7th November 1999

Front Page|

News/Comment|

Editorial/Opinion| Plus|

Sports|

Sports Plus| Mirror Magazine

![]()

Top priority for agriculture to ensure food security

A fresh concern for food security has emerged. A few weeks ago a body of scientists met under the auspices of the National Academy of Science to discuss the country's food situation. Some months ago when the prospect of a global water scarcity was discussed the concern for food security was uppermost in the deliberations. Why this fresh concern for food security at a time when world food supplies are aplenty and food prices are tumbling ?

Several reasons account for this concern. One is with respect to the future global food supplies which appear threatened by the prospect of water scarcities in critical regions of the world. China and India which have between them over one-third of the worlds population, are countries which would have serious regional water scarcities. Another is the mismatch between global food supplies and food demand.

Rich countries of North America and Australasia have abundant food supplies but sub-saharan African countries are not only food deficient but these nations cannot afford to import the required food. South Asian countries have improved their food situation since the crises of the sixties and seventies. Yet a few problems do signal warnings. One of these is the water scarcities which could affect the region's biggest country - India. Second, a global reduced supply could raise prices of essential foods and some countries of South Asia still import substantial quantities of food. This includes Sri Lanka, which imports all her requirements of wheat flour, about 10 per cent of rice requirements, 85 per cent of sugar and a very substantial portion of milk.

If global food supplies are outpaced by global demand, the international prices of these commodities would rise. Then the country becomes vulnerable. Food imports become a strain on our foreign exchange resources and we would have a reduced capacity to import. While we are basically in a good situation at present, it does not lend itself to complacency.

Currently we are in a reasonably secure food situation. Our agricultural exports alone cover the food imports. In fact the export earnings from tea alone meets our import bill on wheatflour, sugar, milk and rice. But once again this should not lead to complacency as tea prices are very volatile. Readers need hardly be reminded of that. Also our industrial exports, the majority of which are garments, are also vulnerable especially with rising production costs and the prospect of the Multifibre Agreement (MFA) quotas lapsing in about five years.

Our terms of trade could turn adverse with export prices declining and import prices of food, in particular, increasing.

So what do we do ? First of all we must get rid of our bias against agriculture. From the 1930s till the 1980s there was an emphasis on food production, especially paddy production. That is why the country which imported over 50 per cent of its rice requirement in 1950 to feed 7 million people, imports only around 10 per cent of the requirement to feed a population of 19 million today. True part of this reduction in rice imports has been due to a marked increase in wheat imports.

Still our per capita consumption of all cereals are also likely to have increased. But since the late 1980s we have neglected our agriculture. We have not achieved any substantial increases in paddy yields. What is more paddy farming has become rather unprofitable. Paddy farmers are surviving by off-farm activities rather than paddy farming. Government support is dwindling - no research breakthroughs, no effective extension service and inadequate marketing channels. So we have low productive agriculture.

Two other threats have emerged. The World Bank pundits have told us that Sri Lanka has no comparative advantage in paddy production. Impliedly our paddy farmers must stop cultivating paddy and grow something else and import all our rice requirements. This recommendation is so absurd and impractical that it will never be implemented. Yet the real fear is that the government will not focus its atention and give support to our paddy farmers. Paddy farming still provides employment and incomes to large numbers, and is very much a part of our cultural heritage which we cannot destroy. It is the food security for small farmers. Japan, the industrial giant, still supports her rice farming in various ways despite American and World Bank pressures to depend on imported rice.

The second threat comes from our eagerness to embrace free trade with India. It is well known that India is able to produce most agricultural commodities at a cheaper price than us. Free trade in agriculture could threaten our farmers existence. Mindful of this we must act in our national interest and fashion our trade policies accordingly.

At this stage of our economic development we cannot afford to neglect agriculture.

This does not mean that we should protect it at all costs and thereby develop an inefficient agricultural system. What it means is that we must identify the crops in which we can be efficient producers and give the required support to achieve high yields. We have to improve the efficiency and productivity of our agriculture by research to produce higher yielding varieties, extension services to convey the best methods of cultivation and a considerable improvement in the marketing of agricultural produce. The government has a lead role to play in this. Agriculture must be given top priority once again if we are to ensure long term food security.

