Sri Lanka heading for a major debt crisis

It is with great pleasure and delight that I recall the fund management days at the General Treasury with R. Paskaralingam and S. Shanmugalingam who partly provided us with on-the job practical experience for budding young officers on how to utilise foreign debt-based development finance as an essential prerequisite for development projects in Sri Lanka. Those days, most of the foreign borrowing was for the targeted projects with guaranteed outputs and benefits and on concessionary terms with debt repayments on long term, providing enough time to pay back the debts. In addition, the fund management was monitored on a one-to-one basis, targeted for capital development projects like the Mahaweli Development Project, managed separately from recurrent expenditure. This project, which even today gives enormous benefits; producing mainly food crops, power and energy, exportable products and saving foreign exchange and many more income sources to masses, supports the fiscal situation in the country. The foreign debts-based projects have generated intended development outcomes while accelerating economic growth. Such projects have become a blessing for the economy because it has been monitored carefully, avoiding waste of funds as the way Asian Development Bank (ADB) does for its financed projects.

In recent times Sri Lanka has on one hand taken more foreign debt anxious to implement “infrastructure based economic development”while on the other hand to built “preconditions for takeoff” of the economy. Sri Lankan economic development experience is even different from the “creation of investment funds through budgetary deficit financing” (as expressed by one global economist) when considering the accumulated foreign debt. However, the present system of economic development in Sri Lanka and related foreign debt situation is entirely different from the development theories we studied in our university days. According to the evidence, it is merely “a politically cultivated ambiguous way of development” without funds at the Treasury and relatively securitising the future generation’s tax money. The main focus of this article is on the “foreign debt for development” in Sri Lanka as this is the most critical way of fund raising for development among the overall sources of public debts.

Foreign debt as the main focus

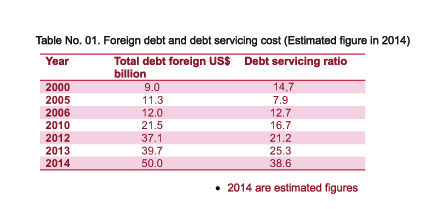

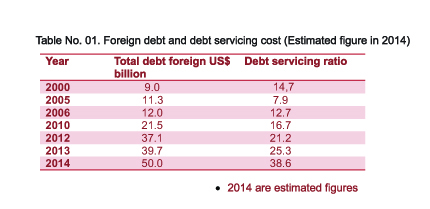

As noted in Table No. 1, foreign debt has increased significantly since 2010, became a serious problem because many are commercial borrowings at higher rates of interest. Related debt servicing cost has really become a burden on the balance of trade and on the balance of payment if there are no remittances by Sri Lankan workers abroad. The most dangerous situation is allowing state enterprises to borrow funds abroad in addition to the Treasury. The Bank of Ceylon, National Savings Bank, DFCC and few others are among those whose actual foreign debt value is not known. The actual debts and debt servicing cost may be more than the figures mentioned in Table 1 because the actual figures are not yet compiled properly.

As noted in Table No.2, total accumulated foreign debt balance increased from US$ 21.5 billion or 36.1per cent of GDP in 2010 to around $39.7 billion or 58.8 per cent in 2013 and $57 billion or 69.4 per cent of GDP (estimated) at the end of 2014. By the end of March 2015 overall foreign debt may have gone beyond $70 billion. Further, it indicates a dangerous signal when compared to the government revenue than GDP apart from eating out sizeable export earnings annuall

Foreign Debt as a percentage of GDP: Debt servicing cost as a percentage of export and total debt repayments as a percentage of Government revenue. The last column shows foreign debt as a percentage of Government revenue:y. As shown in the Table No. 2, the total government revenue is only and almost sufficient to pay the total debt repayments. Under this situation, the country is indebted to Sri Lankan workers employed abroad for sending their remittances to manage the overall balance of payments situation in the country. In addition, the present government has obtained a further $377 million worth of foreign debt at higher rates of interest up to April 2015 issuing “Sri Lanka Development Bonds” in order to meet the current commitments, left behind by the last regime. Taking debts and repaying debts is going to be an actual situation under the given conditions even in the future Sri Lanka.

(See Table 2 above)

Since 2010, foreign debt is relatively short term with high rates of interest and short mature repayment. There are large volumes of repayment bills monthly waiting for settlement. Under the present circumstances, the government has to take especially more foreign debt in order to repay debt already committed and also for settling unpaid bills of the ongoing development projects. The recent appeal of the Government indicated that the current commitments are more than Rs. 400 billion and in April 2015, the government has resorted to the approval of the Parliament to increase debt limits.

