The most challenging task would be to undertake a range of reforms to resolve the structural problems of the economy to ensure economic growth. Budget 2016 in November this year should be the cornerstone for an economic framework for the full five-year term of office of the new government. A stable government with a proper understanding of the economy, a clear long-run vision and pragmatic policies is indispensable.

Economics ignored

Economics ignored

Some parties appear to be completely oblivious or unconcerned about economic matters. Their immediate passion to be elected obscures any concern for economic policies. In fact their extravagant promises would undermine the economy and drive it to crisis proportions. They either lack understanding of fundamental economic principles or are so possessed by their life and death struggle for power that serious economic issues do not matter to them. Promises that pander to the multitudes and get votes is their main interest even though they may know the disastrous consequences of their promises.

Formidable task

The economic policies of the last few years and this year’s political motivations and distractions have aggravated fiscal difficulties. It will indeed be a formidable task to strengthen the fundamental economic conditions to ensure economic and financial stability to pursue policies for high economic growth.

The most fundamental and difficult problem to resolve is the distressing state of the country’s public finances. Government revenue is only about adequate to meet its debt obligations. In several recent years, government revenue was less than the debt servicing costs. Last year, 95 percent of government revenue was spent for debt servicing. This is a clear indication of the country’s fiscal paucity.

The government’s finances are comparable to a household in severe debt whose income is inadequate to pay debt instalments and interest payments that economists call debt servicing costs. However, a significant difference in public finances to those of a household is that a government could borrow from the Central Bank, which can create money that leads to inflation, increases the trade deficit and renders the balance of payments unsustainable.

Inadequate revenue and high government expenditure resulted in large fiscal deficits that required further borrowing to meet its current and capital expenditures. Despite this weak fiscal position, massive wasteful expenditures of the previous government and large expenditure on infrastructure projects, many of which were of doubtful value and not yielding returns in either the short run or long run, resulted in high fiscal deficits and increased public debt.

A foremost task of the new government is to increase government revenue and bring down government expenditure to levels that are aligned with revenue prospects. It would be difficult to achieve this in 2015 as both the revenue and expenditure are fait accompli. The interim government accentuated the fiscal situation by its inability to increase revenue and increased its expenditure, even though some wasteful expenditure was reduced. Although the interim budget projected a fiscal deficit of only 4.4 percent of GDP, it is likely to exceed 5 percent this year.

Fiscal strategies

An improvement in the fiscal situation would require bold and mostly politically unpopular decisions on both taxation and expenditure. Tax revenue must be enhanced by eliminating excessive tax exemptions, improving tax compliance and reducing tax avoidance. These are not easy as administration of tax proposals have been difficult. Political interference has been one of the root causes for this. Higher taxes on conspicuous spending and luxury consumption are essential to reduce the evasion of taxes by the affluent. A system of expenditure taxes may be needed to rake in revenue from the super rich. Will the next government have the resolve to implement such taxes?

Foreign debt

In as much as the country’s fiscal situation is weak, foreign indebtedness is a heavy burden, as the government resorted to large foreign borrowing that increased foreign debt to US$ 45 billion at the end of last year that was 60 percent of the country’s GDP of US$ 75 billion in 2014. Foreign debt servicing is an important component of the high total debt servicing cost referred to earlier and required one quarter of export revenue to service it.

Achieving a lesser trade deficit than the recent trade deficits of over US$ 8 billion is essential to generate a higher balance of payments surplus through remittances, tourist earnings, other services and capital inflows to reduce foreign indebtedness. Only a strong and knowledgeable government would pursue policies to reduce aggregate demand that will reduce imports and promote exports.

Electoral expectations

What we could hope for is that the election would result in a strong government commanding a majority in parliament. The new government must ensure stability and have the political courage to take unpopular decisions to resolve the fundamental economic problems of a high fiscal deficit, declining government revenue, massive foreign debt and the large trade deficit. The new government must face the challenging tasks of enhancing institutional capacities, resolving educational and knowledge gaps and policy reforms that are conducive for foreign investment that are vital to achieve high and sustained economic growth. Will such a government be elected by the good judgment of the people?

Leave a Reply

Post Comment