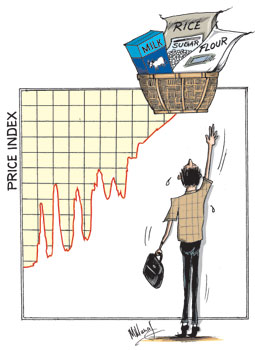

While the main opposition party has taken to the streets to protest about the increasing prices of commodities and the unbearable cost of living, price statistics disclose a different picture. Inflation, as calculated by the Department of Census and Statstics’ Colombo Consumer Price Index is quite modest. It is much less than what it has been in recent years. Then why is there considerable dissatisfaction about the level of prices? Why is there a difference in the perception of consumers and the disclosure of price statistics? What is even more surprising is that the main reason for the modest rate of inflation has been the slight increase in food prices mainly due to a decline in rice prices. Food prices have a large impact or weight on the index and influences the outcome, unlike such items as gas and oil prices that have much lower weights on the index.

The consumer price index discloses that prices increased by 4.3 per cent in July 2010 from a year earlier. This is a decline from the price increase of 4.8 per cent in June. What is more it is part of a declining trend in prices. The drop in the rate of increase of prices was the fifth successive monthly fall in prices. The 12-month moving average however has been on the rise since March, and rose to 4.2 per cent in July 2010 from 3.9 per cent in June 2010. In July the Colombo Consumer Price Index remained almost static at 217.6: down from 217.7 in June 2010.

Why is there dissatisfaction on prices when the indices disclose a fairly moderate increase in prices? First, it must be noted that what the figures indicate is that there has been an increase in prices, though the rate of increase has been lower.

The statistic must not be interpreted as one of a decrease in prices or price levels. Therefore consumers have faced a further increase in price on top of the earlier increases. Earlier price increases have already been registered. Therefore the perception that prices have risen, though not by much and lesser than it was a year ago, is correct.

Second, the increase in prices in the index is an average increase in the price of a basket of commodities that an average family in urban areas, Colombo to be precise, consumes. Consumers, especially those in the lower income groups are affected by common items of consumption like rice, wheat flour, sugar, dhal and vegetables.

When prices of these commodities rise, the pinch is greater. The index itself places a higher importance to food giving it an almost 50 per cent (47 per cent) effect on prices. The decrease in rice prices has had a particular downward impact on the index. In the eyes of the urban consumer the bread price increase may be more burdensome.

Third, there may be problems in the compilation of the index. The price collection may be from lower price markets than what consumers generally access. For instance government controlled outlets have lower prices than what prevails elsewhere. The collection of price statistics from such markets would have a downward bias in the index. It is well known that government agencies tend to be biased towards statistics being favourable and no doubt price statistics are one such area. Consumer perceptions may be that the index is not a true reflection of consumer prices. In the absence of an alternate index and an analysis of prices, it may not be correct to cast aspirations on the integrity of the compilers of the index. However the silencing of Central Bank and Finance Ministry officers adds credence to this view.

The perception of high prices is the result of the cumulative impact of price increases over the years. Further, much of the price increases have been in basic commodities. The increase in the price of wheat flour and bread, sugar and gas affects urban lower classes adversely. Therefore the burden on the poor has been quite a serious one. Wage increases have not kept pace with recent price increases and promises of wage increases at the elections not being given has added to the grievances. Apart from the actual impact of prices, there are also the political motivations that heighten the perception of price increases.

The recent increases in the prices of these items are a reason for discontent. The serious social problem facing the country is that the prices of basic items have increased and caused a serious erosion of the real value of lower incomes that spend a large proportion of their earnings on basic items. This has been the intractable problem rather than the increase in the general level of prices.

Quite apart from the increases in the costs of living that is a harsh social problem, the increase in the general price level or inflation affects the costs of production and thereby makes export commodities less competitive. This is a serious economic concern for an export economy. The depreciation of the rupee has been necessary to compensate for the relatively higher increases in the costs of production. Even this it appears has not been an adequate adjustment as the export performance of industrial goods has shown a low growth of less than 4 per cent. The growth in industrial exports has been very modest and in some categories of exports, such as garments, the price increases coupled with a depressed international market have resulted in exports declining.

The country has had high rates of inflation in recent years. Inflation reached 22.6 per cent in 2008. It was brought down to 3.4 per cent in 2009. Inflation has been an important factor in reducing the country’s competitiveness in international markets. Depreciation of the currency is a double edged weapon as it results in increases in import prices that in turn feed into inflation. It is therefore important that inflation be kept at a modest level and in line with the rates of inflation of our export competing countries. There is evidence that there is an acceleration of inflation in India owing to the high thrust in growth. The prices that affect the cost of production are however different. They are electricity, gas, petrol and imported raw materials and wages that are related to consumer prices.

In this background the lowering of the rate of inflation is indeed a favourable development. Hopefully, the prices of basic items would not rise in the remaining months of the year. It is the intention of the government to keep inflation at single digit levels this year. Both consumers and exporters would certainly wish this outcome would materialize. |