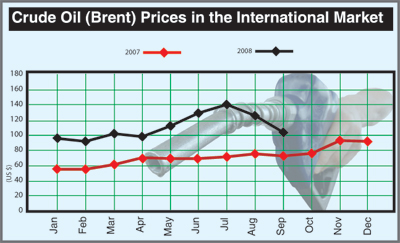

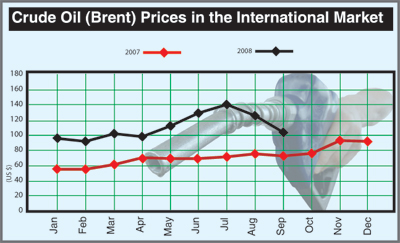

“Crisis over oil hedging deals and CPC in debt up to $20 million a month” were the headlines, respectively in The Sunday Times and The Sunday Times FT on November 9. Chairman/CPC Asantha de Mel in response had admitted the existence of the hedging contracts with the banks and also that CPC was fully “educated by the banks” of the consequences of such hedging contracts. He also had accepted that several millions of US Dollars were due to the banks as a result of hedging contracts and that such contractual obligations would be honoured by the CPC. Therefore the concerned banks cannot be accused of any unethical and/or sharp practices as implied in the articles at issue. “Crisis over oil hedging deals and CPC in debt up to $20 million a month” were the headlines, respectively in The Sunday Times and The Sunday Times FT on November 9. Chairman/CPC Asantha de Mel in response had admitted the existence of the hedging contracts with the banks and also that CPC was fully “educated by the banks” of the consequences of such hedging contracts. He also had accepted that several millions of US Dollars were due to the banks as a result of hedging contracts and that such contractual obligations would be honoured by the CPC. Therefore the concerned banks cannot be accused of any unethical and/or sharp practices as implied in the articles at issue.

The banks had marketed their products and the CPC had purchased them with the full knowledge of the implications inherent in such deals. The doctrine “Caveat Emptor” holds good in this case as well. The fact is that the officials of the relevant committee, who recommended the “Hedging Contract”, had not recommended to the Cabinet the most suitable option - the correct “Instrument” - obviously due to ignorance and had thereby created the present financial crisis at the CPC as well as the country as a whole. The present crisis will worsen when the CPC starts settling the payments due to the Iranian government for the crude oil the CPC had purchased several months back on deferred payment basis, which will be within a couple of weeks.

When purchasing petroleum products the CPC is expected to follow a certain tender board procedure. For the CPC to go through the formalities of the procedure and to purchase a parcel of petroleum products from a foreign supplier it will at least take a minimum lead time of a month. According to the procedure the purchase price of a petroleum product will be based on the prices prevailing in Singapore on the date of the Bill of Lading of the Tanker carrying the particular cargo. As an example I may point out that in the declining market if the CPC was able to arrange purchases of petroleum products, without a hedging contract of course, to be loaded, say in the second week (for example October 17), the position would have been as follows:

The Singapore based FOB prices of Gas Oil (Diesel) and Gasoline (Petrol) on Friday 17-10-2008 were:

1.Gas Oil (Diesel) with 0.25% sulphur content was US$79.70 a barrel FOB. Assuming the freight cost would be US$2 per barrel the landed cost of a barrel would have been approximately US$81.70, which when converted to rupees at Rs.109 a US Dollar the landed cost of a barrel of Gas Oil would have been Rs.8905.30. Therefore, a litre of Gas Oil would have cost the CPC approximately Rs.56.

2.92 RON Unleaded Gasoline (Petrol) was US$71 a barrel. Assuming the freight cost would be the same as (1) above the landed cost of a barrel would have been approximately US$73 which when converted to rupees at Rs.109 a US Dollar the landed cost of a barrel of Gasoline would have been Rs.7957. Therefore, a litre of Gasoline (Petrol) would have cost the CPC approximately Rs.50.

