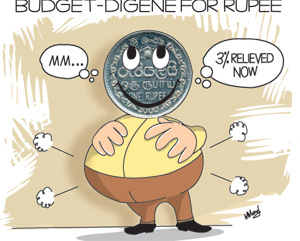

President Mahinda Rajapaksa, as Minister of Finance, presenting the 2012 Budget made the unexpected announcement that he was devaluing the rupee by 3 percent immediately. He said: "We need to reduce the import cost and increase export revenue. When our currency has strengthened, our trading partners' currencies have depreciated. So I propose to devalue the currency by 3 per cent with effect from today."

The devaluation of the currency by 3 per cent increases the prices of imports and makes the country's exports more price-competitive. By reducing imports and increasing exports, the trade deficit is expected to improve. It was a corrective action that was deemed necessary for some time owing to the massive trade deficit. However, the Central Bank, the authority for managing the exchange rate, had stubbornly resisted the depreciation of the currency. Instead, in the face of a mounting trade deficit, it decided to defend the rupee by selling US dollars. The Central Bank is estimated to have spent more than US$ 1 billion of reserves this year to keep the rupee value close to Rs 110 to the dollar.

Even after the devaluation, the Central Bank has attempted to keep the exchange rate from depreciating further and according to a Reuters report spent "at least $60 million on Wednesday to defend the currency at the new level amid depreciation pressure." It is very likely that the rupee would depreciate further despite the Governor's resolve to not allow it to depreciate. The depreciation of the currency and the increase in tariffs that were announced in the budget should reduce import expenditure, while making imported goods dearer to consumers.

Trade imbalance

The gravity of the deteriorating trade balance that was highlighted in this column often was not of much concern to the Central Bank. It was a serious anxiety to the IMF, which withheld the last two tranches of its US$ 2.6 billion stand-by facility that saved the country from a huge balance of payments crisis in 2009. The IMF may now release the remaining two tranches and restore some degree of confidence in the country's external finances.

In the first eight months of 2011, the trade deficit reached a massive US$ 5,960 million. Although export earnings increased by 28.6 per cent to US$ 6,966 million, import expenditure increased by 50.6 per cent to US$ 12,926 million. Although the country suffered this huge trade imbalance, no corrective action was taken with respect to the exchange rate.

The Central Bank position was that the expansion in exports, earnings from tourism and increased inward workers' remittances would contain the impact of the widened trade deficit on the current account. These earnings had brought down the current account of the trade deficit to US dollars 2,262 million in the first eight months. Further, the Central Bank argued that the foreign exchange reserves were high and enough to finance about 6 months imports.

The fact that a high proportion of these reserves comprised foreign borrowing rather than earned reserves was ignored. The depreciation of the rupee that was a means of coping with the trade deficit was resisted by the Central Bank. These were the antecedents that led to the devaluation of the rupee on November 21.

Price hikes

The depreciation of the rupee and increased tariffs are likely to lead to an increase in prices of all imported commodities. The government has imposed increased tariffs on selected items that include food commodities. The budgetary rationale for this is to increase domestic production of import substitutes. The increased prices are expected to provide incentives for increased domestic production of agricultural produce. The immediate effect of increased tariffs and higher import costs would be an increase in prices of food. This would increase the costs of living.

Decreasing fiscal deficit

In the hullabaloo of the currency depreciation, the controversy over business takeovers under the Revival of Underperforming Enterprises and Underutilised Assets Act, and the commotion in the Well of the House when President Rajapakse was presenting the budget, the most fundamental issue of fiscal consolidation could be forgotten. Reducing the fiscal deficit is vital for macroeconomic stability and economic growth. The reduction of the fiscal deficit would have an important bearing on economic stability and long-term growth. The decrease in the fiscal deficit would also assist in the domestic component of the public debt not increasing by much.

The estimated budget deficit for 2012 is Rs.468.9 billion. The figures presented in the budget indicate that the fiscal deficit for 2011 would be an estimated 7 per cent of GDP. The government expects to bring the deficit down to about 6.2 percent of GDP in 2012. This is an important fiscal improvement that will have favourable implications for the economy.

The reduction of the budget deficit is expected to be achieved by an increase in government revenue and grants by 19.8 percent. Although government expenditure would increase by 14.15 percent, a high proportion of current expenditure is expected to be covered by revenue and grants. Deficit financing will be mostly for capital expenditure. The implication of these figures is that the inflationary impact of the budget would be limited.

However, budget outcomes are often different to the estimated amounts: there are revenue shortfalls and expenditure overruns. It is most likely that government expenditure in 2012 would be higher than the budgeted figures. Supplementary estimates are often passed in a hurry by parliament to meet expenditure overruns or additional expenditures.

There may also be shortfalls in expected revenues. It is most likely that there would be additional revenue measures during the course of the year, as has been the practice for many years. It is likely that additional taxation measures would be introduced during the course of the year to increase government revenue. There is a tradition of not introducing unpopular taxes at the time of the budget. Therefore some additional taxes or an increase in taxes could be expected during the next few months.

Whatever mid course changes are made, they should ensure that the fiscal deficit is contained at the projected 6.2 percent of GDP by efficient collection of revenue and by careful government expenditure. There has been a declining trend in the fiscal deficit from 2009 when the fiscal deficit was as high as 9.8 percent of GDP. Improvements in government revenue and increases in the GDP have enabled the denominator of the statistic.

The curtailment of public expenditure has, however, not been achieved. The objective of reducing the fiscal deficit must be pursued persistently. Wasteful expenditure must be pruned. The reduction of losses in state-owned enterprises provides an important means of achieving a reduction in the fiscal deficit. Reforms in the large loss-making enterprises are a priority.

Summing up

The devaluation of the rupee and the increased tariffs would exert significant inflationary pressures. The increasing trade deficit may require a further depreciation of the currency to cope with balance of payments difficulties. This is especially so as global economic conditions are not favourable for the country's trade.

The most significant development in the budget is a further fiscal consolidation by bringing down the fiscal deficit to 6.2 percent next year. It is vital for the country's economic stability and growth to achieve this fiscal target.

|