Colombo COL index outdated

Inflation:

Looking at what’s gone wrong

The Sunday Times FT team – Bandula Sirimanna, Fazl-ur Rahman, Lakwimashi Perera and Natasha Gunaratne – takes a look at inflation, cost of living, fuel prices and printing money; issues that have become very important to people and companies for their existence.

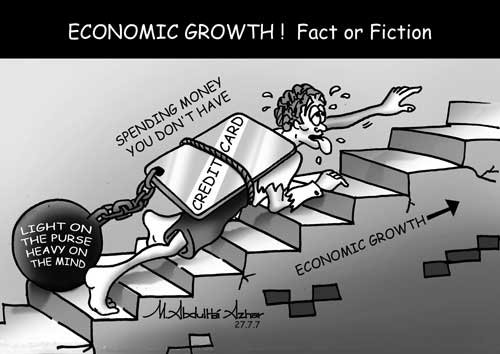

The recent comments by Central Bank Governor Nivard Cabraal on inflation and the cost of living has triggered many comments from the media and the public and jibes by newspaper cartoonists.

The Central Bank has however in the past consistently maintained that the cost of living index now used is outdated and needs to be changed, a decision blocked by trade unions.

Treasury Secretary Dr P.B. Jayasundera, when asked for his comments, described the Colombo Consumer Price Index (CCPI) as 'totally outrageous and in my view, it is not meaningful.'

In the basket of goods used to compute the inflation rate, the CCPI does not take into account water, gas, electricity, certain food items and private tuition rates. "If we take those items into our CCPI and develop a good index, you may see much lower but more realistic and meaningful inflation rate for the country," he said.

"But the kind of index we have has flour and no adequate data on rice so the balance is not there. Liquor, cigarettes, kerosene, these sorts of items and even vegetables are hand picked items because diversity was not there in those days. Today, the situation is totally different. For example, 70% of consumers have electricity so kerosene must come down. Now, there will be a cost of living allowance for people who don't use kerosene even though their cost of living didn't increase due to kerosene."

|

Jayasundera said Sri Lanka needs a more realistic, urban, working based index. "The implicit inflation rate with monetary growth of 18% or 19% and economic growth of 7% means inflation is about 8% or 9 % annually but the index distorts it. This is not to say there is no cost of living problem. There is a cost of living problem but our index is not capable of capturing it. We need a professional group to work out a more meaningful core price index. Also, workers like this (current) index because it is good for their wage negotiations."

Consumer Price

Indices

The compilation of Consumer Price Indices (CPI) in Sri Lanka commenced in the early 1940's with the computation of the Colombo Working Class Index (CWCI) and the Estate Labour Index Number (ELIN). The Colombo Consumer's Price Index (CCPI) which replaced the CWCI, is based on a family budget survey conducted by the Department of Census and Statistics in 1949-50 of 455 working class households in the Colombo municipality. The expenditure data obtained from this survey were re-valued at 1952 prices to determine the weights of the new CCPI.

The Greater Colombo Consumers' Price Index (GCPI) was introduced in 1989 based on the results of the nationwide 'Labour Force and Socio-Economic Survey' conducted in 1985-86.

In addition, the Colombo District Consumer Price Index (CDCPI) was introduced by the Central Bank in 1998, based on the Consumer Finance and Socio-Economic Survey of 1996-97.

Economic analysts argue that a new CPI is needed to eliminate many of its current problems and limitations. They argue that the new CPI should be based on a specially designed Household Expenditure Survey that should be undertaken primarily for designing weights for the CPI.

Economist Dr. Harsha De Silva said the Sri Lanka Consumer Price Index (SLCPI) was created to include a larger more representative demographic, encompassing all of the 20 urban centres in Sri Lanka, excluding only the North and East, as compared with the CCPI whose target demographic is the population in the Colombo Municipal area. Although the SLCPI is still being calculated and compiled on a regular basis, the CCPI remains the official index. He said the SLCPI is used by the government unofficially as a reference when determining monetary policy.

New index

Dr. P. N. Weerasinghe, Director Economic Research of the Central Bank, responded to questions from the newspaper on the cost of living index:

What is the consumer price index

used in Sri Lanka currently?

In Sri Lanka, the Colombo Consumers’ Price Index (CCPI), which is compiled and published by the Department of Census and Statistics (DCS), is considered the official indicator of changes in cost of living and used to determine the cost of living allowances payable to government servants, plantation workers and workers in other industries covered by the said legislation. It is widely used by firms and individuals in planning current and future consumption and investment, thereby affecting inflation expectations.

How accurately does it reflect the

cost of living?

The CCPI is based on the spending patterns of the lowest 40 per cent of households, who lived in the Colombo Municipal area in 1949/50, by their monthly expenditure. Therefore, it is not an accurate measure of cost of living in Sri Lanka in the current context.

