Columns

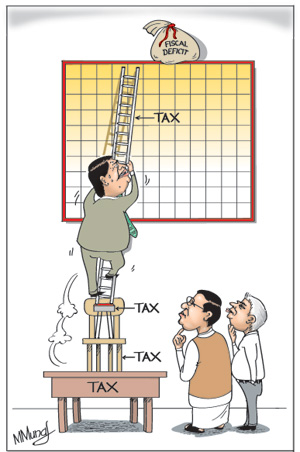

New opportunity to chase elusive fiscal deficit target

View(s): Reducing the fiscal deficit to below 5 per cent of GDP is essential to ensure economic stability and sustained economic growth. Successive governments’ intent to bring down the fiscal deficit has proved elusive. The new Government’s commitment to good governance provides another opportunity to reduce the fiscal deficit.

Reducing the fiscal deficit to below 5 per cent of GDP is essential to ensure economic stability and sustained economic growth. Successive governments’ intent to bring down the fiscal deficit has proved elusive. The new Government’s commitment to good governance provides another opportunity to reduce the fiscal deficit.

The need to contain the fiscal deficit is not contentious. In December 2002 the Fiscal Management Responsibility Act (FMRA) made it mandatory for the Government to take measures to reduce the fiscal deficit to 5 per cent of GDP in 2006 and kept at that level thereafter. As it turned out, the fiscal deficit was 8 per cent of GDP that year. It averaged 8 per cent in the five years (2004-2008) and has been brought down to around 6 per cent of GDP in recent years.

Consolidated deficit

Consolidated deficit

Although official statistics have shown a reduction in the fiscal deficit in recent years, this is by not including borrowing of state enterprises from banks. When these liabilities are taken into account the deficit to GDP ratio is much higher than the 5.9 per cent in 2013, probably about 6.5 per cent of GDP. What matters is the consolidated fiscal deficit that includes the contingent liabilities of the Government as it adds to aggregate demand in the economy.

Challenging task

The intent of the interim budget to reduce the fiscal deficit to 4.2 per cent of GDP is a challenging task. The expenditure cuts of the Government would help in reducing expenditure and bringing it into closer alignment with revenue. This was not an option available to the Treasury during the last regime that considered ostentatious spending inviolable. In contrast, the interim budget was able to cut large wasteful expenditure.

Fiscal consolidation is difficult owing to the limited revenue base of only about 12 per cent of GDP, large debt servicing costs that absorb the entirety of revenue, huge expenditure on public service salaries and pensions, big losses in public enterprises, a large defence expenditure, expenditure on subsidies and wasteful conspicuous state consumption. Many of these expenditures have rigidity and are difficult to reduce.

Revenue

The tariff reductions on essential food imports and reduced price of fuel would decrease revenues. It is not certain whether the new taxation measures in the interim budget, as amended and implemented by a weak tax administration, would yield additional revenue. The likely increase in international oil prices too would reduce revenue unless domestic fuel prices are increased commensurately with international prices.

Increasing revenue is a difficult task as tax administration is weak. Furthermore, GDP is likely to grow slowly owing to less infrastructure development, disruption of economic activities due to elections, uncertainties in policies and lesser public spending. As the GDP is the denominator, the lower increase in GDP would increase the debt to GDP ratio. This is however a mere statistic and if the total fiscal deficit is moderate in 2015, it would be an achievement.

Increasing revenue

Increasing government revenue from as low as 12 per cent of GDP in 2012 to about 18 per cent of GDP over time is vital for fiscal consolidation. Although government revenue has increased in value, it has fallen as a proportion of GDP in recent years. Revenue decreased from 20 per cent of GDP in 2005 to 12 per cent of GDP in 2013 and is likely to be around the same proportion in 2014. This revenue to GDP ratio is below levels of countries with Sri Lanka’s per capita income. Tax avoidance and tax evasion are important reasons for this.

The reform of trade and excise taxes, a broader tax base and more effective tax collection are needed to achieve higher revenue collection. Some taxes may require reconsideration, modification and perhaps even change. What needs to be done is to increase coverage of corporate, personal and indirect taxes in a progressive manner with heavy expenditure taxes on luxury consumption rather than ad hoc and targeted taxes. Increasing revenue depends very much on the realistic nature of the tax reforms and the administrative capacity and integrity of tax administration.

New opportunity to chase elusive fiscal deficit targetOne way to begin a rational and efficient taxation system is to make public the Presidential Taxation Commission Report that has been shelved and discuss its proposals. The new Government’s willingness to tax luxury consumption of the affluent who avoid taxes in diverse ways is one means of increasing revenue.

New opportunities

The new regime’s commitment to good governance provides an opportunity to reduce the fiscal deficit by curtailing wasteful expenditure of the previous Government that spent large sums on unnecessary and wasteful expenses. The new Government must spend public money carefully by eliminating wasteful government expenditure.

If the expenditure on defence can be brought down by even 1 per cent of GDP, its burden on the public finances could be eased significantly. Huge losses incurred by public enterprises like SriLankan Airlines, Mihin Lanka, the Ceylon Electricity Board (CEB), the Ceylon Petroleum Corporation (CPC) must be reduced by introducing reforms. Privatisation of lossmaking enterprises could provide both reliefs to public expenditure as well as revenue from the privatisation proceeds. Can this option be exercised by the Government?

Other public expenditure such as salaries of public servants and pensions, subsidies such as for fertiliser and Samurdhi payments are not likely to be reduced. In fact the salaries bill would once again increase.

Conclusion

The road to the realisation of a reduced fiscal deficit is not an easy one. The interim budget has taken several steps in the right direction towards fiscal consolidation, especially by cutting down wasteful and ostentatious public spending. However, increasing tax revenues in the short term would be a challenging task.

The containment of the fiscal deficit to 4.2 per cent of GDP in 2015 is unlikely owing to revenue shortfalls and lower GDP growth. With economic reforms and careful management of public finances, the Government has a splendid opportunity to bring down the consolidated fiscal deficit in 2016 onwards.

Leave a Reply

Post Comment