A “barrel” of products contain 42 US gallons and a US gallon contains 3.785 litres. Therefore, 42 x 3.785 = 158.97 litres for a barrel – say 159 litres. Another contributory factor for the crisis at the CPC is due to resultant adverse effects of deviations from time-tested tender procedures followed by CPC for several decades. The said procedures ensured the credibility of the suppliers that the CPC was dealing with. With the assumption of office by the current Chairman/CPC, these time-tested tender procedures were changed and/or amended to suit certain “dubious suppliers of Petroleum products and Ship brokers”, who presumably enjoyed the patronage of certain unscrupulous politicians. The very first deal the Chairman/CPC put through having deviated from the time-tested “Petroleum products purchasing tender procedure”, which ensured the credibility of the suppliers, was a disaster to the CPC, the details of which appeared in The Sunday Times FT of October 7, 2007, under the caption “CPC to lose Rs.1.5 billion in one year”. The supplier concerned - Titis Sampurna of Indonesia- , who was not pre-qualified and with whom CPC have had no previous dealings, failed to perform the contract.

The CPC entered into a 1-year contract in August 2008 for the carriage of crude oil from Kharg Island, Iran to Colombo at a rate of US$12.20 per MT. That was the best rate received for the subject tender at that time but was a price that CPC is contractually obliged to continue paying until July 2009, i.e., for fourteen (14) voyages. While the average prices received for the previous years for the same purpose were much less than the aforesaid rate, the incumbent Chairman/CPC, in his wisdom, had thought it proper to enter into a long term contract without any proper knowledge of future markets. Today the price the world over will pay for a Suez Max size parcel, 135,000 MT cargo, for ”Kharg Island – Colombo” is less than US$ 1 million, whereas the CPC is contractually obliged to pay US$1.65 million for the same freight until July next year.

That deal it is understood had been rejected by the relevant Cabinet Appointed Tender Board but the incumbent Chairman/CPC having by-passed all the relevant procedures had obtained the assistance of the then Secretary to the Treasury, who was unceremoniously unseated from that prestigious seat at the Finance Ministry, to steer through successfully another questionable Cabinet Paper, perhaps misleading the Cabinet of Ministers too, and to obtain the Cabinet approval for that questionable award.

So far only two voyages had been completed against this contract and with the performance of the balance twelve (12) voyages CPC will stand to lose around US$6 million or Rs.654 million at the current rate of exchange. A perusal of the average freight rates for similar size vessels during the past years will prove this point.

Another apparent miscalculation by Minister Fowzie and Chairman/CPC – a coincidence or by design?

A joint venture – CPC/GAC Shipping – came into being and its activities are to supply bunker fuels to ships calling at the Colombo Port.

Certain remarks made by Chairman/CPC to the media in justification of the formation of the aforesaid JV are given below:

1.CPC will provide fuel.

2.GAC Shipping will provide barges and do the marketing

3.CPC will have a small profit margin and as a result the price of bunker fuel in Colombo will come down and the bunker sales will be increased.

Has the Chairman/CPC achieved the above objectives?

Items one and two above have been fulfilled. However, neither the Chairman/CPC nor Minister Fowzie, who is said to have blessed the project, has been able to achieve the desired results.

The CPC never earned a profit, whether a small margin or otherwise. CPC delivers the bunker fuel to Interocean Shipping Pvt. Ltd., the local arm of GAC Shipping, at prices below the imported cost of the fuel thus making a loss to the CPC.

In the “Bunker Delivery Notes” prepared by Interocean Pvt. Ltd., which carry the emblem of the CPC, for the purpose of delivering bunker fuels to seagoing vessels it is shown that the delivery of fuel is being done “For and on Behalf of Ceylon Petroleum Corporation” thus binding the CPC for the transactions effectuated by this third party. Can a third party thus bind the CPC? This note is the proof of physical supply of bunker fuel to a vessel. However, it is understood that such Bunker Delivery Notes or their copies never reach the CPC for any further action. No reconciliation of Bunker fuel sales by CPC to GAC Shipping vis-à-vis bunker fuel sales by GAC Shipping to seagoing vessels is done at the CPC.

