The Sri Lankan economy being a trade dependent one will always be subject to the vicissitudes of the international economy. External shocks are therefore inevitable. When international prices are extremely unfavourable to our exports and imports or to either exports or imports the economy receives a setback. These external shocks are inevitable when an economy is highly dependent on trade as the case with Sri Lankan economy.

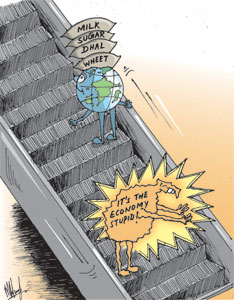

From time to time ever since independence and before the Sri Lankan economy has been subject to external shocks. From independence till about 1980 the economy was highly dependent on the prices of primary commodities both for exports and imports. Tea, rubber and coconut were our main exports and the prices fetched in international markets determined the level of economic prosperity. We were dependent on a number of imports of primary commodities as well. These included wheat, sugar, rice, dhal and milk. This has been so although the nature of that dependence has changed significantly. However the extent of dependence has remained more or less the same.

The export dependence on primary commodities has declined significantly with industrial exports such as textiles and garments, rubber and leather goods, ceramics and other manufactured products being the foremost exports. The dependence on some of the primary produce such as rice has declined, but the dependence on a number of primary products like sugar, milk and dhal continues. There is now an additional dependence on petroleum, raw materials for industrial manufacture and other intermediate and capital goods.

|

This is inevitable for a small country whose raw material resources are extremely limited and the country must depend on export markets. Sri Lanka’s exports are themselves import-dependent. This too is inevitable as the country’s resource base is limited and most raw materials have to be imported. Therefore there has been an exchange of one type of dependency for another.This change in the character of dependency has been succinctly captured by Professors Premachandra Autukorala and Sisira Jayasuriya in their book ‘Macroeconomic Policies, Crises, and Growth in Sri Lanka’.

They point out: “The structural transformation had been achieved by placing the economy in a new and more precarious posture of trade dependence. The reduced importance of imports in final goods masked greater dependence on imported intermediate and investment goods.” The most recent experience of this dependence was in 2008 when the global escalation of oil and food prices affected the economy. Then again with the global recession the country’s exports of manufactured goods, as well as tea and rubber experienced decreased earnings.

On both occasions, the terms of trade went against us and affected our trade balance. The effect of the rise in oil and commodity prices affected the economy more adversely than the recent recession, though the latter has had an adverse impact on employment and incomes.

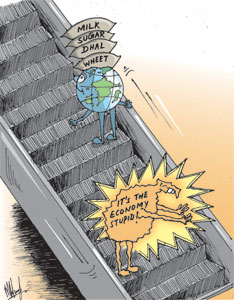

There are several attitudes and approaches that could be taken towards external shocks. One is to say that these are beyond the control of the country and their adverse impacts have been the reasons for the country’s economic performance. One cannot deny that these external factors affect the economy adversely. Yet such an approach is a complacent and irresponsible one that does not look to countervailing measures to reduce the adverse impact and could be detrimental to the economy.

The other approach is to develop strategies and programmes that would make the country less dependent on external developments. While this is an admirable attitude and strategies must be adopted in this direction, its ability to reduce the degree of dependence is limited. Certainly steps must be taken to reduce the country’s dependence in an economically rational manner.

For instance, increasing the production of rice would lower the dependence on wheat imports; increased production of grains could reduce imports of some food imports like lentils. In the case of sugar and milk, the prospects of decreasing the dependence on these imports in the short run is extremely limited as we import about 80 percent of these and other resources. Therefore import substitution of most of these primary produce imports through increased domestic production is a limited strategy. In any case, food imports are now less than 10 percent of the import bill.

There is a much greater opportunity in diversifying the economy to export manufactured goods and services. This would only happen if the economic and other conditions in the country are such that they are conducive to producing exportable goods at competitive prices. This means that our rate of inflation must be under control and kept in tandem with those of competing exporters. In other words the real effective exchange rate should be favourable. The investment climate must be improved with a stable and unwavering macroeconomic policy environment.

The third approach is to acknowledge the vulnerability of the economy to external shocks and ensure that the economic fundamentals are strong enough to take countervailing measures. The inability of the country to respond to the external shocks has been owing to the weak management of the country’s finances. This weakness has been aptly stated in the Institute of Policy Studies, State of the Economy 2009 annual review of the economy. “The constraints that weak public finances impose on the ability of governments to respond with appropriate policy flexibility to external shocks - such as the current global economic downturn - are clear from Sri Lanka's experience.”

The external dependence of the Sri Lankan economy is inevitable. A small economy with a limited domestic market and inadequate raw material resources must necessarily depend on export markets for its products as well as imports for manufactures. Fluctuations in international prices and demand conditions for exports are inevitable. These conditions must be accepted and policies that ensure the country’s competitiveness must be pursued.

The most fundamental macroeconomic condition that must be fulfilled to ensure a resilience and competitiveness in the international economy is fiscal discipline and management of the public finances. This is so as the fiscal outturn and the quality of public spending and the manner of revenue collection have an important bearing on the rate of inflation, the exchange rate, investor confidence, international competitiveness and the capacity to take mitigating policy measures to face a crisis. Sound macroeconomic fundamentals are the essential foundation for resilience of an import-export dependent

economy. |