Two economic issues have dominated discussions on the economy recently. One has been whether the government should present a budget rather than a vote on account and the other is whether the government should abrogate the IMF stand-by arrangement. The decisions on these do not appear to have been made. The latter issue has been quite comprehensively discussed in the Sunday Times Business section of last Sunday in response to an article on the previous Sunday (April 25). This issue has also been discussed in this column several times when there was concern that the IMF may pull out owing to the government not containing the fiscal deficit to the agreed proportion of GDP.

|

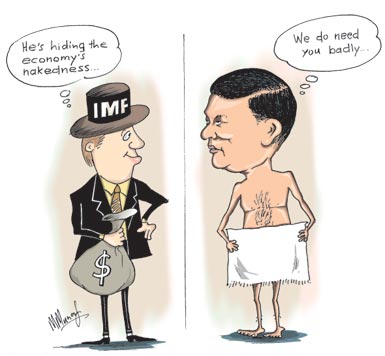

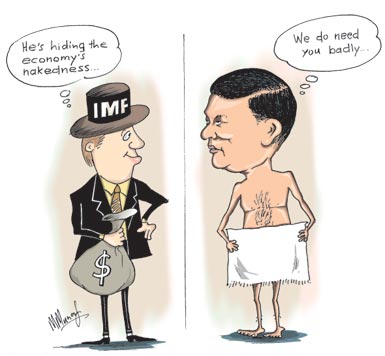

The contention that the IMF stand-by arrangement no longer serves a purpose is based on a narrow interpretation of the economic situation. It is confined to the sole piece of information that the country’s reserves are strong at over US$ 5 billion. The metaphor that the country is using inappropriate clothing when the reserves are high can be turned around to say that the clothing is hiding the economy’s nakedness. The external reserves position seems strong but in fact is weak for several reasons.

Most of the reserves are borrowed funds with about two-thirds being short term funds. Economists who celebrate the high reserves should look into how we have obtained it and the vulnerability of reserves built up in this manner. In fact the withdrawal of the IMF from the country will signal investors to take back their money. The confidence built up by the participation of the IMF is an important factor in the flow of funds to the country and for investment capital inflows.

Conversely, if the IMF withdraws or is asked to leave, there would be serious erosion of confidence in the economy. Just as much as there was an inflow of capital after the IMF support and the country’s credit rating improved, the withdrawal of the IMF will result in an outflow of short term capital and a lowering of the credit rating. Commercial borrowing would be more difficult to obtain and would be at a higher cost. Let it be very clear that it is not the amount of finance that the country obtains from the IMF that is important. It is the contingent confidence the arrangement confers on the economy that is significant.

There are other weaknesses in the external finances of the country. Indications are that the country would have a large trade deficit this year. There is a likely deterioration in the terms of trade this year owing to increasing prices of imports that will increase the trade deficit significantly. In addition, the country’s industrial exports are becoming less competitive and with the withdrawal of the GSP + concession export earnings are likely to decline. In the face of an increasing trade deficit that is not likely to be offset by remittances, the withdrawal of the IMF would aggravate the overall balance of payments difficulties through adverse movements in the capital account.

For these reasons it is vitally important that the IMF arrangement is kept intact even if the third tranche is further postponed. Apparently the underlying reason for abrogating the arrangement is the government’s unwillingness to be bound by the conditions laid down by the IMF. Some economists who are advisors to the government in various capacities are paranoid about the IMF. They view the conditions, whether good or bad for the economy, as an affront to the sovereignty of the country. This is a dangerous stance for a weak economy.

Contrary to the views of some economists, the conditions imposed by the IMF are desirable for the economy. Large budget deficits are injurious to the economy. Irrespective of the IMF conditions, the containment of the fiscal deficit is an essential condition for the stabilization of the economy. The Central Bank has said this, the Institute of Policy Studies has argued strongly for fiscal consolidation and Parliament itself has passed the Fiscal Management Responsibility Act that has stipulated a much lower fiscal deficit than the IMF. Therefore the compliance with the conditions laid down by the IMF are desirable and should not be used as a reason to abrogate the IMF stand-by arrangement.

In fact the IMF has been very accommodating to have not withdrawn the facility completely when the agreement to contain the deficit at 7 per cent of GDP was exceeded by a large margin to be 9.8 per cent of GDP. Despite this the IMF appears to have agreed to continue with the standby facility with revised conditions. It is said that the IMF will give the next tranche soon and the new arrangement is for the government to contain this year’s fiscal deficit to 7.5 per cent of GDP. This should be possible to attain with the recovery of the economy, lower defence expenditure and the government intending to cut losses of public enterprises. With or without the IMF condition, a fiscal deficit exceeding 7.5 per cent of GDP is a serious impediment to the expected rapid growth of the economy.

The good fortune to the economy has been the increasing inflow of remittances from expatriates. Last year it increased by 14 per cent and completely wiped out the trade deficit creating a current account surplus. Last year’s trade deficit had fallen owing to the lesser costs of imports. Remittances are continuing to grow at 12 per cent as shown in the first month of this year. Yet the extent of the trade deficit this year is likely to be much higher and remittances are not likely to offset it completely. This is another important consideration with respect to the external finances of the country that should temper any rash decision regarding the IMF role in Sri Lanka.

It is the responsibility of economists in high places to advise the country in a realistic manner. Advice must be on the basis of actual economic conditions and not ideological and political prejudices. In a nutshell, it is important that the country continues with the IMF stand-by facility and conforms to the conditions laid down, especially the containment of the fiscal deficit. There is no other path for economic stabilization. |