CPC to lose Rs.1.5 billion in one year

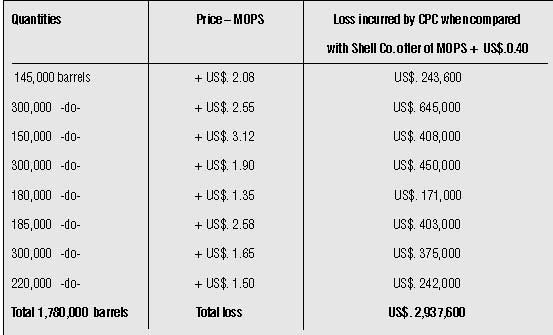

The Ceylon Petroleum Corporation (CPC) will lose Rs.1.5 billion by June 2008 over a botched up deal made with an unlisted Indonesian company, Titis Sampurna, over an agreement to purchase 500,000 metric tons of crude oil. Reliable sources told The Sunday Times FT that instead of going with an internationally renowned party such as Shell, the CPC insisted on making an agreement with Titis Sampura which did not adhere to the tender conditions, resulting in massive losses to the CPC and the country. "The collapse of the supply agreement between Ceypetco (Ceylon Petroleum Corporation) and little known UK trader SGG LEAD could damage the delicate Sri Lankan economy" says, according to Platts, the well known magazine for the petroleum industry. The details given in the magazine relate to a deal concluded by the present management of the Ceylon Petroleum Corporation (CPC). The source said that CPC Chairman, Asantha De Mel, issued several public statements through both the print and electronic media to the effect that his efforts had saved several billions of rupees in foreign exchange to the CPC in particular and the country as a whole. "He spoke of deals the CPC concluded to purchase Crude Oil and Gas Oil (diesel) from parties with whom CPC had never dealt before," the source said. "Both deals fell through to the embarrassment of Mr. Asantha de Mel and the CPC and the CPC's abortive attempts to purchase Gas Oil of "Russia, Venezuela and Elsewhere" origin from a party unknown to CPC., Titis Sampurna of Indonesia had caused a heavy loss to the CPC in particular and the country as a whole, the source said Agreement to Purchase Crude Oil CPC's invitation to bid dated May 2007 was for 500,000 metric tons (3,650,000 barrels) or 1,000,000 metric tons (7,300,000 barrels) of Crude Oil, either for six month's supplies or one year's supplies respectively commencing from 01/07/2007 at CPC's discretion. The lowest offer amongst eleven bidders was from SGG LEAD & Co. UK., presumably a then unregistered party with the CPC., for 12,000,000 barrels (one million per month) of Arabian Light Crude at "average Platts Oman + Dubai minus US dollars 3.00 per barrel" FOB. This party had not submitted a Bid Security Guarantee as required by the tender documents and neither had they agreed to offer extended credit. With all those deficiencies, the CPC accepted the offer of SGG LEAD & Co., UK and requested them to produce Supply Guarantees from the Saudi Government (ARAMCO) and their contractual details with it as promised by them. They were given an extended period of time until 31st July 2007 to produce the required documents but SGG LEAD & Co., failed to comply with those requirements and the agreement did not materialize. The CPC had to turn to the Iranian Government Crude Oil suppliers to keep the Sapugaskanda Oil Refinery flares burning. Platts states "The state oil company usually buys crude oil on an annual term basis, and looks likely to revert to that model in the wake of the disastrous tender experience". As regards SGG LEAD Co., UK the Platts reports as follows: "SGG LEAD could not be reached for comment. The company's website lists the outfit as being based in Middlesex, in England, but gives sparse details. Calls to the London-listed telephone number provided on its website could not be completed, suggesting that the phone number has been cut off, if it worked in the first place". Agreement for Purchase of Gas Oil (Diesel) In like manner in May 2007, the CPC invited public tenders for the purchase of Gas Oil (0.25% sulphur) for a period of six months/one year, the quantities being 240,000 metric tons (1,800,000 barrels) for six months and/or 480,000 metric tons (3,600,00) barrels for one year, supplies to commence from 01/07/2007. Fifteen parties submitted bids and the lowest offer was from a party not known to CPC, viz., Titis Sampurna of Indonesia. Their offer was to supply 480,000 metric tons (3,600,000 barrels) Gas Oil of "Russia, Venezuela and Elsewhere" origin at "Mean of Platts' Singapore (MOPS) Gas Oil assessments, with a discount of US$ 25 per metric ton (approximately US$ 3.25 per barrel), payment terms being 30 days or 90 days after the Bill of Lading date and the interest for extended credit to be mutually agreed upon. At the time of the offer they had not established a Bid Bond and their offer was not in conformity with the relevant tender conditions. The offer submitted by Shell Co., in response to the same advertisement, conformed to tender conditions and the price quoted was 'Mean of Platts' Singapore (MOPS) Gas Oil assessments plus premiums of US$ 0.55 for six months supplies and US$. 