However, now it doesn’t even reflect the cost of living of the people living in Colombo Municipal area. This is because the original weights of a price index for different items automatically changes over time. The shares of the items with rapid price increases in the index rise while the shares of items with lower price increases attenuate. As an example, the original weights of kerosene and vegetables in 1952 have been 1.1% and 5.9%. Now kerosene has a share of around 6% and vegetables has a share over 21%. At the same time, the share of clothing category has dropped from 9.4% to 1.9%.

What does that mean?

If the prices of vegetables increase by 10% due to a landslide in Nuwara Eliya, CCPI increases by 2%. If the kerosene prices are increased by 15%, it increases by another 1%. But, if the prices of clothing decrease by 10%, due to increased production, inflation will go down only by less than 0.2%. When this happens continuously, the inflation is overstated as the share of items with rapid price rises, increases.

This is only a part of the problem with the index. The consumption patterns do not remain unchanged. When the income level of people increases the share that they spend for food usually decreases.

When the infrastructure facilities develop, people reduce kerosene usage and consume more electricity. In 1953, only 4.3% of the households had electricity but by 2003 this has increased to 75%. In the Western Province this ratio is 94%.

The weight for kerosene in the index should represent this. But, what has actually happened? The share in fact has increased. The CCPI was originally designed as a measure of the cost of living of low-income households then lived in Colombo Municipal Area, but not as a measure of inflation in Sri Lanka. But, as explained above, now the CCPI does not even represent the current expenditure patterns of that selected segment. At least it doesn’t represent the expenditure pattern of the original sample prevailed in 1952. That’s why we say the CCPI is “disreputably outdated”.

Yes, the annual report of the Central Bank called the CCPI “disreputably outdated”, yet it is still being used. Why is this?

As explained earlier, the CCPI is highly outdated and it has been outdated for decades. The Central Bank, as one of the major users of the index has highlighted this issue since 1970s. Consequently, the Sri Lanka Consumers’ Price Index (SLCPI) was introduced in 1997. Unlike the CCPI, SLCPI has an island wide coverage and represents the consumption patterns of 80% of the population.

However, this index has also not been revised since then and becomes outdated now. As an example, SLCPI also over represents food category. Another major problem is that the one-month lag involved in releasing SLCPI numbers. This in fact is a tradeoff for it’s comparatively larger geographical coverage. However, as a result many people make judgments based on the movement of CCPI, rather than waiting one more month until the release of the SLCPI.

Anyway, the Central Bank, like any other central bank in the world, clearly knows the difference between the inflation and the cost of living. We also can estimate the extent to which a particular price index can represent even the cost of living.

Therefore, when we take our policy decisions we rely on our analysis of the movements of various price indices, internally derived core inflation measures and even internally computed cost of living indexes.

But, whatever the actual inflation in the economy, many people are still relying on the CCPI. Many people who never consume kerosene negotiate for pay hikes when the CCPI moves up just due to the increase in kerosene prices. Many investors, fund managers and bankers take serious business decisions only looking at the impact of price increases on the cost of living of 415 households lived two generations ago.

Therefore, the changes in CCPI make a real economic impact on the economy through expectations. On those grounds, the Central Bank also has to consider the movement of the CCPI to a certain extent when policy decisions are taken.

Will there be any revisions to the CCPI? If so, what will those changes be?

The problems with the CCPI were extensively discussed at the National Economic Council meetings since the beginning of the year. The Department of Census and Statistics is planning to introduce a new representative price index during the year in place of the prevailing official price index.

Do you think those changes will make a real difference to the people at the ground level of the Sri Lankan economy?

A revision of the price index will help economic decision-making by major stakeholders of the economy and it will eliminate some of the existing anomalies. However, the people at the ground level of the economy will only have a neutral impact by revising the price index. Their living conditions can only be improved through long-term sustainable economic growth and elimination of disparities.

What/Who are the obstacles/opponents you are likely to confront when effecting these changes?

The revision of the index is a technical process usually done very frequently in many countries.

However, since we have not revised the index for decades, and we are so used to CCPI numbers, many financial decisions and medium-term contracts in the county have been based on the CCPI. Therefore, one might have a wage contract that says ‘an allowance of Rs. 5 will be paid for an increase in each index point of CCPI’ or a supplier contract that reads, as ‘The price paid per unit of X will be revised according to the increase in CCPI’. Such contracts, if any, may have to be renegotiated if the index is revised. Other than that there will not be any obstacle when revising these changes.

What is the significance of the SLCPI (an index issued by the Census Office) to the Central Bank and the government?

As explained earlier, the SLCPI is more representative of actual changes in cost of living of an average Sri Lankan, when compared with the CCPI. However, SLCPI too does not represent present consumption patterns precisely. The government as well as the Central Bank carefully observes the movements of SLCPI also as an alternative proxy of inflation.

The CCPI is being used by the Central Bank and the government to calculate the cost of living and the rate of inflation, yet the government is using the SLCPI to determine monetary policy. Why is this?

