The zero cost collar hedging strategyThe Ceylon Petroleum Corporation got into a ground breaking agreement with the Standard Chartered Bank earlier this year. The agreement was to provide upside price protection to the CPC from escalating crude oil price in a spot market. This agreement was a trailblazer initiative that introduced the concept of commodity hedging using Derivative instruments for the first time in Sri Lanka. By introducing hedging, the CPC created a precedent in Sri Lanka. However, despite having a hedge model in place to provide upside price protection the CPC had to increase the retail fuel prices in the recent months. Rationally, these recent price increases from a laymen’s analysis, potentially disputes and questions the very validity of the hedging process. Given due regards to the recent price revision, this article intends to discuss the validity of commodity hedging as it would apply as a measure introduced to guarantee price and provide protection in a volatile market. Validity of the Price Guarantee Mechanism: Financial instruments referred to as Derivatives facilitate the hedging process. Derivative instruments can be exchange traded or that are traded over the counter between two counter parties. Futures and Options are Exchange traded while Over the Counter (OTC) Derivatives are customized trades. For the most part, Success of a hedge model is contingent upon the selection of the -

*Correct Instrument ( Futures, Options, and SWAPS)

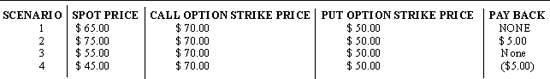

What is a Zero Cost Collar? Transaction Basics: A Zero Cost Collar strategy combines the sale of a Put Option and the purchase of a Call Option. Put Option gives the holder the right to sell the underlying product ie. commodity at a strike price(capped price) that is pre determined. Call Option gives the holder the right to buy the underlying product at the strike price that is pre determined. In a situation where the protection seeker wants protection from increasing spot market prices, as illustrated above the Option premium collected by the sale of the Put Option with a lower strike price (capped sale price) will fund the purchase of a Call Option with a higher strike price(capped purchase price). For the most part, due to the inverse relationship between the strike price and the Option premium with a wide spread between the Put Option and the Call Option, the limited proceeds from the sale of the Put Option will only fund a Call Option with a relatively higher purchase price of the underlying commodity thereby compromising the potential benefits. Zero Cost Collar, essentially creates a position of a “Synthetic Futures”. Futures contracts “locks & guarantees” the purchase / sale price for forward delivery. Extreme downside participation is given up for partial benefits from upside participation. Effectively, the Zero Cost Collar will pay off once the spot market price exceeds the Call Option strike price (=call capped price). The Put Option will expire worthless. However, if the spot market price drops below the Put Option Strike price (=put caped price) the Zero Cost Collar strategy will not allow any participation in the down side. The above is an illustration of a Zero Cost Collar strategy. When the spot market price moves over and above the strike price of the Call Option, the Call Option will be exercised and the difference between the strike price and market price will be received by the Zero Cost Collar buyer. Meanwhile, if the spot market price is below the strike price of the Put Option, the Zero Cost Collar buyer cannot participate in the lower spot market price. As long as the spot market price moves between the Put option strike price and the Call Option strike price, there will be no pay backs. However, the moment, the spot market price moves beyond the Call Option strike price, the Call Option will pay back. Over a long period of time, the sport market prices can move significantly. The price pendulum can move from one extreme to the other. Given the implied volatility of the spot market price movement, Zero Cost Collar is a strategy that will be effective only on the short term. If used on a long term basis, the benefits will be minimal since the strategy effectively creates a synthetic futures position due to the put option locking in the future delivery price even when the spot market price drops below the Put Option strike price. There is a trade of in any situation. It is said that you get what you pay for. Zero Cost Collar is a protection seeking strategy virtually for free. This is akin to getting an auto insurance policy free without any premium payments. But how good is that policy going to be? Obviously, it will provide the policy holder the bear minimum. By the same token, a Zero Cost Collar while being a relatively cost effective process of seeking limited upside protection gives up the potential to participate in the downside price movement. Given the above matrix of the Zero Cost Collar structure, the better alternative to the Zero Cost Collar is a basic Call Option strategy that will provide upside protection for the upfront payment of a premium. This strategy will allow the Call Option holder to participate in the downside of the market price movement. The Option premium is an investment and not be seen as an expense. As long as the Option Premium is perceived as an expense, potential benefits of the hedge will be compromised by not getting into hedging and seeking a price protection. |

| || Front

Page | News

| Editorial

| Columns

| Sports

| Plus

| Financial

Times | International

| Mirror

| TV

Times | Funday Times|| |

| |

Copyright

2007 Wijeya

Newspapers Ltd.Colombo. Sri Lanka. |