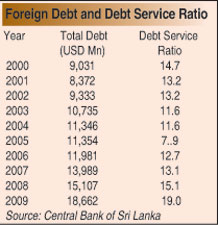

The large increase in the country’s foreign debt in recent years is a serious concern. Sri Lanka’s total foreign debt has increased considerably in recent years owing to expenditure on large infrastructure development projects, the financing of imports and loan repayments. Consequently by the end of 2009 the foreign debt had more than doubled what it was in 2000 to reach a massive US$ 18 billion. As much as 19 per cent of export earnings in that year were required to service the foreign debt by way of capital repayments and interest costs.

By the end of last year the foreign debt is likely to have increased by a significant amount and the servicing of this debt is likely to have absorbed a still higher proportion of export earnings. The absorption of a high proportion of export earnings for servicing the debt is a serious strain on the balance of payments and raises the issue of foreign debt sustainability.

Benefits of foreign borrowing

Foreign borrowing can assist in resolving constraints in foreign resources for development. It is a useful means of supplementing inadequate domestic savings for investment and undertaking large infrastructure projects that could enhance economic development over time. Incurring foreign debt of a reasonable extent for developmental objectives is an economic strategy for developing countries. It can also assist in overcoming temporary balance of payments difficulties. The International Monetary Fund (IMF) assists countries to resolve balance of payments difficulties as happened in Sri Lanka in 2008/2009.

|

Therefore foreign borrowing can assist countries stabilise their external finances and enhance economic growth. It could be an important means of spurring an economy to higher levels of economic growth than its current resources permit. However the extent of borrowing, costs and terms of borrowing of foreign funds, and most important the use of funds have significant implications for macroeconomic fundamentals.

The prudent management of foreign debt to ensure sustainability of foreign debt is critical. Foreign borrowing could have either beneficial or adverse impacts on long-term economic stability and development. Therefore management of foreign debt servicing costs is vital for economic stabilisation and long term economic development, especially for a trade dependent export-import economy. It is vital that Sri Lanka avoids a debt trap.

Increasing foreign debt

Foreign debt increased significantly in the last decade. The figures of foreign debt from 2000 to 2009 in the table 1 reveal this. The increase in foreign debt is particularly sharp between 2008 and 2009 when it increased by 10 per cent. The issue of foreign sovereign bonds in 2007 and 2009 increased the debt significantly.

The government raised US$ 500 million from a sovereign bond in 2007 and again another US$ 500 million in 2009. Almost $300 million of the latter borrowing was used to pay off foreign loans. Sri Lanka recently borrowed $810 million from Exim Bank of China to fund the second-phase development project of the Hambantota Port being constructed by the China Harbour Engineering Company Ltd. These commercial borrowings have also tilted the debt profile more towards commercial borrowing from the earlier bias towards concessionary loans from bilateral and multilateral sources.

Debt servicing costs

The Ministry of Finance estimates Sri Lanka’s foreign debt servicing costs comprising of both principal and interest payments for last year (2010) at $ 810 million. The debt service payments this year is expected to be US$ 954.5 million. This is expected to nearly double in 2012 from that of 2011 to an estimated US$ 1,539.4 million. The sharp increases in debt servicing costs are due to the increased borrowing in recent years, especially those in 2009 referred to earlier. The debt servicing costs of 2012 could absorb about one fourth of export earnings unless export earnings increase substantially.

Exports are woefully inadequate to finance the country’s imports. The trade deficit was over US$ 5 billion last year. In such a situation in external trade, the debt servicing costs are a strain on the balance of payments.

However, this unfavourable state of external finances has been made sustainable owing to the large and increasing remittances from abroad. Remittances from abroad financed as much as 80 per cent of the merchandise trade deficit and the country’s balance of payments was in surplus owing to these remittances, other capital inflows and foreign exchange earnings from Tourism that exceeded one half billion (US$ 574 million). The balance of payments surplus should not however lead to turning a blind eye to the large trade deficit and the huge foreign debt servicing costs.

External debt sustainability

High external debt could have harmful effects on an economy. Therefore, the sustainability of the country’s foreign debt is an important issue. The international concept of sustainable debt is the level of debt which allows a debtor country to meet its current and future debt service obligations in full, without recourse to further debt relief or rescheduling, and avoiding accumulation of arrears, while allowing an acceptable level of economic growth.

The World Bank and IMF defines foreign debt sustainability as a situation when "a country can be said to achieve external debt sustainability if it can meet its current and future external debt service obligations in full, without recourse to debt rescheduling or the accumulation of arrears and without compromising growth". It is to the credit of Sri Lanka that it has always met its debt servicing obligations. However the government should be mindful of strains in debt repayment when the foreign debt is rising at a high rate.

In recent years foreign debt has been sustainable owing to the large inflows of foreign remittances. If these are also taken into account in determining foreign debt servicing ability, then the external debt servicing ratio falls to much lower levels. In other words, the foreign debt servicing costs are comfortable owing to the capital inflows rather than its export earnings.

Final word

In this context what is important is that the country should incur foreign debt for developmental purposes. According to the Ministry of Finance 75 per cent of recent foreign borrowing has been for infrastructure development such as for power and energy, ports, roads, bridges, water supply, agriculture, fisheries and irrigation, among others. On the face of this statistic recent foreign borrowing could be justified as contributing to the country’s development. Nevertheless a word of caution is appropriate.

All infrastructure development is not necessarily justified from an economic perspective. Many infrastructure projects are not only hugely expensive, they also have a long gestation period. The benefits of some infrastructure investments in relation to their costs may be even doubtful. Infrastructure projects that either save foreign exchange or earn foreign exchange are the least burdensome on the foreign finances of the country. Prioritisation of infrastructure development on the criterion of their contribution to the country’s balance of payments is a prudent strategy for investment from foreign borrowing.

|