It did not take much time after the announcement that the international financial crisis had no repercussions on our financial institutions to find ourselves having our own home grown financial crisis. It certainly had no connection with what was happening in the United States and its repercussions on advanced financial centres. To those acquainted with financial institutions, the Ceylinco Group crisis was not a sudden development. It had been growing over many years, its proportions increasing and expanding like the branches of a banyan tree. If one were to change the metaphor the crisis was simmering over many years. It was known among those in the financial world but not so with the general public that was impressed with the enormous expanse of the Ceylinco Group of Companies.

The recent financial crisis in the US exposed the inadequacy of the financial regulations there. It was difficult to imagine the mighty US Federal Reserve had neglected prudential control of financial institutions. It was indeed shocking to be told that banks and financial organisations were indulging in reckless financial practices in search of high profits without regulation and supervision by the Federal Reserve Bank. The East Asian financial crises of the ‘nineties demonstrated the need for central banks to have in place prudential financial regulations. Equally important, the East Asian financial crises also demonstrated to the world that having regulations in the books of central bank manuals were inadequate, they had to be implemented. The inability of Central Bank in the East Asian region was an important explanation for the East Asian financial crises.

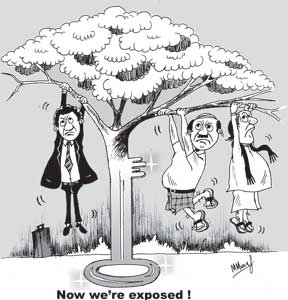

|

Why were the prudential regulations not implemented in East Asian countries? The main reason was political interference. In one country where prudential regulations were in place and there was a high degree of good governance, there was imprudent lending to politically influential parties such as sons and nephews of the powers that be. This pattern prevailed in several of the East Asian countries that faced the financial crises. In some otherwise well regulated countries there were surprisingly inadequate prudential financial regulations in place. The lessons of these crises were clear. There is a need for a prudential regulatory framework and strict supervision and enforcement of the regulations. One without the other led to financial disaster. Therefore what is needed to ensure financial institution stability is clear.The Central Bank has made its role on regulating and supervising the financial system in a very lucid statement. “One of the core objectives of the Central Bank is to maintain financial system stability. The Central Bank discharges this role by establishing the required legal framework, regulating and supervising key categories of financial institutions, maintaining stability in key financial markets, overseeing the payments and settlements system, acting as lender of last resort and by regular surveillance of the entire financial system, including insurance and stock market activities.”

Then what went wrong? As we said earlier it would be quite inadequate to have the rules and regulations in the books of the Central Bank. These have to be implemented. Were they implemented? In the court proceedings of last Tuesday it was stated that Golden Key Company was under the supervision of the Central Bank from 2006. Presumably then the Company had not erred since then or did they? According to the CID investigations there was an unaccounted Rs. 26 billion of liabilities that had no asset backing. Did the regulatory authorities know this and what action was taken to correct this?

The Seylan Bank as a licensed commercial bank was always under the supervision of the Central Bank. For this reason it is expected that there is no fundamental problem with the finances of the Bank, only a possible liquidity problem owing to a possible run on the bank due to panic among customers. This problem has probably been resolved with the Central Bank intervention and assurance of the safety of depositors’ funds. Even to those not privy to the details of Seylan Bank’s finances, two questions arise. One is whether the ownership of the Seylan Bank conformed to the regulations of the CBSL. Did the Ceylinco Group of Companies own a disproportionate share of Seylan Bank than permitted by the rules of the CBSL? Was the lending of Seylan Bank prudent? Did the Bank lend excessively to the Ceylinco Group of Companies? If so what actions did the CBSL take to keep the Bank’s lending in accordance with the rules? Is it also possible that the audited accounts did not reflect the true position of the Bank? Then there is a question about the auditors’ role and also whether the Central Bank detected any discrepancies and irregularities in its regular supervision of the Bank.

There were efforts by the Central Bank to convince people on the imprudence of investing in high interest deposits in unregistered financial institutions. The Central Bank, from time to time, placed advertisements imploring people not to invest in high interest unregistered financial exploits. There were also countervailing influences that negated these advisories. High powered advertising by these companies gave the impression that they were financially strong, stable and profitable places to invest in. Deposits were taken by companies that had no right to accept deposits.

The question then is why a large number of people placed deposits in such companies. There are many varied reasons for this. Simple minded small savers were simply attracted by the high interest rates. They were trying to maximise the returns on their savings oblivious to the dangers to their capital. Others, including rich professionals, were avoiding taxes. These institutions had the character of Swiss Banks in that the information on depositors was not available. This is a clue as to how and why Golden Key was able to amass a massive Rs. 26 billion.

The facts about the Golden Key scam are still to unfold. Many depositors are likely to lose their savings. Some of them are small savers, others are tax dodgers. There is anxiety as to whether this crisis would have repercussions on other companies in the Group, in which case it would have serious financial consequences on the financial system and the economy. There is a need to control the repercussions. There are several important guiding principles to be followed.

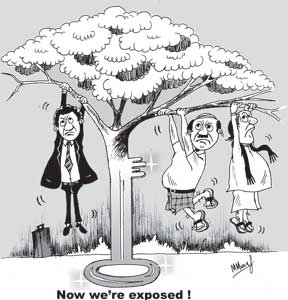

First, at a time when bail outs are internationally fashionable, the Central Bank of Sri Lanka should not get into that act. The imprudence of the general public, mismanagement of highly paid executives, corruption of business leaders and financial managers should not be bailed out by public funds. Second, there must be an investigation into why prudential practices were not followed. Is it that the regulatory framework was inadequate or was it due to its ineffective enforcement? Third, if it is the latter what were the reasons for ineffective enforcement? Are the reasons similar to those that caused the crises in East Asia? Many are the questions that could be asked about this crisis. One thing is certain, it must not be allowed to impact on the rest of the financial system. |