As the previous government followed a system of spending without funds at the Treasury and without a proper financial planning with a long-term vision, the new interim government also has to follow the same practice. Today the Government has to borrow and pay most of its recurrent commitments. This situation is appearing in the prevailing huge fiscal gap between the revenue and expenditure of the government especially due to accumulated budgetary deficit over the years. The accumulation of Sri Lanka’s large public debt is a result of the accumulated fiscal deficit over the years. After the war, policy makers failed to manage the fiscal deficit properly, in spite of inadequate revenue and continued massive government expenditure. The fiscal deficit from 2010 to 2014 was around 7 per cent as stated in the budgets speeches, but actual is around 12 per cent to 15 per cent if we do a post-budget audit. The overall public sector fiscal deficit is even more when considering the big losses in public enterprises and wasteful conspicuous state consumption. Finally it is the “ongoing vicious circle” of taking debt and settling huge debt servicing costs annually. In addition, evidence suggests that the outcome of the debt-related investments already undertaken, do not yield sizable returns to pay back the debt, no resultant increase in exports or reduction in imports and not at all supporting the Treasury. Many of this foreign debt-based projects are just “white elephants and rosy projects” and becoming a serious burden to the Treasury.

As the previous government followed a system of spending without funds at the Treasury and without a proper financial planning with a long-term vision, the new interim government also has to follow the same practice. Today the Government has to borrow and pay most of its recurrent commitments. This situation is appearing in the prevailing huge fiscal gap between the revenue and expenditure of the government especially due to accumulated budgetary deficit over the years. The accumulation of Sri Lanka’s large public debt is a result of the accumulated fiscal deficit over the years. After the war, policy makers failed to manage the fiscal deficit properly, in spite of inadequate revenue and continued massive government expenditure. The fiscal deficit from 2010 to 2014 was around 7 per cent as stated in the budgets speeches, but actual is around 12 per cent to 15 per cent if we do a post-budget audit. The overall public sector fiscal deficit is even more when considering the big losses in public enterprises and wasteful conspicuous state consumption. Finally it is the “ongoing vicious circle” of taking debt and settling huge debt servicing costs annually. In addition, evidence suggests that the outcome of the debt-related investments already undertaken, do not yield sizable returns to pay back the debt, no resultant increase in exports or reduction in imports and not at all supporting the Treasury. Many of this foreign debt-based projects are just “white elephants and rosy projects” and becoming a serious burden to the Treasury.

The country is heading for a major debt crisis and needs taking sustainable precautions to avoid such a situation in addition to so-called upcoming financial structural problems in the near future. During the last regime, the ongoing debt problem has not been considered seriously and short term commercial dollar loans secured at high rates of interest overlooking the high debt servicing cost. The situation is precarious now considering that the high rate of interest of 12.5 per cent demanded by foreign investors for bonds issued last February. When investors drive up high rates of interest it indicates the risks associated with the debt and suggests that the country’s debt position is approaching a critical level. In addition to the government, public-owned institutions are also pressed for obtaining dollar loans in the past. The previous government has continuously taken huge short term loans at high rates of interest and signed unsolicited proposal-based, uneconomical debt-based contracts for the Colombo Port City Project, Hambantota Harbour Project, Nelum Tower and Mattala airport and for the international cricket playground without proper economic cost benefit analysis. The returns of some of those projects are still doubtful although repayments are due soon out of taxpayers’ collections.

Merit of taking foreign debt

Countries take foreign debt with the aim of stimulating economic growth, supporting and providing various services for the poor as fund-raising measures. The foreign debt capital could be beneficial if the funds borrowed are used for right-type, long term development projects and the expected returns are higher than the total outcomes including the interest payable on the borrowing. Borrowing is a means of increasing total savings and overall investments of a country and helping imports of scarce technical knowhow. The Mahaweli Development Project is an example of a successful project in Sri Lanka, carried out on borrowed funds, able to develop technical knowhow in energy generation and new knowledge in construction sector and related research skills. Furthermore, specifically targeted project loans are provided by multilateral institutions like the World Bank (WB) and the ADB and this foreign debt is real injection for a higher trajectory of economic growth. The debt has been an essential input for development of Sri Lanka, used for its improvement of economic strength and people’s welfare together with reducing poverty and inequality. Moreover, debt has been used for the purpose of financing the gap between the available funds and needed funds for development projects in the past. However, in the recent past, Sri Lankan political policy makers used to act over-ambitious and debt capital has been used to achieve political objectives overlooking the basic principles of debt capital investments.