Rich pickings might land you in trouble

As the securities market develops,the Colombo Stock Exchange and Securities and Exchange Commission are reviewing their rules. Some of the existing rules tend to be outdated as is the rule on short selling which is not permited in Sri Lanka and is a capital offence in a neighbouring Asian country. It is however a feature of most developed markets. The Sunday Times Business looked at the trading offences, some of which may not remain in the books for too long.

By Dinali Goonewardena

Cherry picking does not take place on a fruit farm. And wash sales don't happen at your local car wash. These are just some of the offences under the Securities and Exchange Commission (SEC) Act and rules which could see your stock broking licence revoked, imprisoned for five years or fined Rs 10 million.

Wash sales involves the execution of a transaction in shares but there is no change in beneficial ownership and the transaction is intended to create a false market. Wash sales are unethical and conflict with Rule 20 of the SEC rulest. A transaction which does not result in a transfer of beneficial ownership can be used to avoid making a mandatory offer to minority shareholders.

The Merchant Bank of Sri Lanka was reprimanded by the SEC for executing wash sales which were used to inflate the company's profits. Lanka Securities the stock broking company which facilitated the wash sales was suspended from trading for five days.

Cherry picking occurs when a broker or investment advisor violates the allocation procedure. Cherry picking is no longer possible under the new automated trading system of the Colombo Stock Exchange where trades are keyed into the system on a real time basis.

Under the old system, a broker would purchase shares during the day, executing numerous orders in the process but would only key the trades into the system at the end of the day. Thereby he would allocate the best trades for himself.

Front running doesn't happen at the Olympics. Infact it is just another offence that could see you hauled over the coals. Front running involves a broker or investment advisor trading ahead of the client while knowing the orders to be executed on behalf of his client.

The astute broker trades ahead of the client with the intention of unloading the shares purchased on his client at a profit. Comtrust Equity Fund had its licence suspended for six months for front running.

Short selling is the sale of shares which are not in the possession of the seller. Barred by the Rules of the Colombo Stock Exchange, naked short selling begets capital punishment in Malaysia. Naked short selling is short selling which is executed without underlying security for the sale. However short selling is a feature of most developed markets and a liquid market is essential for short selling.

The SEC is contemplating permitting short selling in five or six securities in Sri Lanka but this move will be concurrent to permitting share lending and borrowing agreements.

Market manipulation is the creation of a false or misleading appearance of the market for securities, the price of shares or even giving the impression of active trading in securities. Rule 19 of the SEC rules prohibits market manipulation. Chandana Tissera, General Manager Finance of Carson Cumberbatch and Company Ltd, instucted a broker to buy 565,000 Ceylon Brewery shares at Rs 51 on behalf of Carsons and sell 420,300 Brewery shares held by Indo malay Estates at Rs 48.50 and 149,700 shares of Brewery held by the Good Hope Company Ltd at Rs 51. These prices were lower than the prevailing market price and an SEC investigation revealed that the transaction contravened Rule 19.

The offence was compounded by the SEC and the compounding paid into the compensation fund of the SEC. The consequences of market manipulation can be drastic for those engaged in margin trading as new security would have to be furnished to accommodate a falsely depleted share price.

Unit trusts whose unit prices are calculated daily would also be affected. Non disclosure of price sensitive information by a listed company is an offence which contravenes the SEC's rules..

Non dissemination of material information which could have a bearing on the price of securities is an offence as listed companies must disclose information on time and fully. When Kotagala Plantations Ltd chose not to take up a new issue of shares in its subsidiary Lankem Plantations Ltd (LPL) it lost its controlling interest in LPL and its indirect holding of Agrapathana Plantations. The company failed to disclose this information causing the SEC to institute legal proceedings against the company and the directors for aiding and abetting to commit the offence.

Unauthorised kick backs where broker firms pay back a portion of the brokerage commission charged by them to selected clients goes against the grain of the Colombo Stock Exchange rules.

The SEC imposed a trading suspension on Sommervile Stock Brokers for two days for giving kick backs and the firm has appealed to the ministry of finance against the suspension imposed by the SEC.

