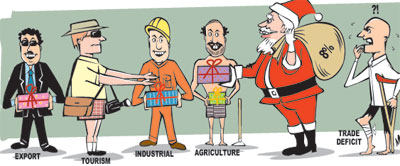

Economic growth is expected to be around 8 per cent this year. The agricultural, industrial and services sectors of the economy have all contributed to this growth that has been supported by growth in exports, increased tourist earnings and continued higher inflows of remittances.

The rate of inflation has been modest and the budget disclosed a declining fiscal deficit. There have been improvements in infrastructure that should contribute to the productivity of the economy in due course. Foreign direct investments are also expected to have increased substantially.

The downside in the economy has been the unprecedented large trade deficit causing a strain in the balance of payments that lead to a devaluation of the currency. The government continued its foreign borrowing and increased the foreign debt.

There was also a setback to the investment climate due to the government's moves to control several areas of the economy. Despite the high economic growth this year there was a reversal of the optimism and prospects of sustaining growth next year owing to this interventionist approach. The dip in the share market reflects this lack of business confidence.

Eight percent growth

The economy is expected to sustain its growth this year at around 8 per cent. The Central Bank estimates this year's growth to be slightly less than the 8.3 per cent it predicted earlier, but higher than 8 per cent.

It is hardly worth quibbling about a decimal place when many estimates that go into the national accounts are flawed by inadequate collection procedures and some production estimates being biased guesstimates.

Nevertheless there are no alternate estimates of national accounts and indications are that the economy grew at a satisfactory level with all three sectors of the economy contributing to overall economic growth. Increased industrial exports were an impetus to industrial sector growth, while increased tourist earnings contributed much to the services sector growth.

Moderate inflation

Despite high economic growth and increased import prices, inflation was moderate over the second half of this year. There was a further decline in the year-on-year inflation as measured by the Colombo Consumers' Price Index (CCPI).

According to the Central Bank, the annual average inflation was 6.9 per cent by November 2011. Improvements in the supply side, particularly with respect to agricultural produce, it is suggested, helped bring down domestic prices. Growth without undue inflation is a formidable challenge in the coming year. This is especially so due to the depreciating currency and increasing trade gap.

Tourism

Tourism displayed a robust growth. Tourist arrivals increased by 34 per cent to 598,006 in the first nine months of 2011 compared to the first nine months of 2010. Earnings from tourism increased by as much as 48 per cent to US dollars 580 million in the first nine months of 2011, compared to the corresponding period of 2010. This together with the fact that average earnings per tourist per day increased to US dollars 97 this year compared with US dollars 88 for the same period in 2010 augurs well for the economy.

Furthermore there is a diversification of tourist traffic. The majority of tourists continued to be from Western Europe. However, the growth of tourists from other parts, especially the region, is an encouraging sign. Tourist arrivals from the Middle-East, East Asia, South Asia and Australasia increased significantly.

Tourist arrivals for this year are expected to reach 850,000. The significance of this development in tourism lies not only in the amount of foreign exchange earnings of the industry, but the indirect favourable impacts on several economic activities as growth in tourism has backward linkages to other areas of the economy, such as transport, handicrafts, gems and jewellery and food items.

Therefore the increase in tourism this year has given a significant boost to other economic activities and contributed to this year's economic growth.

Export growth

Export earnings from nearly all categories have increased. However the achievements in exports this year have been overshadowed by the large trade deficit. The export earnings from industrial goods exports have been especially impressive.

The main contributors to increased industrial exports are garments and textiles, diamond and jewellery, rubber products and food, beverages and tobacco. Earnings from exports of textiles and garments increased by 13.7 per cent while diamond and jewellery exports increased considerably by 88.7 per cent in September 2011.

The exports of rubber products increased by 37.3 per cent for the same period. Exports of food, beverages and tobacco increased by 48 per cent in September 2011 -- with significant contributions coming from tinned and bottled fruits, animal fodder, fruits and vegetable juices.

Earnings from agricultural exports increased by 14 per cent in the first nine months compared to that of the same period last year. There was a growth in all key sub-categories of agricultural exports mainly due to increases in prices.

The average export price of tea increased by 3.9 per cent to US dollars 4.57 per kg whereas, the average rubber prices rose by 40.3 per cent to US dollars 4.96 per kg in September 2011 compared to corresponding month of 2010.

Earning from exports of coconut increased sharply by 75.6 per cent in September, 2011 against the same month of 2010 owing to the increase of both volumes and prices of desiccated coconut, copra and coconut oil. Earnings from minor agricultural exports also grew by 12 per cent in September 2011.

Balance of payments

The most adverse development this year was the large trade deficit. This unfavourable development in the trade account was despite an export growth of 28 percent in the first nine months of this year. The growth in export earnings was inadequate to offset the massive increase in import expenditure. Consequently there was a strain in the balance of payments. The trade deficit is likely to exceed US$ 8 billion this year. However the Central Bank is of the view that the widening of the trade deficit in 2011 is not a matter of serious concern as there are other developments that would mitigate the problem.

The inflows to the services account, particularly with respect to tourism; higher inward remittances; inflows to the financial account including long-term debt obtained by the government in relation to development projects; foreign direct investment, which is estimated to have exceeded the targeted level of US$ 1 billion in 2011; inflows to commercial banks which would help strengthen their capital base, and inflows on account of short-term financing obtained by commercial banks are expected would reduce the balance of payments deficit. Workers' remittances grew at 25.9 per cent to US $ 3,782 million for the first nine months of 2011.

The expansion in exports of services and increased workers' remittances helped contain the impact of the trade deficit on the current account. For the first nine months of 2011, the deficit of the current account was approximately US dollars 3,058 million.

Summing up

The positive developments in the economy are the growth of production in all the key sectors of the economy. The expansion of tourism and increased and diversified exports were encouraging economic developments. However these have not been adequate to contain the trade deficit owing to the massive import expenditure.

Consequently there were strains in the balance of payments and need to devalue the currency. The foreign debt has increased further owing to government borrowing and the foreign debt servicing costs are rising. The setback to business confidence owing to the government taking over enterprises was as unfortunate as unfavourable for investment. The favourable developments in the economic performance of 2011 have been tilted in the unfavourable direction by this intervention.

|