Columns

October’s large trade deficit dispels prospect of better trade performance in 2014

View(s): Sri Lanka’s trade performance in October is disappointing and disturbing. Exports decreased by 13.7 per cent, import expenditure increased by 25.6 per cent and the trade deficit widened by 141 per cent compared to that of October last year. If this deterioration continues in the last two months of the year, the trade deficit is likely to exceed US$ 8 billion: higher than last year’s trade deficit of US$ 7.6 billion.

Sri Lanka’s trade performance in October is disappointing and disturbing. Exports decreased by 13.7 per cent, import expenditure increased by 25.6 per cent and the trade deficit widened by 141 per cent compared to that of October last year. If this deterioration continues in the last two months of the year, the trade deficit is likely to exceed US$ 8 billion: higher than last year’s trade deficit of US$ 7.6 billion.

The export growth that began in mid-2013 was expected to gain momentum owing to economic recovery in the US and Europe that are our main markets for manufactures. This was so in the first three quarters of the year, but in October the tide turned and exports declined by as much as 13.7 per cent compared to that of last October. An increase in import expenditure by as much as 25.6 per cent aggravated the problem. In October 2014 the trade deficit was 142 per cent more than that of the same month last year.

Expectations

Expectations

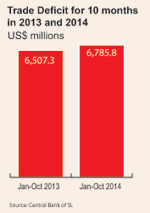

The trade deficit was expected to be much less this year than in recent years. Consequently a significant balance of payments surplus was expected at year’s end. However, the trade performance in October, and the cumulative trade deficit of US$ 6.78 billion for the ten months of the year compared to US$ 6.50 billion in the first ten months of last year — an increase of 4.3 per cent — point to a higher trade deficit than anticipated. A likely trade deficit of over US$ 8 billion in 2014 is higher than last year’s trade gap of US$ 7.6 billion.

Recent trade deficits

The trade deficit of US$ 4.8 billion in 2010 increased to a massive US$ 9.7 billion in 2012 and created a balance of payments crisis that required remedial measures in 2012. The rupee was devalued and its float resulted in continuous depreciation. Even though there was an improvement in the trade balance in 2013, the deficit of US$ 7.6 billion was high.

Export growth and a restraint in imports were expected to reduce the trade deficit this year. By mid-2013 there was a noticeable improvement in exports that led to expectations of a lower deficit in 2014. As expected, exports grew on the strength of an economic recovery in the West, most notably in the US. This trend in export growth appears to have been arrested in October this year. The October performance in exports and imports suggests a deterioration in the trade balance .This portends serious setbacks to exports in the coming months leading to a large trade deficit this year and in 2015.

Setback

The cumulative trade deficit for the first ten months of the year was US$ 6.78 billion. Even a favourable projection of the trade deficit on the ten months performance gives a trade deficit of around US$ 8 billion. If the unfavourable developments in October continue, it is likely that the deficit would exceed this.

October exports

October exports

Export earnings declined by 13.7 per cent in October 2014 compared to the same month in 2013. The drop in exports to US$ 899 million in October was a reversal of the increasing trend in exports since June 2013. As exports increased in the first nine months, export earnings for the ten months of 2014 increased by 9.7 per cent to US $ 9.2 billion.

The decline in exports in October is worrisome as the largest contribution to the decline in exports in October 2014 was from the country’s main industrial export — textiles and garments — that declined by 8.7 per cent. The decline in garment exports was to the main markets: to the EU by 10.1 per cent and to the USA by 8.4 per cent.

Export earnings from the country’s main agricultural export tea, also declined due to a decrease in both export prices and volumes. In contrast, coconut exports increased by 51.5 per cent mainly led by the significant increase in kernel product exports. Export earnings from spices declined continuously this year due to the lower production compared to the previous year.

Ominous developments

Ominous developments

These developments in exports are ominous. The country’s main industrial and agricultural exports have been adversely affected. It is an indication that these main markets may not increase demand for our type of products. Furthermore, the decline in oil prices could depress the demand for tea in Russia and the Middle East that are the main markets for the country’s tea exports. It is indeed unfortunate that the expected improvements in trading conditions have been stultified.

Imports

The deterioration in the trade balance is mostly due to increased imports. The surge in imports in October is a serious concern. Expenditure on imports increased by as much as 25.6 per cent in October 2014 compared to October 2013 to US$ 1.75 billion. In the first ten months of this year imports grew by 7.3 per cent to US$ 16 billion.

The increase in import expenditure in October 2014 was mainly due to significant increases in imports of fuel, motor cycles and motor cars. Despite the decline in refined petroleum imports, expenditure on fuel increased significantly due to increase in crude oil imports. Rice imports also increased significantly during the month due a shortfall in domestic rice production.

According to the Central Bank, imports of textiles and textiles articles, wheat and maize, paper and paper boards, vegetables and dairy products also increased during October, while fertiliser imports declined. Import expenditure on investment goods increased by 12.9 per cent.

In conclusion

The unsatisfactory trade performance in October is disconcerting as the export growth that has been arrested in October may continue. The trade deficit that was expected to improve this year is likely to increase owing to decreased exports and increased imports. In the first ten months export earnings were only 57 percent of import expenditure that has ballooned. The export growth that has been arrested in October may continue. This is a serious concern for the country’s economic growth.