Columns

Tax the rich and spare the poor

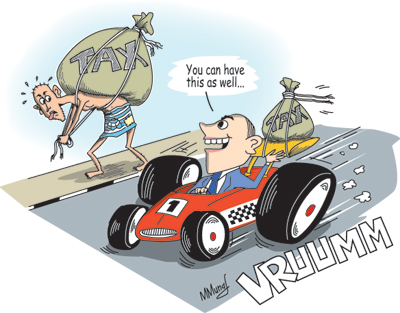

The burden of taxation has fallen on the poor in recent years despite the budget 2013 and previous budgets being described as being ‘people friendly’. No doubt there were several specific measures of relief for the poorer sections of society. Yet the sum benefit on the poorer sections is small compared with the taxation measures that increase their cost of living.

The general thrust of taxation has been such that a heavy burden falls on the lower income earners through indirect taxes on basic food items. The fundamental reason for this is that to achieve the required revenue, the Government depends on indirect taxes that increase the prices of essential commodities. There are high levels of taxation on basic commodities, while direct income taxes that fall on the affluent bring in a relatively low amount of revenue.

Regressive taxes

No less a person than a Senior Minister in the government, Prof. Tissa Vitharana, pointed the regressive nature of the country’s taxation structure during the Budget debate. The deep-seated reason for a regressive taxation scenario is the fundamental structural weaknesses brought about by the fiscal situation of the country. The inability to collect taxes from the affluent due to tax evasion, tax avoidance, inefficiency and corruption in the tax administration has been a reason for regressive taxation. In addition, the expenditure pattern of the Government is at the root of the problem that necessitates taxes that fall on the poor people of the country.

Specific taxation measures could be adduced to support this contention, as happened during the Budget debate, when Senior Minister Vitharana criticised the Government’s taxation policy as one that looked after the interests of the rich and heaped burdens on the poor. While pointing this out he asked for remedial measures.

Prof. Vitharana supported his contention on the grounds that indirect taxation fell on basic commodities consumed by the poor. The reliance on indirect taxes rather than direct taxation has resulted in the burdens of taxation falling on the poor, whose incomes are spent on these basic items. This is the regressive nature of the country’s taxation.

Prof. Vitharana advocated that ” all indirect taxes on a basket of ten essential items like milk powder, sugar, dhal, and dried fish should be eliminated, till such time as arrangements can be made for them to be given at substantially reduced prices to all with incomes below Rs 25,000 a month,”. Taxes on these basic items have been justified as needed to protect and encourage the production of these food items or their substitutes. The minister contended that domestic production should be achieved through other policy measures.

Direct taxes

Further, he went on to point out that the direct tax revenue was inadequate. He pointed out that the country’s tax/GDP ratio was only 12.4 per cent in 2011, when the benchmark for middle income countries is twice that at 25 per cent. He went on to show that tax revenue which was Rs. 12.2 billion in 2007 fell to Rs. 6.3 billion in 2011. This he said reflects not only the inefficiency but also the corruption in the Inland Revenue, Customs and Excise Departments and that strong corrective action is indicated to improve tax collection. There is no doubt that there are possibilities of increasing direct taxation by improving the administrative efficiency of the tax authorities.

Other possibilities

There are possibilities of increasing taxation by imposing direct and indirect tax measures on the affluent sections of the population. Take the case of the increase of the annual motor car licence by Rs 1500. This is a progressive measure but inadequate. A car owner of a 1300 cc car would now pay Rs. 3,500 as annual licence fee instead of Rs. 2,000. This means that even with increased tax the cost per month as licence fee is less than Rs. 300. Surely this tax could have been increased much more.

This argument is stronger when it comes to higher value higher power cars. The motor car licensing fee is on a system of progressive taxation with increases in engine capacity. Yet, in a context when the rich who possess such vehicles are evading taxes and the administrative machinery is incapable of collecting direct income taxes from high income earners, taxation on luxury consumption is a surer means of passing the incidence of taxation on to the affluent.

There are other similar possibilities of increasing tax revenue by imposing taxes on high income tax evaders. These are essentially expenditure taxes on “conspicuous consumption” of the affluent. Instead the reduction of duties on racing cars that stood out as an example of regressive taxation even though the revenue implications may not be significant.

Public expenditure

The other side of the coin is the nature and extent of public expenditure. The Government’s committed recurrent expenditure is high. The large public debt has a huge servicing cost.

The interest payments on debt absorbs a fourth of the government’s expenditure. Salaries and wages absorb another 23 percent of expenditure. The massive loses of public enterprises will require 15 per cent of expenditure. In this pattern of expenditure the expending of as much as 26 per cent on economic infrastructure appears excessive.

In contrast social infrastructure absorbs only 3 per cent of public expenditure. It is the large public expenditure of servicing the public debt, salaries and wages, losses of public enterprises and investment on infrastructure that requires high indirect taxation that falls on necessitates and essential basic items. Therefore there are possibilities of reducing the tax burdens on the poor if government expenditures are prudent, if waste is eliminated, and if the huge losses of public enterprises are curtailed.

Revenue profile

The revenue profile is dependent on indirect taxes. More than half of government revenue (51 per cent) is obtained from taxes on goods and services, while a further 21 per cent is obtained from external trade (mainly import taxes). Income taxes amount to only 17 per cent of total revenue. This structure in taxation can be changed by both changes in the tax structure and by the reduction of public expenditure.

The structural weakness in public finance must be addressed to ensure that the burden of taxation does not fall on the poor. The reduction of the public debt and its servicing costs, a drastic reduction of losses in state enterprises and prudent government expenditure are vital to reduce the burden of taxation on the poor.

Follow @timesonlinelk

comments powered by Disqus