When ADB and the WB lend development capital they use to supervise all debt related projects, start to end and maintain development financial discipline. They insist on counterpart funds from the Government as well as from the beneficiary communities for the purpose of building commitment and ownership to the project. Most of those project-targeted –debt is economically beneficial and results are guaranteed. The evidence suggests that some of the debt related development projects started in Sri Lanka were without financial investment discipline and subject to malpractices and misappropriations together with excessive cost. Many of those debt capital based projects are brought in under unsolicited proposals, at exorbitant cost without proper evaluation regarding their outcomes. The evidence suggests that Sri Lanka has not established a good track record of utilisation of foreign development debt and blamed for severe leakages in terms of corruption, bribes, malpractices and various other improper practices. There are criticisms on utilisation of debt and priority of project selection and excessive project cost over benefits and utilisation-discipline of debt-funds for economically unhealthy projects. Benefits of Lotus Tower, Mattala airport, Colombo City and Hambantota Harbour may not be generated in sizable volumes or results are doubtful for years while the debt repayments are becoming a huge burden on the current government budget.

Impact of foreign debt than what Sri Lanka can manage

The Government has sold development bonds and taken foreign debt worth $357 million up to April and further more bond auctions may have to be floated every month in the coming years in order to settle bills on hand and repay the debt already taken. Presently Sri Lankan development bond creditors are international open market investors who are providing short term debt and demanding higher rates of interest than LIBOR rates. Those creditors to Sri Lankan development bonds have already quoted higher rates of interest because they have already rated the risk associated at present as very high. Under the circumstances, even the institutions like IMF, hesitates to support Sri Lanka unless we prepared to undertake appropriate policy measures and overall economic reforms to minimise the on-going risk.

The ongoing practice of debt taking and paying installments with high debt servicing costs would create inflationary pressure that increases the cost of production and erodes the country’s competitiveness in the international markets. On the other hand the exchange rate could go up and debt repaying burden may be seriously affected widening the fiscal deficit further and the balance of payment like in Greece. Then, the exports begin to further reduce and import prices increase which implies high cost of living, loss of employment, lower income to workers and huge social unrest. It is a vicious circle of debt taking and repaying until such time of reaching the disastrous “Red Line” of debt crisis. Thereafter too, debt is needed and obtainable even at higher cost of interest after producing the country assets as securities. The way out of this vicious circle is through taking necessary policy directives to manage the foreign debt with required utilisation discipline and introducing reforms for a stronger economy with higher rate of growth.

According to the present signals, Sri Lanka is going to face a severe debt repayment problem or almost heading closer to the doorstep of a debt crisis situation which could create dangerous internal impacts especially serious implications for everybody in Sri Lanka. Accelerating debt beyond the debt honouring level is likely to invite internal financial structural problems as mentioned above that cannot be overlooked as the general public may suffer the most. The people in Greece are experiencing similar financial structural difficulties on these days. The creditors of the Government are also not going to be silent until such time they recover all dues fully. Those creditors may eventually form a creditors’ pressure group internationally and create long-term international pressure on Sri Lanka.

Sometime back, Latin American and East Asian countries experienced similar debt crisis situations and the creditors mercilessly applied the famous “Baker Plan (1985)” and “Brady Plan (1987) solutions and finally recovered all debts. The IMF and the WB ultimately supported the creditors. According to the Baker Plan, firstly the principal and interest repayment is arranged to a sustainable schedule or rescheduling and secondly, forgiving part of the principal and interest repayment is arranged obligating all creditors groups to act in a uniform manner. Debt forgiving part is used to be small and mercilessly forced to repay all, in a different way. At the end, they will use many other ways to get paid back. According to experience, these plans are cumbersome and subject to various international issues depending on the interest groups, especially politically motivated objectives. Under the Brandy Plan, in addition creditors lobbied for securitising the debt and selling them, to the investors who are willing to take over (Asset Backed securitisation Method). In East Asian (1997), the creditors applied the Asset Backed Securitisation Scheme to write off the bad debts of public and private enterprises. However, the losers always are the debtor-countries who face worse outcomes for generations.

