“Interest difference for banks in Sri Lanka”

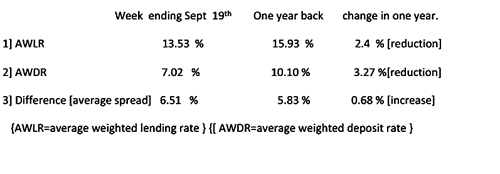

Let me at the outset thank Mr. C.J. Wijetillake a senior banker, for his timely explanation under the above caption in Business Times on September 28 regarding the rationale for Sri Lankan banks to maintain relatively higher ‘spreads’. In this connection please permit me to apprise the readers of some interesting statistics related to this issue. Based on data published weekly by the Central Bank of Sri Lanka, the position of interest rate changes during the period of one year could be shown as follows:

Week ending Sept 19th One year back change in one year.

I would kindly invite discerning readers to form their own opinions about these data.

While the above data may look too simplistic to make generalisations, yet to me these data appear to indicate inter-alia that,

(a) the reduction in deposit rates during one year had been more than the reduction in lending rates.

(b) consequent to the disproportionate reduction in the deposit and lending rates, the spread (margin) of commercial banks has increased. ie their profit margin appears to have increased. (c) as at present, banks’ average spread is 92 per cent of AWDR while it was only 58 per cent a year ago. Thus while depositors incurred a considerable loss in interest income, commercial banks appear to have improved their income position due to disproportionate downward adjustment in interest rates. Could this be one of the reasons for the impressive increase in profits announced by some banks despite the reduction in lending rates?

While appreciating the position explained by the writer which tends to indicate that there is more to ‘intermediation costs’ of banks than just the ‘spread’, yet the responsibility of banks towards millions of depositors to provide a reasonable return for their deposits, should not be ignored.

This scenario raises the issue as to whether the authorities have developed adequate mechanisms to monitor the ‘spread management’ approaches of banks.

As to what the relevant norms which are applied in other countries, is also an aspect to consider? Data given above tends to show that there appears to be a case for banks operating above the average levels to consider an increase in the deposit rates especially for senior citizens.

M. W. Panditha

Retired bank employee