It is a misconception that the government and the Central Bank are using SLCPI to determine the monetary policy. The SLCPI, similar to the CCPI is a measure of cost of living. They represent the changes in consumption expenditure of a particular segment of the economy.

Therefore, central banks usually consider that the changes in a cost of living index are less important to the monetary policy than a correct measure of demand pressures in the economy.

|

Inflation

Inflation is defined as the devaluation of money and this generally occurs when there is too much money chasing too few goods in an economy. In Sri Lanka, the rate of inflation is officially calculated using the Colombo Consumer's Price Index (CCPI). The Central Bank uses this to calculate the wages and pensions of government employees, to measure the cost of living and to generally assess the economic state of the country.

Dr. Harsha De Silva said inflation would be irrelevant if income increased in proportion but this is not what is happening.

"The government blames the rising global oil prices for the inflation in this country but the fact is that our neighbours India, Pakistan and Bangladesh, to name a few, are equally dependant on oil for their economies. Why have their inflation rates stayed relatively low as compared to ours?"

Principal researcher at the Point Pedro Institute for Development, Dr. Muttukrishna Sarvananthan said that public and private debt could also fuel inflation. "Borrowing by either the government or the private sector, including individuals or households, means that the demand for money is greater than the supply of money. Therefore, the value of money decreases, thereby pushing the price of goods up. Besides, both public and private borrowings limit the money in circulation which depreciates the value of money, resulting in inflation."

Chairman of the Ceylon Chamber of Commerce Mahen Dayananda said that when inflation is on an upward trend, an increase in interest rates is essential in order to contain money supply and also to keep real interest rates positive.

However, it is a fact that high interest rates discourage investments as the cost of capital escalates.

The inflation rate for July 2007 was registered at 17.2%, higher by 6.8% compared to the same period last year level of 10.4%. The month on month inflation rate of the Colombo city was 0.2% higher than that of last month's rate of 17%.

Printing money

There is a lot of confusion about what 'printing of money' actually means. Dr. Muttukrishna Sarvananthan said that in fact, when people talk about 'money printing', what they really mean is 'money creation' which does not necessarily mean the physical printing of new currency notes. New money could be created by physically printing new currency notes or by some other means.

Dr. Harsha De Silva said that 'printing of money' means accommodating monetary policy.

Fuel Price Hikes

According to a Ceylon Petroleum Corporation (CPC) insider, petrol is bought at US$ 86 a barrel with another US$ 2 added for shipping charges totalling US$ 88 when it comes to the country.

The price of a litre of petrol when it is brought to the country can be worked out as follows:

**US$88 x 112 (to convert into rupees) = Rs 9,856

As there is 157 litres per barrel, Rs 9,856%157 = Rs 62.77 per litre

**Rs 62.77 + Port charges of US$ three per ton of oil + VAT (15% per litre) + Excise duty (Rs 20 per litre) + Port and airport charges (three percent per litre) + Provincial council tax (one percent per litre) + Dealer's commission (one percent per litre) + Business Turnover Tax (one percent per litre) + Terminal charges (one rupee per litre) + Maintenance (Rs 2.50) = Rs. 107.00

The current selling price of a litre of petrol is Rs 117 and the difference of the selling price and the total price after adding up the various taxes is Rs 10. This, the insider alleges, is tagged on by the CPC to cover their financial burdens.

The insider also said that financial mismanagement and corruption within the CPC has made it into a loss making institution.

Director General of the Employers Federation Ravi Peiris said that manufacturing, tourism and industrial sectors have been badly hit by the recent fuel hike and employers of these sectors should be lauded for paying wages for workers by managing their companies under difficult circumstances.

Cost of Living

The Colombo Consumers Price Index (CCPI) is considered to the official cost of living index which is primarily used to measure changes in the price level of consumer goods in Sri Lanka.

The index is based on the spending patterns of individuals living in the Colombo Municipality area. However, it merely covers the spending patterns of the lowest 40% of households in the Colombo Municipal Council area based on 1952.

Ravi Peiris told The Sunday Times FT that some private sector companies are paying a cost of living allowance for its employees based on their own structure by considered the Consumer Price Index (CPI) and the rate of inflation. But most of the private sector institutions driven by market forces cannot make such payments owing to the sky rocketing of fuel prices and various other factors.

The Sri Lanka Employers Federation has agreed to raise the minimum salary of private sector workers to Rs.5000 and some 450,000 workers from 500 private sector firms have benefited from this increase.

Dr. Harsha De Silva said that the cost of living allowances for estate workers, government employees and the like are calculated according to the inflation rate which in turn, is calculated using the CCPI. The law mandates that for every unit increase in the index, salaries will increase by Rs.2.

The CCPI is a very volatile index and thus, tends to move up faster and more often which means more money for the labour unions. De Silva added that this is why they put pressure on the government to keep the current CPI.

|