Trading in the shares of listed companies, while possessing unpublished price sensitive information about the shares of the company is called insider dealing. Unpublished price sensitive information is held by a connected person. And who is a connected person you ask? A director of the company, employee or officer is connected as are his family members including parents and siblings. Friends also figure in the equation.

A person is also connected by virture of being a director of a related company, which includes a holding company, a subsidiary, an associate company or another subsidiary of the company's parent company. A professional or business relationship with an unrelated company may also make you privy to information which should not be used to trade in securities. There is a prohibition on the abuse of information obtained in an official capacity by a public officer.

A connected party, privy to unpublished price sensitive information should not counsel a third party to trade nor should a third party trade in information when there is a reasonable cause to believe that information should not be disclosed except in the performance of the job of the connected party. Trading is also taboo if it can be shown that information received is unpublished and price sensitive. Section 32 and 33 of the SEC Act prohibits insider dealing and seeks to maintain a level playing field between market players.

The CID has instituted court proceedings against Ana Punchihewa for insider dealing.

An SEC investigation had revealed that Punchihewa who was the Managing Director of Pure Beverages Company Ltd had sold 20,000 shares of the company on the Colombo Stock Exchange immeadiately after a board meeting which revealed the company's accounts showed a loss. This price sensitive information was not available to the public.

Market update by Dinali

Political, military forces affect market

The market picked up marginally this week amidst speculation that the UNP widely considered firm favourites of the business sector would win elections. However political analysts scoff at this notion. The market was also rife with speculation that the LTTE's success over security forces in Oddusudan and Nedunkerni bobes ill for the ruling People's Alliance in election time.

The All Share Price Index gained 1.55 per cent to close at 539.54 while the Milanka Price Index rose 2.16 per cent to register 867.89. The MBSL Midcap index rose 2.12 per cent to close at 968.33. Foreign influence in the market was strong, with foreigners contributing 82 per cent towards a record turnover of 281.07 mn on Wednesday. Large quantities of John Keels Holding and National Development Bank were traded.

The week saw net foreign inflows to the tune of Rs 23.5 mn. Average turnover during the week was Rs 98 .9 mn. A parcel of 2.007mn shares of Lanka Ceramics changed hands on Friday when Readywear Group sold a 7 per cent stake to the Ceylon Theatres Group.

Top gainers for the week included Vanik Incorporated 25 per cent, Blue Diamonds 14.29 and Lanka Tiles 13.51 per cent. Profits of Lanka Tiles for the six months to September 30 99 were 34.8 mn, up 121 per cent YOY. Losers included Kapila Heavy 29.41 per cent, Colombo Fort Investment 25 per cent and Overseas Reality 18.18 per cent.

"The market will be speculation driven with the expectation that captive sources may enter the market in early December prior to elections," Head of Research MMBL Phillip securities, Nauzab Fareed said. "A mini rally can be expected in mid December with both parties expressing economic policies in some way," he said. "The economy is on the recovery path but fundamentals have yet to be strong. The first quarter of the year 2000 will be a decisive indicator of where the economy is heading as political affiliations will be clearer and the regional global impact on Sri Lanka will also be clearer," Fareed said.

"The market should hold. It will either go up or stabilise. Prices are holding," Head of Research, CDIC Sassoon Cumberbatch, Diluk Desinghe said.

"Politics and the war can always throw up the unexpected which could lead to a much greater level of volatility than we have seen in the recent past," Strategist, Jardine Fleming HNB Securities, Amal Sanderatne said. "The fighting in the north has negative fundamental implications in terms of a possible escalation in the defence budget, an adverse effect on tourism arrivals and overall uncertainty," he added.

National Chamber of Commerce AGM

The National Chamber of Commerce held its 41 Annual General Meeting last week. However, this year's AGM did not follow the budget as it has done in previous years, because of the government's decision to conduct the presidential elections next month, and accordingly postponed the budget.

Hence the speeches published in the annual report were not relevant as it made references to the budget that was previously scheduled to be tabled two days before the AGM.