When considering the ongoing situation, if Sri Lanka faces a debt crisis, creditors may act according to the debt recovery plans mentioned above and apart from the debt rescheduling and debt forgiving relief, creditors may collectively force Sri Lanka for asset backed securitisation. Most of the Sri Lankan type debt-related assets are economically critical popular business ventures for creditors. Moreover, Sri Lanka as a middle income country may receive little benefits under sustainable rescheduling and re-arranging principal and interest repayments and also some relief under debt forgiveness. These reliefs depend on the creditors’ political and social interests. Most probably creditor groups may inevitably demand for securitisation of related debts-connected assets and force to sell them to investors. Many East Asian and Latin American countries have experienced and followed both Baker and Brady Plans and sold their critical assets to the creditors and faced long term consequences even at present.

Similarly, at the end of a debt crisis situation, Sri Lanka may have to handover the related assets to creditors and thereafter those assets will be owned and controlled by the investor-creditors under the Assets Backed Securitisation scheme. Then, Sri Lanka may understand the beauty of so-called “kindness of creditors’ support”, and beauty of offering handsome loans towards developing countries under government-backed sovereign guarantees. When the country faces a debt crisis, the very same creditors may demand a boneless pound of flesh and blood. They will demand ownership of some of those highways, Hambantota Harbour and Mattala airport, Colombo Harbour and Port City, Lotus Tower, Kerawalapitiya Coal Plant and many other important critical economic ventures such as Petroleum Corporation, Electricity Board or National Savings Bank, etc. Sri Lankans are going to face a seriously disastrous situation, intolerable to all of us.

Then, foreign creditors will own and control those economic ventures until such time they recover the entire debt with accumulated interest together with all profits and other benefits for years. They will employ their citizens and utilise their resources imported by them. There will be fully owned foreign economic zones within Sri Lanka and foreigners will fix the price of their services and products and sell them to Sri Lanka. For example Sri Lankans may have to pay Rs. 2,500 or Rs. 5,000 from Colombo to Matera and Rs 3,000 from Colombo to the airport. Similarly, foreign owners may fix the price of a unit of electricity as Rs. 130 or a litre of water for Rs. 70 or a litre of petrol for Rs. 200 and no more subsidies. Will Sri Lanka be able to tolerate price fixing for fuel, electricity, water etc. by the foreign owners? Sometimes they may restrict Sri Lankans entering the Colombo Port City or not permit access to Sri Lankans at the Hambantota harbour. They will make Lotus Tower a secret communication centre threatening the regional security too.

They may forcefully demand the ownership of Petroleum Corporation, Ceylon Electricity Board, Water Board, National Savings Bank, etc because they have taken separate debt under dollar bonds. Therefore, a situation may arise that a foreign-country-entity within the “Nationalism-popular-Sri Lanka”, would threaten the national sovereignty. Those investors will recover the full loan, interest and everything from Sri Lanka. At the end, years later Sri Lanka would find discarded, unusable anymore, scrap project leftovers by the powerful creditors. Can the Sri Lankan citizen tolerate such situation or why not take precautions to avoid a debt crisis situation before it becomes the worst ever national disaster?

Way forward

Foreign debt is a dangerous issue, excessively created since 2010, left by the previous regime, which the present regime has to manage properly and avoid a debt crisis situation in Sri Lanka. At the end of March 2015, the overall volume of foreign debt would have reached $70 billion or nearly five times of the government revenue while debt repayment is almost equal to the revenue. According to the evidence, the country could be closer to the “Dangerous Red Line” of debt crisis. If Sri Lanka actually faces a debt crisis situation, it woud be intolerable and miserable for all us as we are a relatively inward-oriented and proud nation. The gateway out of the debt crisis lies in between the destiny of continuing to take foreign debt in the future and creation of a strong economy leading to earning sizeable volumes of foreign exchange while taking appropriate policy reforms preventing a debt crisis. In addition, the probable remedial measures that can be taken to avoid this crisis lies in a politically stable government in Sri Lanka in the near future, enabling them to take both short term and long term policy precautions.

(The writer is a freelance Economic Consultant after retiring as the Director General (Economic Policy Planning) in the Ministry of Rural Economy in 2006. He was attached to the Ministry of Finance; Treasury from 1988 to 2002 and has wide experience in Treasury operations. He could be reached at palithaeka@yahoo.com)