Encouraging whistleblowing is the panacea for all corporate ills!

The Business Editorial of The Sunday Times on May 17th rightly questions the wisdom of encouraging whistleblowing (WB) by employees and shareholders with suitable guidelines in an effort to ward off corporate scandals that have raised its ugly head in an unprecedented manner in the last two decades.

Athula Ranasinghe

Whilst commending the editor for visiting the multi-factorial issues that led to this corporate malady, it may be opportune to examine whether the mere establishment of WB at the company level would bring the desired expectations. My honest answer, having first hand experience and familiarity with the subject, is absolutely – NO.

Having been instrumental in establishing WB in a couple of leading companies, my candid opinion is that the management commitment is paramount importance beyond the installation of policy guidelines to achieve the intended results. In almost all the companies, I am told, the WB guidelines have not gathered momentum among the employees and shareholders and the lackadaisical enthusiasm and commitment displayed by the management have been the bane for the non-popularisation of this new paradigm shift.

Myths and obstacles

Most employers tend to think that the employees and shareholders will prompt to blow the whistle automatically highlighting the malpractices and scandals, once the WB policy guidelines are set in motion. This is only an illusion. To make WB an effective tool, companies should ensure that a host of the prerequisites are in place. Much effort has to be taken by way of training the employees, inviting their unstinted support to make WB a reality and the fear of victimisation against the employees who blow the whistle must be dispelled. Hence, a conducive organisation culture free of retaliation against whistleblowers throughout the company has to be inculcated in the minds of the employees, if the WB is to be effectively implemented.

Ideally, the complaints from the whistleblowers should be confidentially handled by the Chairman of the Audit Committee, preferably an independent director of the Board and an acknowledgement to be sent to the whistleblower, no sooner a complaint is received. The substance contained in the complaint must be thoroughly investigated even by summoning the whistleblower from whom further information of the scandal could be elicited. Communicating the results of the complaint to the whistleblower on a regular basis would strengthen the morale of the whistleblower who would repose much confidence in the management in the eradication of this menace and the WB policy itself.

Continual promotion and sustenance of the WB policy across the board would compel the whistleblowers to expose more scandals to the notice of the management. There is an inherent tendency on the part of the employees and the trade unions not to perceive the WB as a genuine effort on the part of the management. Members of the corporate management feel threatened by propagating this system of management and it is one of the reasons that had not popularised this concept. Critics allege that a sense of animosity between the corporate executives and the rest of the staff within the workplace would inevitably result in industrial unrest, which is harmful to the industrial harmony and peace in the workplace.