In addition to the budget, the Secretary General in his speech said that in keeping with globalisation and the vast development in IT, the Chamber was creating a Management Information System and along with it hopes to launch a website that would be registered on 200 web sites.

Ceylinco insures the Japs

Ceylinco Insurance formed a strategic alliance with Japanese insurance giant Mitsui Marine & Fire Insurance recently for the purpose of serving the insurance requirements of the Japanese companies operating here.

This strategic alliance will focus on Japanese investment and Japanese government funded projects in Sri Lanka and other insurance opportunities. Ceylinco Consolidated Chairman, Deshmanya Lalith Kotelawala said addressing the media after the ceremonial signing.

The two companies will also collaborate in product development and the Sri Lankan insurance market will be benefited by Mitsui's experience, he said.

Mitsui General Manager (Overseas operations) Tatsuo Fujioka said his company hoped to utilise Ceylinco's extensive islandwide presence to reach a large base of prospective clients.

ocals bite into the forbidden fruit{tc "Locals bite into the forbidden fruit"} "Then I took some of the fruit and I ate." Eve regretted her move for she knew that she had sinned. Unlike in the biblical story, Adam and Eve's descendants eat apples (in mythology said to be the forbidden fruit) without feeling guilty about it. Sri Lanka's generally pious community too have got onto the apple cart as they are eating up more of the forbidden fruit. No, not because Satan persuaded them to, but due to the bounty of the fruit at very low prices. The streets of Colombo and other popular market places around the country have seen a dramatic change in the range of fruits available for sale. The screens of greens and yellows of the mango and papaya, which covered many a walk, has been replaced with the reds and greens of apples. Selling at prices as low as Rs. 10, this one time luxury commodity which people looked forward to eating when somebody came from abroad, is now, well, lets just say it has lost its juice. However, apples continue to attract the buyer for its price and its convenience to the traveller, especially because it is widely available at all major and minor transit points. Statistically speaking Sri Lanka's apple consumption went up by approximately 3.1 million kilos of apples in 1998 over the previous years 4.1 million kilos. The quantity of Sri Lankan produce however is drying up. Many local produce such as Bananas, pineapples and papayas droped in voulme in 98 over the previous year. Papayas especially dropped from 31 million fruits to 27 million fruits during the period.

Tea update

Dismal news all round for tea

Production figures are due to drop in the coming weeks due to the death of Livestock and Estate Infrastructure Development Minister, S. Thondaman. Low worker turnout was witnessed in the high and mid grown regions during the course of the week. Workers are not expected to return to work until Monday the latest because of today's Deepavali Festival.

Asia Siyaka Commodities said that consequent to this disruption to work, quantities offered for the public auction of November 23 is expected to decline.

The greatest impact is however anticipated for the sale of December 1. Low grown categories are however not expected to drop because the low country private sector did not esxperience disruption ofwork.

Export figures for September showed a slight decline over the same period last year. Exports for the month of September dropped 2 million kilos from 203.1 million kilos in September 1998. The year on year figure however dropped significantly as it fell over 31.61 million kilos from 189.85 million kilos for January-June 1998 to 158.14 million kilos for the same period this year.

Russia continued to be the largest importer and actually increased its imports over last year marginally.

The greatest change came from Egypt who reduced their import quantity significantly. Imports dropped from 9 million kilos to less than 7 million kilos this year.

This is mainly attributed to Egypt buying from Kenya under the COMESA trade agreement.

Last week's auctions proved to be another disappointing week for the local tea industry as prices continued to slide. Brokers said that buyers tended to discount high price teas of last week that had dropped in quality. As a result there are fewer invoices selling in the top price bracket, Asia Siyaka Commodities said. They added that the greater weight is now concentrated marginally above the tea for price policy. Low prices in other markets were also responsible for bringing down prices here because buyers tend to prefer teas at the lowest prices and hence the price adjustment.

However, it is understood that some additional buying is expected for December to benefit from low prices.

Who should pay for incoming calls?

Pager companies say no to "Caller Party Pays" (CPP) because they believe that the introduction of the system would further affect their already dwindling industry.

In an epic battle between the parties for and against the issue of who should pay for the incoming calls of cellular phones, pager companies argued that cellular phones already affect their business and the introduction of CPP would worsen the situation.

