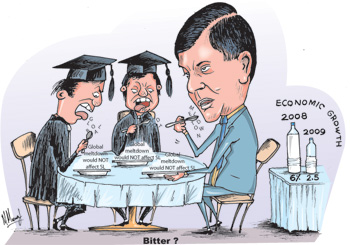

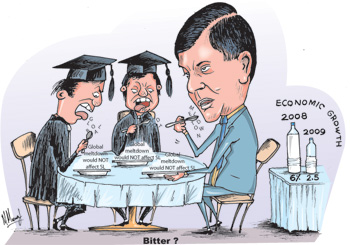

Economic growth has been on a declining trend since about the middle of last year and has reached a steep decline. The Annual Report of the Central Bank of Sri Lanka clearly indicates that it expects economic growth to drop drastically in 2009. According to the Bank economic growth would drop from the 6 percent achieved in 2008 to 2.5 percent this year. This the Bank has called a pessimistic scenario.

Its optimistic prediction is much higher. Other projections by international agencies place the expectation at somewhat less than this. It is creditable for the Central Bank to accept even belatedly such a sharp decline in the economic growth rate rather than project a high figure on the basis of optimistic expectations globally and nationally. Nonetheless it places the blame entirely on global factors rather than face up to the actuality of economic mismanagement as an important cause for the deterioration.

The Central Bank observes that all sectors of the economy contributed positively to growth in 2008. The economic growth of 6 percent was mainly due to the robust growth in agriculture and fisheries that grew by 7.5 percent. Fisheries production was particularly impressive at 9 percent. This is attributed by the Central Bank to higher commodity prices in the first half of the year and the “Re-awakening of the Eastern Province”. However, the Agriculture sector contributes only 15 percent to GDP. The agriculture sector’s contribution came from paddy, sugar, fish and rubber production that increased substantially.

|

The “remarkable growth of paddy production was attributable to an increase in the extent of lands cultivated due to high farm rate prices for paddy, the liberation of the Eastern Province, and the effect of the government national programme to increase domestic agricultural production.” The Central Bank observes that tea production was buoyed by high prices. However a “sharp turnaround of tea prices at the Colombo tea auctions in the latter part of the year and the measures adopted to arrest the falling prices caused production to decline significantly towards the end of the year.”

Industrial growth was moderate at 5.9 percent, a dip from a 7 percent growth in the previous year. This dip is significant as industry accounts for 28 percent of gross domestic product. Sri Lanka’s main industries suffered heavily in international markets owing to the escalation of production costs. The services sector that has been the main source of growth in recent years and accounts for 57 percent of GDP and contributes significantly to overall growth decelerated to a growth of 5.6 percent down from the previous year’s growth of around 7 percent. This decline was due to all its sub-sectors recording slower growth compared to the previous year. The Central Bank attributes the slowdown mainly to the deceleration in export trade, transport and financial services. Owing to these factors the services sector decelerated. The reasonably high rate of economic growth in 2008 was achieved mainly in the first half of the year. Then onwards it was a story of deceleration in growth. The fourth quarter of the year revealed the effects of the global recessionary conditions and the lack of a countervailing response by Sri Lankan policy makers.

In the first nine months of the year the economy grew by 6.5 percent but growth slowed down to 4.3 percent in the last quarter of 2008. While the Central Bank attributes the slowing down of the economy to global conditions, in fact poor management of the economy aggravated the economic slow down. To begin with there wasn’t even recognition that the global meltdown would have an effect on the Sri Lankan economy. Even the common man in this country is aware that world conditions impact on the Sri Lankan economy quite forcefully. The pundits thought otherwise. This, as we have pointed out often, was a cause for the lack of countervailing actions on the part of the government and the Central Bank. This was especially so with respect to the management of the exchange rate in the evolving global conditions. Consequently the country’s export competitiveness deteriorated.

A root cause for the deterioration in economic fundamentals was the lack of fiscal discipline fuelled by persistent high public expenditure. The revenue collection for 2008 increased only by 16 percent. This is mainly attributed to a sharp drop in international trade related taxes and the slowdown in domestic economic activities that resulted in a drop in the revenue from both direct and indirect taxes. Meanwhile public expenditure was particularly sharp in 2008 with recurrent expenditure exceeding the budgetary target, though it declined as a per cent of GDP. Public investment was maintained at 6.0 percent of GDP, compared to 6.4 percent recorded in the previous year. Consequently the fiscal deficit rose to 7.7 percent of GDP. This fiscal deficit was of the same magnitude as in 2007 and was a deviation from the target of 7 percent of GDP that the government stated in the budget. Unless there is fiscal discipline to bring down the budget deficit to around 5 percent, the economy would continue to be weakened and the external trade performance is unlikely to be corrected.

The Central Bank has been complacent with respect to the large trade deficits that the country was incurring year in year out till it reached a gigantic proportion of US$ 5871 million last year. In the past it was possible to be complacent as there was a balance of payments surplus despite the large trade gap due to capital inflows. Most significant of these inflows were private remittances and foreign loans. The massive trade deficit and the requirement to repay foreign loans that were short term loans at high interest rates created a severe dent in the balance of payments in 2008. The balance of payments recorded a deficit of US $ 1,225 million by end 2008. Consequently, external official reserves declined and by end 2008, the gross official reserves, declined to US $ 1,753 million. This is the crisis that has made the government to turn to the IMF for assistance in various guises.

The declining trend in the economy is clear. What the Central Bank Annual Report failed to state is that fundamental weaknesses in the management of the economy were added reasons for this decline apart from the global recession. Placing the blame on international factors without adjustments in economic policy cannot help. Now that the economy has reached a crisis, it is best to recognize that the current situation requires remedial actions. The depreciation of the Rupee has already commenced.

The containment of the fiscal deficit is now the most important policy to implement. The fiscal deficit should be at least brought down to 6 percent by the curtailment of unproductive and wasteful expenditure. The end of the war would no doubt make this task easier. |