Auditors as Whistleblowers

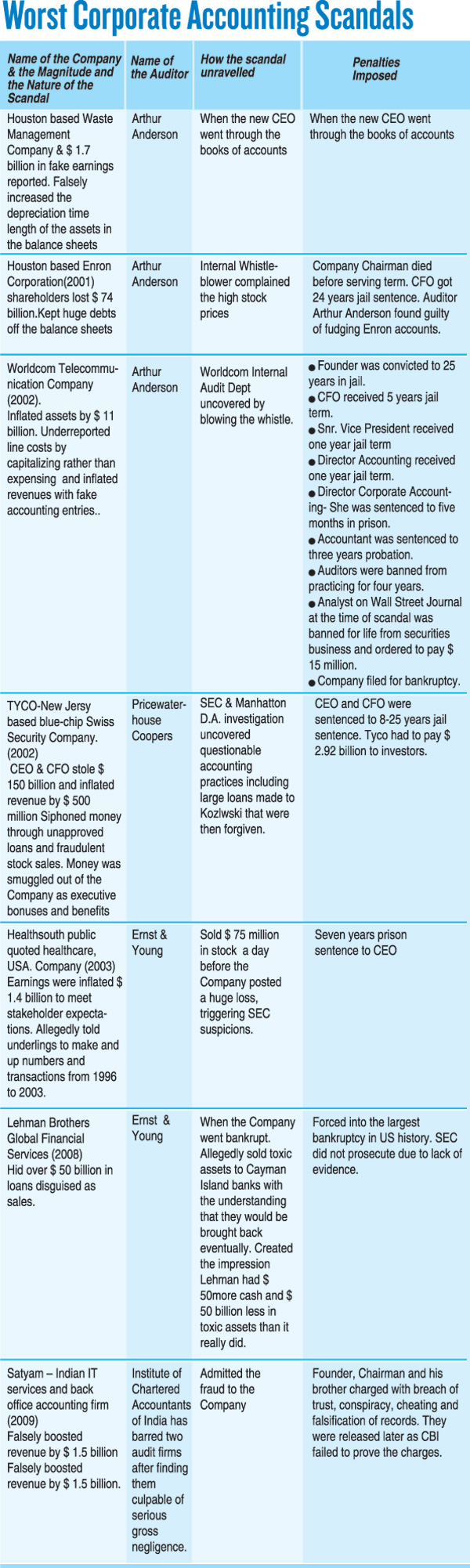

Sri Lanka’s Securities and Exchange Commission (SEC) Chairman in his recent address has expressed the view that the SEC expects auditors to blow the whistle, whenever the financial irregularities and improper conduct are detected so that the SEC as the regulator could quickly move into such findings. This is a laudable statement. It is an inescapable fact that large scale corruptions and scandals can go unabated, without the blessings of the professionals, especially the auditors and accountants who perform their fiduciary duties and obligations with the connivance of the wrongdoers. Surely, large scale scandals will continue to thrive even in the future, if the auditors and the accountants do not discharge the duties expected of them in the professional manner. If one analyses the worst corporate scandals (see the following schedule) and the manner in which the auditors have been dealt with for the complicity of the crimes committed, there appears to be a serious conflict of interest, resulting in losses to the tune of billions to the investors and the national coffers. In majority of the cases listed below, whistleblower actions have yielded desired results.

Role of ICASL

In the wake of the unprecedented scandals now emerging from the corporate sector, the President of the ICASL (CA Sri Lanka) is reported to have said at a recent meeting that the WB element would be incorporated into its “Ethics Code” so that its members would abide by this ethical requirement. This, I believe, is only a baby step in the right direction. The writer doubts very much the effectiveness of this inclusion in the so-called “Ethic Code” because I personally believe that all the members of this noble profession are not paragons of virtue and there is every probability that the miscreants of this profession would line their pockets at the expense of the companies they audit even in the future. It must be stated in no uncertain terms that part or major portion of the blame (scandals) must be laid at the doorstep of the auditors.

Hence, what is required at this juncture is a legislative enactment compelling the auditors to take the fiduciary responsibility as a criminal lapse. However, it is a good omen that the SEC and the ICASL are now currently engaged in finding a durable solution to this professional malady. If the relevant authorities do not take meaningful action within a foreseeable future, the day may not be far off for them to suffer humiliating consequences and ramifications. Auditors are well aware of the gravity of section 511 and 512 of the Companies Act No 2007 in that penalties can be imposed for false statement on any person who makes false or untrue statements through any document such as Balance Sheets, P&L Accounts, returns, and prospectus intentionally.

Role of the Audit Committee

The credibility of the Independent directors who chair the Audit Committee Meetings has become a contentious issue in the manner in which they have conducted audits in certain enterprises. Take for instance the Weliamuna Report on SriLankan Airlines and its damned revelations regarding corruption deals running into billions. One could reasonably question as to why the auditors and the Audit Committee failed to highlight these scandals. After all, as one writer has pointed out that the audit committee of the airline comprised high-profile and eminent business magnates. Having personally associated with some of these members and very well knowing their high level of integrity and the professional conduct they have exceptionally executed in their respective fields, I am constrained to cast aspersions for the alleged complicity.

However, the fact remains that the scandals discovered in the Weliamuna Report are too serious to be ignored and the auditors and the Audit Committee Chairman owe an explanation for their dismal failure to blow the whistle. Ideally, we ought to have auditors and Audit Committee Chairmen who are above suspicion, like the proverbial Caesar’s wife. In this particular instance, the stock silence of the Internal Auditor and the accountants of SriLankan who were privy and unfettered access to financial documents is a moot point. Since the names of the prominent figures who chaired this Audit Committee come into the light for the alleged complicity of the scandals, admittedly they have a legitimate right to clear their names and innocence without allowing the public to come to wrong perceptions, at an inquiry. On the other hand, it is high time for the airline to install the WB in this enterprise and promote this concept in the total interest of the public and the nation even at this belated stage.

