Banks favoured; no faith in regulator-poll reveals

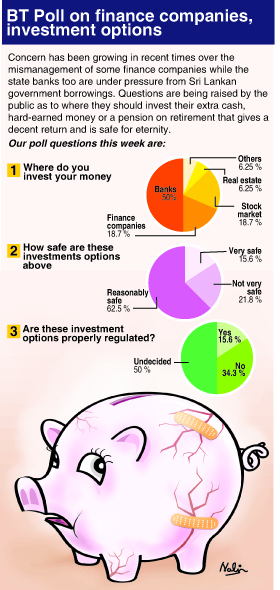

Most Sri Lankans favour banks, particularly state banks, to invest their hard-earned money or pensions and have no faith in the regulators to effectively control and monitor other investment options here, a joint poll has revealed.

CIFL depositors fill forms at a protest meeting on Monday. Pic by M.A.Pushpa Kumara

A street poll conducted by Colombo-based Research Consultancy Bureau (RCB) revealed that 99.4 per cent of respondents invested in commercial banks while that percentage was exactly 50 per cent in the email poll organized by the Business Times (BT).

The joint BT-RCB poll (on email and the street) on seeking public views and perceptions on investment options in Sri Lanka followed growing concern over the collapse of some finance companies and the credibility and faith in this system.

Many respondents, investors in a range of options, gave vent to their fury even calling those who own finance companies ‘a bunch of crooks’ bent on making poor investments, enjoying luxurious lifestyles and gambling away at casinos. Only a few have made proper investments … with other people’s monies.

“This goes on unabated since there is no one to regulate their activities. The regulator comes into the scene ‘to close the stable after the horse has bolted’,” retorted one angry depositor.

Another respondent/depositor said most of these companies have directors and CEOs enjoying all the perks including the latest luxury vehicles, properties abroad and bank accounts overseas especially in Singapore and also the Cayman islands. He urged the Government to bring in laws where directors, CEOs and senior management are personally liable to pay back, otherwise these individuals should be blacklisted, both financially and socially.

“The situation has reached such serious levels that something radical must happen to restore confidence in the system,” he said.To the question, ‘how safe are these investment options, 62.5 per cent respondents in the BT said they were ‘reasonably safe’. Asked whether these options are properly regulated, 50 per cent of the BT respondents said they were undecided while 34.3 per cent said ‘No’.

The poll results – BT and RCB – are given separately as respondents in the RCB survey have given one to three investment options and also different options in the ‘safety’ category.

The poll results – BT and RCB – are given separately as respondents in the RCB survey have given one to three investment options and also different options in the ‘safety’ category.

Among the comments received in the BT poll, one respondent said the regulator should insist that the investments made by finance companies made public and that depositors be kept informed of all the activities of the finance companies

“Any company which goes into a wrongful investment should be properly punished in the short term, so that it will be a deterrent for them to go for unlawful investments. Unless this is done, the “vicious circle” will go on. There will be more & more, HPTs, Ceylinco’s, Golden Keys, F&Gs, Sakvithis, CIFLs,” he said

Other respondent said:

- Investment the stock market and finance companies with good ratings is safe.

- Investment in the stock market in fundamentally strong shares with good balance sheets is safe.

- Despite the problems of state banks, the government is obliged to honour commitments (investments) in state banks

- Forestry Management Schemes were so notorious in India where quite a few of them were closed down two decades ago, and then they came to Sri Lanka.

- I’d rather invest savings overseas as it has been proven that Sri Lankan finance companies, stockbrokers and other investment companies have poor financial management skills and no ethics for poor investors who invest their hard earned money. – Investments are unsafe as the state regulators play politics and not professional management.

- These investments were well regulated in the past, not anymore.

- Other than banks, most other investment options are not guaranteed. However, putting your money in banks is also a very poor option for investment, because of lacklustre returns on investment offered by them, since the rates are barely above the frequent price increases for food items.

comments powered by Disqus