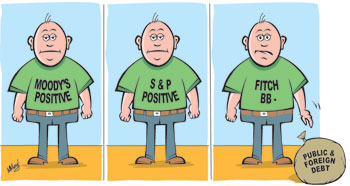

Three international agencies upgraded their ratings and outlook for the Sri Lankan economy during the last fortnight. Their assessments are of much value for the country’s foreign borrowing and foreign investment flows. The improved ratings were due to the economic growth performance of last year and the first quarter of this year; improved fiscal outturn and expectation of further fiscal consolidation; and the containment of inflation. The prospect of these key economic variables improving with sustained economic growth led these agencies to raise their evaluation of the country’s ratings. They did however stress the need to continue improving the fiscal performance, contain public debt and foreign borrowing and ensure political stability by moving towards a resolution of the ethnic solution.

Fitch, Moody’s and Standard & Poor's

Fitch Ratings upgraded the country’s Long-Term Foreign and Local Currency Issuer Default Ratings (IDRs) to ‘BB-‘from ‘B+’. Fitch also upgraded the Country Ceiling to ‘BB-‘ from ‘B+’ and affirmed the Short-Term Foreign-Currency IDR at ‘B’. Fitch’s decision to upgrade the ratings has been based on the stabilization and recovery of the economy and increased efforts by the Government to bring down the budget deficit.

Similarly, Moody's Investors Service upgraded the outlook of Sri Lanka’s B1 foreign currency sovereign rating from ‘Stable’ to ‘Positive’. Moody’s rating upgrade decision has been owing to peaceful conditions, lesser political risk and improvements in macroeconomic performance and financial stability. They have observed an improvement in fiscal performance and an improving external payments position. Moody’s has commented that there is investor confidence and increase in investments and that the economy is expected to expand sustainably by 8-9 per cent in the medium term.

The latest improved assessment comes from Standard & Poor's Ratings Services that has raised its outlook on Sri Lanka's long-term foreign currency sovereign credit rating to positive from stable and confirmed its 'B+/B' foreign currency and 'BB-/B' local currency sovereign credit ratings on Sri Lanka as the outlook on the long-term local currency rating is stable.

However these agencies have pointed out certain vulnerabilities. These include the need to reduce public expenditure and increase revenue collection to bring down the fiscal deficit further, the high level of public debt, the need to reduce political risk by resolving the ethnic issue and the need for greater transparency in government transactions. The need to increase foreign direct investment as a strategy for growth has also been mentioned. These factors would have to improve and the expectations of economic growth and fiscal consolidation realised for further improvements in the ratings.

Fiscal deficit

While observing the progress made in reducing the fiscal deficit from 9.8 per cent in 2009 to 8 per cent in 2010, Fitch underscored the need to bring it down to the target of 6.8 per cent of GDP this year and to continue reducing the fiscal deficit to bring it down to 5.2 per cent in 2012.

This is a key issue to ensure a sustained high rate of economic growth. According to Fitch, recommendations by the Presidential Commission on Taxation of 2009 to review the country's tax system, were implemented in the 2011 budget and the implementation of the recommendations of the Taxation Commission should enable the authorities to achieve, or at least come close to, the budget deficit targets of 6.8 per cent of GDP for 2011 and 5.2 per cent for 2012.

"If Sri Lanka is able to continue consolidating the fiscal position,” it said “its public debt dynamics should be placed on a more sustainable path." Although international agencies cite the Taxation Commission Report, there is no way of judging the veracity of this statement since this report has not been made public. It would have been in the public interest if the Tax Commission Report was made public and there was a discussion of its proposals.

One of the ways by which revenue collection was increased is by the liberalisation of imports by lowering tariffs. This has led to increased revenue from imports, especially vehicle imports. However this strategy has meant a strain on the trade balance. espite significant improvements in export performance, especially industrial exports, the trade balance has widened and the trade deficit in the first four months of the year has increased to as much as US$ 2.53 million.

There may be some respite in the second half of the year with oil prices falling and lower international food prices. Nonetheless the trade deficit is likely to be very high this year at around US$ 6 to 7 million. While the government has been constrained in increasing certain public expenditures, such as the excessive hiring of persons into public services and increasing of salaries, there are continuing high expenditures on unproductive activities that should be curtailed to achieve the fiscal targets.

Public debt

Fitch noted that Sri Lanka's public debt-to-GDP ratio stood at 82 per cent of GDP in 2010, which is well above the 'B' and 'BB' peer rating group medians of 40 per cent and 41 per cent, respectively. It is also above the Asian average debt to GDP ratio of 42 per cent. The debt to GDP ratio is likely to have gone up this year owing to fresh foreign borrowing. It is important to keep both domestic and foreign debt at much lower levels, as the debt servicing costs absorb a large proportion of government revenue, often more than the amount of revenue. Consequently, the government requires further borrowing to finance other expenditure. The debt servicing costs are a serious burden on the economy and stunts economic growth. Additionally the servicing of the foreign debt absorbs a high proportion of export earnings and strains the balance of payments.

Inflation

Containing inflation is the other important variable. If the fiscal deficit is kept in check, then there is a likelihood that the rate of inflation, as measured by the new official consumer price index, would be around an acceptable level of about 7 per cent. The lower import prices of essential imports witnessed in recent months and the downward trend in oil prices would go a long way in containing inflation. There is also the prospect of an increase in agricultural production that would keep food prices down.

Concluding reflections

The upgrading of the ratings has come with some words of warning. For instance Fitch has observed that it "would view the authorities' ability to continue consolidating the budget deficit, by both enhancing the tax revenue base and rationalising expenditures, and in tandem lowering the level of public debt as supportive for Sri Lanka's ratings".

The statement added "A sustained period of strong economic growth, particularly if accompanied by an improvement in the investment climate and private sector capital spending, would also be supportive for the ratings". Fitch said: "In contrast, continued double-digit inflation or deterioration in political stability would put downward pressure on Sri Lanka's ratings."

The improved ratings are an indication of progress in economic performance that includes the key elements of high economic growth, controlling inflation and containing the fiscal deficit. There is good reason to be pleased about these achievements that led to an improvement in ratings. This does not mean that all’s well. There is the high public debt with an increasing foreign debt that creates a strain to service the debt. The debt to GDP ratio is high and should be brought down. The success in containing inflation must not be allowed to slip.

There are favourable factors that would help contain inflation such as the downtrend in international import prices and decreases in domestic food prices. The fiscal deficit should be brought down from 8 per cent of GDP last year to less than 7 per cent this year and reduced further to about 5 per cent of GDP in the following years. The trade deficit is widening despite improvements in exports. There is a need for vigilance on import expenditure. Macroeconomic stability by the containment of the fiscal, deficit, the public debt, trade deficit and the rate of inflation are vital to achieve a better rating.

This should be the objective by the end of this year. And as the rating agencies have observed there should be greater political stability, transparency in government’s transactions and a movement towards ethnic reconciliation.

|