FIFA Scandal and Whistleblower

It was due to evidence given by ailing whistleblower, Chuck Blazer to US investigators, the corruption scandal engulfing Federation International of Football Association (FIFA) resulted in the arrest of seven FIFA officials last week and the resignationof FIFA President Sepp Blatters four days after his election for the fifth successive term. Here the troubling question raised was how the KPMG Auditors failed to sound the alarm over the alleged systematic payments of millions of dollars in bribe. Referring to the involvement of the KPMG in the scandal, a university professor has said that KPMG is a well-established firm with international repute, but in the light of the growing revelations of the fraudulent movement of cash running into millions, KPMG inability to spot this fraudulent cash movement was highly questionable. Leave aside the auditors, how did the accountants treat the siphoning of millions in cash and underhand payments? Had the KPMG blown the whistle highlighting the magnitude of the scandal involved, millions of dollars exchanged underhand could have been easily detected.

Legislative protection

The dearth of legislative protection for the whistleblowers have time and again been highlighted in the wake of ever rising scandals and frauds. History is replete with victimisation incidents against the employees for blowing the whistle by the employees and there had been hardly any redress in the absence of legislative enactments. In the case of infamous Enron scandal, the Whistleblower, Watkins, the female accountant had to resign for exposing the large scale accounting irregularities after being demoted from her mahogany executive suite to a rickety metal desk. In the National Blood Bank incident, the minor employee who blew the whistle had to undergo enormous mental and physical harassments at the hand of the health authorities. It is a matter for solace that the “Witness Protection Act” passed by the Parliament recently has given some mode of protection. However, the need of the hour is to promulgate a “Whistleblowing Act” encompassing all the employees employed in the Public and Private sectors.

The National Ethics Survey carried out in 2011 in the US has observed the following startling revelation of retaliations against Whistleblowers. This is not a rosy picture at all. The Sri Lankan scenario, I believe, is much worse than these findings.

n 22 per cent of American workers who blew WB had experienced victimisation at the hand of the management compared to 15 per cent in 2009.

n Employees experienced retaliation as a result of WB had left the services much sooner. n In the majority of cases, (43 per cent) had not been given due promotions or salary increases. 27 per cent of the employees had been transferred and assigned to menial jobs. 17 per cent had been demoted from their positions they held. About 12 per cent had experienced physical harm.

- Senior Managers who were accessible to financial information were more vulnerable group in the retaliation process than the middle, supervisory and operational cadres.

- Trade Union members had become victims more than the non union members.

- Labour legislation

When one studies the labour legislation, one could see that special protection has been provided to certain category of employees, under special circumstances. According to the provisions of the Maternity Benefits Ordinance and Shop & Office Act, the services of a female employee cannot be terminated on the ground of pregnancy. The Industrial Dispute Act has explicit provisions that the services of an employee cannot be dispensed with when an application has been filed before arbitration. Similar safeguards could be considered for whistleblowers in our labour statues and an agitation from the civil society, labor movements and the media are most desirable.

Recognition awards

The corporate sector recognises the special achievements of the companies such as CSR awards, Best Corporate Business Awards etc. annually and it is extremely doubtful whether any weightage has been given to the whistleblowing factor. The time has come for the Central Bank of Sri Lanka, trade chambers, Employer’s Federation of Ceylon, Institute of Personnel Management, Labor Department, Institute of Bankers, Institute of Chartered Accountants of Sri Lanka, etc to seriously address this issue in galvanising this time tested requirement, which is capable of maximising the shareholder wealth. Recognising the WB is one of the best practices that could be aggressively marketed by the above institutions. Evidently, establishment of a Fraud Risk Management Plan too should gain special recognition in the marking scheme.

CSE role as the corporate watchdog

Invariably, the Colombo Stock Exchange (CSE) as the corporate watchdog has a pivotal role to play in the eradication of corporate scandals. The “Yahapalanaya Goverenance” that dawned in January this year would have undoubtedly strengthened the hands of the Chairman of the CSE. The establishment of the Financial Crimes Investigations Division (FCID) would be an impetus for the CSE to solicit its support to handle major financial scandals. In this endeavour, the findings of the Fraud Survey 2011/12 carried out by KPMG Auditors would be immensely useful for the CSE to adopt a multi-pronged approach, as its recommendations are far-reaching in character, it in its efforts to create a corrupt free corporate business environment in Sri Lanka. The six initiatives suggested are (a) Strengthening employee and 3rd party due diligence, (B) the implementation of a WB mechanism (both Internal & external), (c) the establishment of a framework for monitoring the corporate ethics, (d) Fraud Awareness training,(e) Establishment of a dedicated and independent investigation unit lastly the introduction of a process specific fraud controls.The latest initiative that has come from the civil society is the naming and shaming of the fraudsters, including that of directors, auditors, accountants and errant regulators.