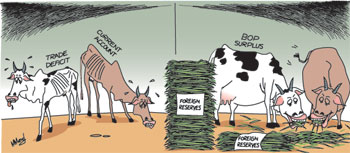

The Central Bank has assured the country that the external finances are healthy. This assurance is based on the fact that despite a huge trade deficit of US$ 5.1 billion in the first seven months of this year, there has been an overall balance of payments surplus of US$ 1 billion. This is likely to be the balance of payments scenario for the full year too.

Despite the trade deficit likely to reach massive proportions at the end of the year, of about US$ 9 billion, the country is expected to have a balance of payments surplus at the end of this year as well. This is likely to be the balance of payments scenario for the full year.

The Central Bank also points to the large foreign reserves of over US$ 9 billion that is adequate to finance 6.7 months of imports, as further evidence of the healthy external financial position of the country. Taking these statistics into consideration is the external financial position of the country a healthy one?

Understanding the balance of payments

In order to get a sound assessment of the balance of payments situation, it is necessary to understand the elements of the balance of payments accounting, especially its components. The balance of payments is a system of accounts that records the transactions between a country and the rest of the world. The BOP accounts record all the international transactions of a country for a year and indicate how the country has fared in its trading and financial transactions in a year.

The BOP has three components: The Current Account, the Capital Account and the Monetary Sector or Official Settlements.

The first two components are determined by residents buying or selling goods and services or by sending or transferring money from or to the country. They are based largely on private decisions of individuals and corporate entities and the expenditure of government which entails imports.

Current account

The outcome and performance of the current account of the balance of payments is what matters. The current account consists of a record of the country's exchange of goods and services for a year. The export values of goods such as tea, garments and rubber and the import values of goods such as wheat, sugar, vehicles, petroleum and machinery are the merchandise items in the current account.

The other item of significance in the current account is services. This item records the receipts and payments for services such as shipping, banking, and insurance. Income derived from investments of nationals abroad and payments to foreigners for investments fall into this category.

An item of substantial significance for Sri Lanka is the current transfers, which includes money sent by Sri Lankans working abroad, more popularly known as private remittances. When the amount of exports of merchandise, service incomes and current transfers to the country are less than the value of imports, expenditure on services and remittances abroad the country has a current account deficit. When the value of exports of merchandise, income derived from foreigners for services performed and the inflow of current transfers exceeds the value that is sent abroad for these, it is a situation of a current account surplus.

In the first seven months of this year, the country had a large current account deficit of US$ 1.94 billion, owing to a massive trade deficit of US$ 5.1 billion. However, the current account deficit was much lower than the trade deficit as the services account was a surplus mainly owing to remittances of US$ 2.9 billion and US$ 451 million from tourism earnings.

Together, they amounted to US$ 3.3 million. Impliedly there have also been payments for services of a much lesser amount. Therefore the current account deficit was much lower at US$ 1.94 compared with the trade deficit of US$ 5.1 million for seven months of the year. Nevertheless it was a large current account deficit.

Capital account

The capital account consists of capital transfers and investments. Money remitted for investment in an industry constitutes a capital account transfer. Portfolio investments are categorised as a short-term private investment in the capital account. Investments in an industry or for building a hotel are a long-term direct investment in the capital account of the balance of payments.

The capital account could be either in surplus or deficit. The capital account would be in surplus if the inward capital transfers and investments into the country exceed the outward flow of capital.

The opposite situation is one of a capital account surplus. In the first seven months of this year, the government received US$ 2.75 billion mainly as borrowings, including a sovereign bond issue of US $ 1 billion. The other item that contributed to the capital account is foreign direct investments of US$ 416 million.

Once the items in the current and capital account are totalled, a country would either have a positive or negative overall balance. If a country has a current account deficit, which is more than offset by a surplus in the capital account, then it would have an overall surplus.

If, on the other hand, the current account deficit is larger than the capital account inflows, then the country would have an overall deficit. If both the current and capital accounts are in deficit, then the overall deficit will be the sum of the two deficits.

The overall surplus of US$ 1 billion in the first seven months owing to the positive capital account balance has been achieved mainly through government borrowing. To recapitulate: the huge trade deficit was reduced by the inflow of remittances and tourist earnings. Nevertheless the current account was in deficit, though much less than the trade deficit. Capital inflows transformed the current account deficit of nearly US$ 2 billion into a surplus of US$ 1 billion. Capital inflows include large government borrowing.

Summing up

The latest statement and statistics released by the Central Bank indicate that despite the large trade deficit of US$ 5.1 billion in the first seven months of the year, remittances, capital inflows to the government, foreign direct investment and tourist earnings have resulted in an overall balance of payments surplus of US$ 1 billion in the first seven months of the year.

However the current account balance is the true indicator of the external financial position. As it is in deficit to the extent of US$ 1.94 billion, it is difficult to characterise the external finances of the country as a healthy one.

What actually matters is the current account balance that consists of the trade balance, incomes from services, tourism and remittances. These are earned incomes. When these are totalled up there is a current account deficit of US$ 1.9 billion.

The overall balance of payments surplus has been brought about essentially through government borrowing and to a lesser extent due to increased inflows of foreign direct investment.

The external finances of the country can hardly be considered healthy as the country has a massive trade deficit and a large deficit in the current account of the balance payments.

It is like unto a person who boasts of having a large bank balance that is the result of large debts far exceeding his income.

|