0.40 for a one year supply, payment terms being 30 days after Bill of Lading date. The CPC accepted the offer of the hardly known party, Titis Sampurna of Indonesia in preference to the known and internationally reputed parties such as Shell Co. etc., and accordingly established a Letter of Credit for the purchase of Gas Oil from that party, the first consignment of Gas Oil to be delivered in Colombo during the month of July 2007. "To the bitter disappointment of Mr. Asantha de Mel, Titis Sampurna could not deliver the expected cargo of Gas Oil and failed to fulfill its contractual obligations," the source said. At the time of the evaluation of tenders for the purchase of Gas Oil, Titis Sampurna had not submitted a Bid Bond in terms of the tender conditions at issue. Had they submitted a Bid Bond at a later stage (contrary to tender conditions), that Bid Bond to the value of approximately US$ 1.5 million should have been enforced. Nevertheless it is alleged that Titis Sampurna had not submitted a Bid Bond and that CPC lost in that account too. The CPC thereafter had no alternative but to resort to the former mode of inviting offers for Gas Oil from those who are already registered with the CPC and had purchased eight consignments of Gas Oil totaling 1,780,000 barrels since then, at premiums (plus), ranging from US$ 1.35 to US$ 3.12 incurring a huge loss of US$ 2,937,600 when compared with the offer of Shell Co. at 'Mean of Platts' Singapore (MOPS) Gas Oil assessments plus US$ 0.40 for a one year supply, payment terms being 30 days after Bill of Lading date. The details of the purchase of Gas Oil by the CPC after the abortive deal are: The average loss on premiums to the CPC per barrel of Gas Oil when compared to the offer of Shell Co. referred to above is US$ 1.65 on the aforesaid eight consignments of Gas Oil. The CPC's requirement of Gas Oil to be imported for a year is over 8 million barrels and on the above basis, the CPC will lose a minimum of US$ 13 million or Rs.1,482,000,000 (exchange rate Rs.114/= per US$) on one year's purchase of Gas Oil. The source explained that it is losses of this nature that make the price of local petroleum products escalate by leaps and bounds and the CPC officials including its chairman should be held responsible for these losses and the escalation of petroleum products prices, the end result of which is the rise of cost of living. The procedure covering the purchase of Petroleum Products had been approved by a Tender Board appointed by the Cabinet (CATB), which was tantamount to a Cabinet approval and the deviation from such a procedure is tantamount to violation of a Cabinet decision. Had the CPC management failed to obtain Cabinet approval for the deviation from the CATB approved tender procedure as aforesaid, the management of the CPC should be taken to task for that matter as well. It is obvious that the deviation from the CATB approved procedure was to select Titis Sampurna, a party hardly known to the CPC, as a Gas Oil supplier. It was alleged that this party had discussions with the CPC chairman and an individual very close to the line Ministry prior to when the tender in question was initiated. The said unsavory deal is causing a colossal loss of approximately Rs. 1.5 billion rupees to the CPC in particular and the government in general in one year. The source said one is at a loss to understand as to why the offer of the unknown Titis Sampurna was accepted by the CPC without verifying the credentials of that party such as the "Supply Guarantees and other contractual details of purported suppliers of Gas Oil of "Russian, Venezuelan and Elsewhere" origin as specified in the bid under question of Titis Sampurna. The only irresistible inference one can draw is that Titis Sampurna had the patronage of an important person. History Repeating Itself In the late 1970's CPC when Daham Wimalasena was CPC Chairman, the country suffered a huge loss in foreign exchange consequent to the CPC concluding a deal with a Singaporean party to purchase Bitumen. The Singaporean party was selected after inviting offers through public advertisements. The selected party was not known to CPC and a Bid bond/Performance bond was not insisted upon from that party. The purchase was to be based on an 'On Sight' Letter of Credit. The purported sellers nominated an already sunken vessel to carry the consignment of bitumen in question, presented fabricated documents to the advising bank and obtained funds covering the 'consignment of bitumen' that never reached the shores of Sri Lanka and disappeared. The source explained that the CPC's efforts to trace the location of the offenders were to no avail and it was later revealed that the purported sellers, who masterminded the sordid deal, had formed themselves into a group only for the purpose of swindling the CPC with the connivance of certain officials who were sympathetic towards a terrorist outfit. Ironically the CPC officers concerned were not disciplinarily dealt with for negligence or otherwise. "With that unpalatable experience, the CPC devised an almost fool-proof system in order to prevent situations of such nature where potential sellers had to register themselves with the CPC having proved their credentials. That system, it is said, had the blessings of the Cabinet." A former CPC Chairman was contacted over the phone and confirmed the above details of the disastrous Bitumen deal. However, the present management, in its wisdom, had deviated from the said Cabinet Appointed Tender Board (CATB) approved system of inviting offers for its requirements only from already registered suppliers with CPC and had resorted to inviting offers for Crude Oil and Gas Oil through public advertisements, presumably in order to satisfy certain interested parties, the source said. Attempts at contacting CPC Chairman, Asantha de Mel for comments were futile. (NG) |

|

||

| || Front

Page | News

| Editorial

| Columns

| Sports

| Plus

| Financial

Times | International

| Mirror

| TV

Times | Funday Times || |

| |

Reproduction of articles permitted when used without any alterations to contents and the source. |

© Copyright

2007 Wijeya

Newspapers Ltd.Colombo. Sri Lanka. All Rights Reserved. |