In spite of the improved export performance in the first quarter of this year, the country is heading towards a large trade deficit. This is owing to fundamental weaknesses in the external trade structure of the country that renders it highly vulnerable o international price movements.

The country is often subject to external shocks, such as sharp increases in import prices or a fall in export prices or both. Such adversity termed a deterioration in the terms of trade have occurred quite often and is one of the reasons for Sri Lanka’s modest economic performance in some past periods. Currently, increases in prices of essential imports have been responsible for the adverse terms of trade. Increases in prices of the country’s exports have been inadequate to offset this disadvantage.

Remittances offset trade deficit

There has not been much concern about recurring trade deficits owing to capital inflows that have converted large trade deficits into balance of payments surpluses. This has been mainly due to the large amount of remittances the country continues to receive. Last year remittances offset about 80 per cent of the large trade deficit of US$ 5.2 billion.

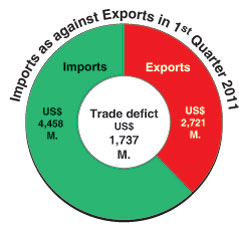

This is likely to happen this year too despite the trade gap expected to be much larger than last year’s huge deficit. In the first quarter of this year a large trade deficit was incurred even though export earnings increased by 54.3 per cent to US$ 2,721 million.

This was because expenditure on imports increased by a larger amount than export earnings: US $ 4,458 million of imports as against exports of US$ 2,721 million. Consequently, the trade deficit expanded to US $ 1,737 million during the first quarter of 2011. This trade deficit of as much as US$ 1.7 billion, points to an annual deficit of around US$ 6-7 billion this year.

Remittances that are increasing at a healthy 37 per cent are covering 73 per cent of the first quarter’s deficit. As pointed out in an earlier column, the country has become a remittance dependent economy. Nevertheless it is important to examine the reasons for this vulnerability in its external trade.

Export import structure

Although the country’s export structure changed drastically in the 1980s after the liberalisation of the economy in 1977, the vulnerability to the vicissitudes of international economic developments increased rather than declined. Some economists have been of the view that the country exchanged one type of vulnerability for another. This is supported by the fact that there wasn’t a single year since 1977 when the country registered a trade surplus. Trade deficits for 33 successive years must surely signal some fundamental weaknesses in the economy, as import expenditure has always been higher than export earnings.

For three decades since independence the country was a primary commodity export dependent economy. Its trade dependence was in the region of 70 per cent of GDP. Although the character of trade dependence changed in the 1980s, the trade dependency is of the same levels, only a percentage point or two lower. Prior to 1978 the country was heavily dependent on the export of primary crops, tea, rubber, coconut products, spices and other minor export crops.

It was also heavily dependent on food imports. From the 1980s, there was a diversification of exports and industrial exports overtook agricultural exports. There has also been a lesser dependence on rice imports and total food imports now account for only around 10 per cent of the import bill. Despite this, there have been trade deficits every year since 1977. The small trade surplus in 1977 was achieved under a severely controlled import regime. Persistent trade deficits for 33 successive years mean there are fundamental weaknesses in the country’s trade structure and economy.

Imports

The trade imbalance is not altogether because of the export side of the trade equation. The composition of imports has much to do with it together with movements in international prices. Most imports are essential and therefore difficult to reduce when prices increase. Economists call this inelasticity, the characteristic of import volumes not reducing proportionately when prices increase. This is so with respect to most large import items of the country.

This applies to food imports like wheat, sugar, milk, lentils, petroleum and fertilizer among others. Although food imports have declined to around 12 per cent of total imports in 2010, they constitute essential imports such as wheat, sugar, milk and pulses.

Recent years have seen sharp increases in prices of these commodities whose amount of these imports cannot be reduced much. While the quantum of these imports cannot be reduced much when prices rise, their import values rise significantly with price increases. The recent world food shortages have increased the country’s food import expenditure.

Intermediate imports consisting of oil, fertilizer, textiles, chemical and other inputs for industry are a large proportion of imports. For instance in 2010 these intermediate imports constituted 55.5 per cent of total import expenditure. Intermediate imports are high as they meet essential energy and fertilizer requirements and the country’s export industries have large import content.

This high import content of exports is inevitable as the country does not have many raw materials for export manufactures and has to be one whose export industries are import dependent for much of its raw materials. Petroleum imports accounted for US$ 3 billion and 22 per cent of total imports. Capital goods imports constituted 22 per cent of imports in 2010. Machinery for industrial production is an important component of such industries.

Increases in food fuel and fertilizer prices have increased import expenditure to such an extent that export growth has been unable to match it. The result has been high and increasing trade deficits. In 2010 the trade deficit reached US$ 5.2 billion. Despite a significant growth in export earnings this year, it is very likely that the trade deficit will exceed last year’s one to reach around US$ 7 billion. The only hope on the import side is that conditions in the Middle East would stabilise, speculation on oil prices will abate and that consequently crude oil prices would come down by about 20 per cent to the US$ 100 per barrel level. Were these to happen, then import expenditure could fall during the next half of the year and reduce the trade deficit.

Tea and spices

There are other ways too in which the external environment has not been helpful. The disruption of trade in the Middle East has affected tea and spice exports. Tea exports have enjoyed a buoyant international market and tea prices have been high. The instability in this region and the US bombings of Libya have erupted trade flows to several Middle Eastern countries. This has resulted in a setback to prices and reduced exports to them.

The significant growth in industrial exports this year lends a glimmer of hope to success in the country’s export led growth strategy adopted since the economic liberalisation in 1977. The increase in raw material imports and imports of machinery are signs of industrial development. It is by the reduction of consumer imports and an increase in industrial exports that the country should attempt to reduce the endemic trade deficit that has plagued the country. The increased earnings from tourism and the large amount of remittances should not blind us to the need to improve the trade balance.

|