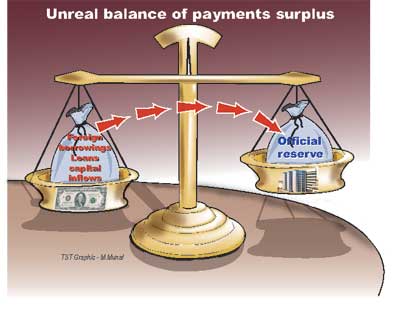

The deceptive balance of payments position

At the end of the year the country realised a balance of payments surplus and foreign exchange reserves were quite adequate. The balance of payments surplus at the end of 2007 has been estimated to have increased to US$ 550 million compared to US$ 204 million in 2006. The official reserves are estimated to have increased to US$ 3,080 million at the end of 2007 compared to US$ 2,526 million at the end of 2006. At the end of 2006 total reserves were US$ 3695 million. In fact, the position was even better at the end of November last year when the country’s foreign exchange reserves were US $ 4614 million and official reserves were US $ 3149 million. The foreign reserve position has improved and is quite sound being able to finance five months of imports. The foreign reserves at the end of November 2007 were 25 percent higher than what it was at the end of 2006. No doubt these statistics make the authorities quite happy about the performance in the external account of the country. The flip side of the equation is however that the country’s foreign debt had reached Rs. 1353 billion at the end of October. This was 29 percent higher than it was a year ago. It may have risen further by the end of the year. This means that while the official reserves were higher the country’s foreign debt was nearly 30 percent higher than at the end of October of last year. It is well known that the foreign reserves were boosted this year with additional loans. Therefore the depiction of the balance of payments position and our foreign exchange reserves as favourable is deceptive. We cannot be happy with either owing to the increased debt that has been responsible for the apparent good position in both. Another important dimension is the huge trade gap that we keep incurring year after year. The trade deficit reached a massive US 2846 million at the end of October and is likely to be around US$ 3400 million at the end of the year. It is in spite of this that the country had a balance of payments surplus of US$ 550 million. An explanation of how the country sustained a massive trade deficit of over US $ 3000 million last year and achieved a balance of payments surplus requires some explanation. In brief, the main sources for this surplus are the capital inflows, the large inflows of foreign exchange, particularly higher remittances, loans and other debt and capital inflows. These consist of remittances to the country by Sri Lankans and expatriates from abroad, inflows into the stock market and the large amount of foreign borrowing. In fact many of the inflows have increased and consequently despite incurring large trade deficits, the country continues to enjoy a balance of payments surplus. For instance foreign remittances to the country in the first ten months were as large as US$ 2051 million. Besides the issues of foreign borrowing there is another dimension to the problem that should be realised. Several types of inflows could reverse into outflows of capital. This is particularly true with respect to investments in the stock exchange. Investors would bring in money to make capital gains and remit a larger amount than they had brought in. As long as there is a continuous inflow of funds that more than match outflows there is no apparent problem. It is when business confidence is eroded that the danger occurs. This was one of the reasons for the Asian Financial Crisis over a decade ago. One has to be conscious of the vulnerability of a high dependence on financial inflows for balance of payments support. For these reasons taking pride about the balance of payments surplus achieved through foreign borrowing and capital inflows that are contingent liabilities is misplaced and dangerous. The balance of payments surplus in 2007 is not an indication that that the country’s external account is healthy. In fact a close examination of the constituent elements of the balance of payments account will disclose the weaknesses of the achieved balance. These weaknesses must be addressed before a more critical situation develops. A favourite and frequent examination question in economics is: “If the balance of payments of a country must balance, how is it that a country could have a balance of payments problem?” The external accounts of Sri Lanka provide an illuminating example of this. The country is having a balance of payments surplus and yet there can be no doubt that it is experiencing a serious balance of payments problem. While the accounts show a balance of payments surplus, it is achieved by borrowing funds and putting the country into further debt. These borrowed funds have to be repaid and are consequently a liability for future years. If these funds do not result in increases in exportable goods and services, the strain on the balance of payments would be much more in the future. The mere attainment of a balance of payments surplus is not an indicator of the health of the economy or even more specifically, the situation with respect to its external accounts. The manner in which the balance has been brought about is vitally important. The large amount of borrowing last year more than offsets the balance of payments surplus. In effect, the country sustained a large deficit that was transformed into an accounting surplus owing to higher amounts of foreign borrowing. Therefore, the balance of payments surplus can hardly be described as an achievement of the economy. The real danger lurks in the authorities not taking remedial measures to improve exports and put in place macro-economic policies to redress the fundamental factors to improve the balance of payments because of the surplus in the balance of payments. |

|| Front

Page | News | Editorial | Columns | Sports | Plus | Financial

Times | International | Mirror | TV

Times | Funday

Times || |

| |

Reproduction of articles permitted when used without any alterations to contents and the source. |

© Copyright

2008 | Wijeya

Newspapers Ltd.Colombo. Sri Lanka. All Rights Reserved. |

What would you tell a friend of yours who boasts of a handsome bank balance in his current account when you know he has borrowed a similar amount from a bank recently? You may like to advise him to spend it carefully. You may tell him politely that what matters is his total assets and liabilities position. You may like to remind him of his loan liabilities in a polite and diplomatic manner. You may wish to advise him to live within his means even though he has a good bank balance, as he would have to pay back the loan he has taken, soon.

What would you tell a friend of yours who boasts of a handsome bank balance in his current account when you know he has borrowed a similar amount from a bank recently? You may like to advise him to spend it carefully. You may tell him politely that what matters is his total assets and liabilities position. You may like to remind him of his loan liabilities in a polite and diplomatic manner. You may wish to advise him to live within his means even though he has a good bank balance, as he would have to pay back the loan he has taken, soon.