Therefore the possibility that bunker fuels, such as Gas Oil, thus sold, passing on to unauthorised hands, such as terrorist organizations, cannot be ruled out. The Chairman/CPC should clarify as to on whose authority the Interocean Pvt Ltd displays the CPC emblem on their invoices/correspondence and as to how Interocean Pvt Ltd transacts business “for and on behalf of the CPC”.

For further clarification I may point out that the Gas Oil sold to GAC Shipping in August 2008 by CPC based on the “July 2008 MOPS prices” was at US$1,057 per MT whereas the price at which Gas Oil was sold to the local public was at US$1207 per MT (at Rs.109 for a U.S. Dollar). In turn GAC Shipping had sold Gas Oil as bunkers to vessels at US$1355 per MT thus making a whopping profit of US$298 per MT.

Currently it is understood that GAC Shipping buys Gas Oil from CPC at US$990 per MT and sells to seagoing vessels at US$1300 per MT thereby making a huge profit of US$310 per MT. On the other hand CPC by selling Gas Oil as bunker fuel to GAC Shipping makes a huge loss when compared to the “Hedged” price at which CPC imports Gas Oil. Who benefits by all these?

The lame excuses given by Minister Fowzie and Chairman/CPC, Asantha de Mel as to why the bunker delivery operations were handed over to GAC Shipping/Interocean had been that the CPC was lacking the necessary infrastructure, such as barges, necessary for these operations. This position of both Minister Fowzie and Mr De Mel cannot be possibly true, for more than 50% of the bunker deliveries transacted by GAC Shipping is being currently done by making use of CPC/CPSTL owned Tank Trucks installed with Power Take-off Pumps.

When a 13,200 litre load of Gas Oil ( 11.2 Metric Tons) is delivered to a ship by a CPC Tank Truck as aforesaid CPC earns no profit but merely incurs a loss, but GAC/Interocean earn a profit of US$300 X 11.2 = US$ 3360 = Rs 366,945.00 at the current rate of exchange. Can anybody imagine the amount of money that the CPC is thus losing and the resultant profit earned by GAC Shipping/Interocean in supplying and delivering about 3000-4000 Metric Tons of Gas Oil monthly on a regular basis. The loss to the CPC will be around Rs. 98 million to Rs. 131 million every month.

Another interesting question that Chairman/CPC should answer is as to why he had permitted the daughter-in-law of Minister Fowzie to attend ‘Stock Review Meetings” of the CPC, especially after the formation of the aforesaid JV. This shows to what extent the CPC has been politicized with Minister Fowzie assuming the Ministerial position covering “Petroleum”.

In the face of the recent Supreme Court judgments, where several high profile public figures, including a one time Head of State, had been exposed of corruption, the government should scrutinize those long term contracts entered into by public officials of the calibre of the incumbent Chairman/CPC, for which the public is committed to pay for the arrogance, incompetence and lack of foresight of those square pegs in round holes.

|

“Crisis over oil hedging deals and CPC in debt up to $20 million a month” were the headlines, respectively in The Sunday Times and The Sunday Times FT on November 9. Chairman/CPC Asantha de Mel in response had admitted the existence of the hedging contracts with the banks and also that CPC was fully “educated by the banks” of the consequences of such hedging contracts. He also had accepted that several millions of US Dollars were due to the banks as a result of hedging contracts and that such contractual obligations would be honoured by the CPC. Therefore the concerned banks cannot be accused of any unethical and/or sharp practices as implied in the articles at issue.

“Crisis over oil hedging deals and CPC in debt up to $20 million a month” were the headlines, respectively in The Sunday Times and The Sunday Times FT on November 9. Chairman/CPC Asantha de Mel in response had admitted the existence of the hedging contracts with the banks and also that CPC was fully “educated by the banks” of the consequences of such hedging contracts. He also had accepted that several millions of US Dollars were due to the banks as a result of hedging contracts and that such contractual obligations would be honoured by the CPC. Therefore the concerned banks cannot be accused of any unethical and/or sharp practices as implied in the articles at issue.