The last of the public hearings held by the Telecommunication's Regulatory Commission, held last week, hosted the three fixed phone operators, four cellular operators, the payphone operators and the pager companies. The fixed phone operators took the stance against CPP supported by the payphone companies and the pager companies while the cellular operators were all guns for it.

Both sides of the argument were heavily supported with mounds of statistics and examples from many countries who have embraced the system in the recent past.

The cellular operators were adamant about the introduction of CPP, stating that the profitability of their companies relied on it. They added that the free incoming calls and one cellular operator's one off charge for incoming calls were introduced in lieu of the introduction of CPP. They said that if CPP was not introduced that they would have to reconsider giving free or charging a one off fee for incoming calls.

On the other hand the fixed phone operators showed cause that it was unfair to charge a premium from a customer calling a cellular phone. They said that the person who owned the cellular phone should be paying the premium for the contactability. They also said that the introduction of CPP was not part of the cellular operators licensing agreement.

The payphone companies in addition to the fixed phone operators argument said that it was an unfair burden on payphone users as most of the payphone users were lower and middle income individuals.

The commission believes that the introduction of CPP is best done in parallel to the introduction of a new national numbering scheme. In addition and according to section 12 of the Telecommunications Act, the commission will initiate a public hearing within three months of the date of this decision to examine affordability and other issues relating to the implementation of CPP. The committee thereafter shall make its decision within six months from the date of initiation of the public hearing. The commission will await the outcome of that hearing before making a final determination relating to the implementation of CPP.

Hot Java will come next year

In vogue with the world, Tritel Services (Pvt.) Ltd. launched netcafe@tritel, in Colombo 6, their first cyber cafe of ten to be opened in major towns in the country.

Surfers get connected at 128 Kbps speed to the World Wide Web on any of the 15 computers available at the cafe.

However, at the moment the cafe does not serve hot cups of Java, but will be introduced soon. Company officials said that tidbits and drinks would be available for surfers from early next year. This addition is expected to top off the company's aim to give the public a world class cyber cafe experience in a pleasing surrounding, with complete user privacy at an affordable price.

A company release said that their rates were cheaper than what a person would pay for a minute if they had a computer of their own with a dial up internet connection. It added that the company was focused on connecting suburban and rural Sri Lanka with the rest of the world not only with state of the art technology, but also with levels of reliability and dependability never experienced before.

Regulator in numbers crunch

By the Business Desk

Plans to introduce a new number system for telecom user next year has come under fire from Sri Lanka Telecom.

Sri Lanka Telecom (SLT) official Mahinda Herath told a telecom watchdog public hearing last week that they (SLT) would consider the system once the tariff re-balancing exercise is completed in 2002.

The Telecommunication Regulatory Commission (TRC) said last year, they intended to unveil a new eight digit numbering system next year.

However, TRC officials said the numbering plan would go ahead as scheduled, as they have not accepted SLT"s proposal.

The existing numbering system for SLT contains 6 digits. All mobile operators have 9 digits. The two fixed access wireless local loop (WLL) operators have 9 digits.

However, the entrance of the WLL operators has caused some confusion. Suntel numbers begin with 074, while Lanka Bell numbers begin with 075. This has led to a certain amount of confusion, as people mistook these numbers for cellular numbers.

Furthermore, some people were wary of acquiring a Suntel or Lanka Bell line as they thought they had to pay for their incoming calls as is charged by cellular operators.

This had given an unfair advantage to the dominant carrier SLT. Industry sources say SLT was at times misleading unsuspecting customers to believe that the WLL operators charged for their incoming calls.

Prior to its launch next year, the TRC intends to embark on an islandwide awareness campaign to enlighten the customer on the impending changes.

The new numbering system would also replace the present 9 digit cellular system, where the prefix '0' would be dropped. Customers dialling long distant numbers would also benefit as they will have to dial only 8 digits.

The numbering system would give a wide range of services like toll-free numbers, premium service numbers, number portability (customers can switch operators but keep the same number) etc. Calls to expensive premium numbers could be barred at the customers' request.

