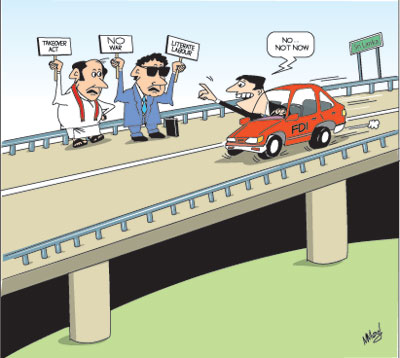

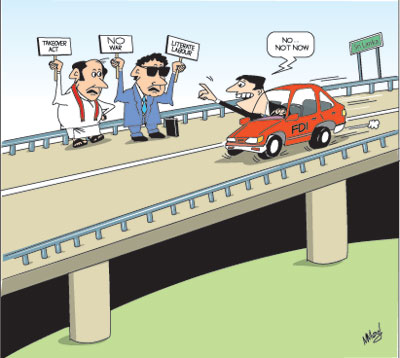

Sri Lanka requires a much higher amount of foreign direct investment (FDI) than what it has attracted in the recent past to sustain a high trajectory of economic growth. Foreign investment was expected to flow in once the war was over.

Initially there were signs of investors wanting to make large investments. However in the two and a half years that have lapsed foreign direct investment flows have been inadequate. Even the investments that have been forthcoming are not in areas of investment that would contribute to improving the country's capacity for exports of manufactured goods. Is the new Act giving government powers to expropriate underutilised and underperforming private enterprises be another deterrent to domestic and foreign investment?

The country has been unable to attract adequate FDI for a number of reasons. The new Act to take over underperforming private enterprises is creating a further stumbling block. The climate of uncertainty that the new law would generate is likely to be a serious disincentive to foreign investors. Consequently the country's economic growth would once again encounter a setback. At a time when other Asian countries are witnessing high rates of economic growth and encouraging FDI, will this law once again deter foreign investors?

Importance of FDI

FDI is needed to attain and sustain a higher rate of economic growth and ensure long-term economic development. There is a strong relationship between foreign investment and economic growth. There are several irrefutable reasons why larger inflows of foreign investments are needed for the country to achieve a sustainable high trajectory of economic growth.

The rationale for foreign investment is not based entirely on the infusion of additional capital alone, however important it may be. It is also needed as a means of transferring advanced technology and improving the country's management capacities and access to foreign markets. Foreign direct investments in industry and services are vital for the country's economic diversification, export growth and enhancing the technological capacity of the country.

|

The country needs to invest around 35 to 40 percent of GDP to accelerate its growth rate to over 8 percent a year and sustain such a growth momentum. National savings fall far short of this. Foreign borrowing and foreign investments have to meet this investment-savings gap. Recognising this, successive governments have attempted to provide various incentives to foreign investors. However, the Sri Lankan record of foreign investment has been far below expected levels and low in comparison with many other Asian countries. In fact it is one of the lowest.

The significance of private FDI is that such investments bring with it the advantages of advanced technology, management practices and assured markets. In due course there is a technology transfer as the local workforce gains knowledge of the manufacturing processes and management practices. The value added in these industries is a contribution to GDP. They contribute to foreign exchange earnings, employment creation and increases in incomes, especially of skilled and semi-skilled workers in these industries. A significant advantage of FDI is that they are risk free to the country unlike borrowed funds that have to be repaid even when the investment fails.

Poor past performance

Sri Lanka missed many opportunities to attract foreign investments in industry owing to the Business Takeover Act of 1971 and later due to the ethnic conflict. In 1983, when economic conditions were propitious for foreign investment, ethnic violence frightened foreign investors. It was a turning point in the economy as we missed the chance of attracting large foreign investors. The subsequent three decades of war and security situation was the main deterrent to attract substantial foreign direct investment to the country, despite tax concessions, financial incentives and assurances. Japanese, the highest aid givers and an important trading partner, did not bring large investments to Sri Lanka mainly due to the security situation here. This lost opportunity has been very costly as it is much more difficult to attract FDI today, when a large number of countries are offering attractive incentives, certainty in their policies and protection to the investments.

Insufficient FDI

Despite the biggest impediment for foreign investments having been removed, foreign direct investment (FDI) has been below expectations. Peace and security are necessary conditions, but not sufficient conditions to attract foreign investment. This is clear from the fact that foreign direct investment has been below expectations in 2010. What are the reasons for the sluggish inflow of FDI? What are the other conditions that must be fulfilled to attract foreign direct investments?

There are many conditions that have to be put in place to attract FDI. It is important to ensure an attractive investment climate. Consistent macroeconomic policies, good governance, economic stability, guarantee of property rights, rule of law and absence of corruption are among the conditions required to attract FDI. Consistency and predictability in economic policies and political stability are preconditions to attract FDI. Are we now making it even less attractive by policies that erode investor confidence?

Sri Lanka needs to develop the physical and technological infrastructure, enhance its human capital and improve its labour-market conditions and administrative capabilities to induce higher levels of foreign investment.

There has been progress in the development of infrastructure. The road network has been improved though urban traffic congestion remains a problem. The power situation is much better though electricity tariffs are high. Skill development leaves much scope for development. Labour legislation is considered a serious disincentive. It is unlikely that the government would formulate the necessary labour reforms to allow for flexibility in the recruitment and discontinuance of workers. This may continue to be a disincentive for FDI as other countries are far more flexible in their labour laws allowing workers to be discontinued when business conditions necessitate a reduction in labour force.

There is an expectation that FDI would reach US$ 1000 million this year. Although this is a doubling of last year's FDI, it is inadequate. Besides the quantum of FDI, the types of FDI also matter. There are foreign investments in the hospitality trade but little in industry and manufactures. Investments in manufactures are especially needed. To attract such investment it is essential to ensure an attractive investment climate. Consistent macroeconomic stability, guarantee of property rights, rule of law and absence of corruption are among the conditions required to attract FDI. Recent events have tarnished the country's political image and foreign perceptions of the country. These non-economic factors too have an influence on FDI.

Business takeovers

In this context, the Revival of Underperforming Enterprises and Underutilized Assets law empowering the government to take over underperforming and underutilising private enterprises is a serious disincentive to both domestic and foreign investors. Other countries guarantee the safety of investments. The overhang of a law of this nature that gives discretionary powers to the government to take over enterprises would be a serious concern to investors. It is likely to scare away foreign investors and local investors too. In an earlier era the Business Undertakings Act of 1971 was responsible for discouraging investment. It is not very clear whether the new law would supersede the Constitutional Guarantee of Investment Protection Agreements that enjoys a legal status. One way the government could instill some confidence in foreign investors is to further strengthen this law.

Concluding reflections

Increased foreign direct investment in export industry is vital for the economic development of the country. Although the end of the civil war led to expectations that much higher FDI would be forthcoming this has not been realized. There has been growth in foreign investment in the hospitality trade. This is good as tourism is expected to contribute handsomely to foreign exchange earnings and economic growth. Foreign investment in the hospitality trade would increase tourists from many parts of the world. However, it is not merely an increase in FDI that is needed but also investment in key areas of manufacture.

Consistent macroeconomic policies, good governance, consistent market-friendly policies, healthy economic indicators, guarantee of property rights and the rule of law are required to attract higher levels of FDI. Without these, economic incentives alone will not bring in an adequate quantum of foreign investment of the right type. The new law would be a serious deterrent to domestic and foreign investment.

|