Snippets

Mexico's Telecom Watchdog extends Calling Party Pays

Mexico's Federal Telecommunications Commission said it was extending the system of calling party pays for calls to cellular phones until next April.

Cofetel, as the telecom regulator is known, imposed a 2.5 pesos a minute fee for local calls to mobile telephones in April, ending the practice of cell phone users paying for incoming and outgoing calls in a bid to boost usage.

The watchdog said it has studied the effects on the market in the last six months and is satisfied with the rate it set initially.

Out of the 2.5 pesos a minute, 1.9 pesos goes to the cellular operator and 0.6 pesos goes to Telefonos de Mexico SA for completing the call.

Telenor, Telia plan to spend in Asia

Telenor (Norway) and Telia (Sweden), recently merged telecoms firms, have announced plans to invest between SKr100 bil and SKr300 bil in Asia by 2002.

The first investment of the unnamed merged entity in Asia is the acquisition of a 30% stake in Digi Swisscom (Malaysia), telecoms firm, for USDlr207 mil.

Telia and Telenor are also negotiating with Total Access Communications (TAC) (Thailand), mobile phone operator, over the possible acquisition of a stake, as well as with other operators in the region, according to Arve Johansen, manager of Telia/Telenor's mobile phone division.

Insiders suggest that Telia/Telenor are prepared to acquire around 40% of TAC, for which they would have to pay around Euro120 mil. Bell Canada (Canada) is also reported to be interested in TAC.

Telia and Telenor were each active in SE Asia before the merger, with Telenor holding a 51% stake in Grameen Phone (Bangladesh), mobile phone operator.

Telia holds stakes in telecoms firms in the Philippines, Hong Kong, India, China and Sri Lanka. Telia and Telenor have a combined mobile phone customer base of around 500k subscribers.

Excite buys Bluemountain.com

Excite@Home says it has agreed to buy Bluemountain.com, the world's leading online greeting card company, for at least $780m.

Excite hopes that the acquisition of Bluemountain, the Internet's 14th most visited site in September, will help push its total audience into the top five on the Internet, surpassing Walt Disney's Go Network.

The privately owned Bluemountain.com has been one of the Internet's most enduringly popular sites, attracting more than 9 million monthly visitors.

Visitors to the site can create free, online greeting cards - featuring moving figures and music - which they send by electronic mail.

Excite believes that there are considerable opportunities to sell goods alongside the free cards for events such as birthdays and Mother's Day.

It has signed deals with three firms, including an online florist, which will see them place a combined $34m of adverts on the site in the next three years.

Mannesmann eats into Orange

German telecom and engineering group Mannesmann AG said last week that it planned to list on the London Stock Exchange as soon as possible following its $33 billion takeover of UK mobile phone group Orange Plc.

In its offer document for Orange, Mannesmann also reiterated that it expected net income for the year ending December 1999 to be less than 630 million euros ($662.8 million) in the absence of unforeseen circumstances. The offer document also said Hong Kong conglomerate Hutchison Whampoa — which has agreed to sell its 44.8 percent stake in Orange in return for cash, bonds and a 10.2 percent slice of the enlarged group — would not sell any of the floating rate notes (FRNs) for nine months. "Hutchison has also agreed that it will not, during the first nine months following issue of the FRNs, sell any of the FRNs without prior consent of Mannesmann...Investors should note that this restriction is highly likely to affect the liquidity of the FRNs," Mannesmann said in the 155 page document.

It said Hutchison has agreed to take its full entitlement of the three-year euro-denominated FRNs, worth 3.20 pounds each. Mannesmann is offering a mix of 0.0965 new shares, plus 3.20 pounds in cash and 3.20 pounds in FRNs or a so-called "mix and match" offer of cash and shares.

The Hong Kong company has also agreed to indemnify Mannesmann in the event of losses suffered "if certain provisions in joint venture agreements entered into by Orange" are triggered as a result of the deal going ahead.

Orange, the third largest of Britain's four cellphone companies, has reseller subsidiaries in France and Germany and stakes in network operators in Austria, Belgium and Switzerland.

The Orange brand has also been licensed to operators in Australia, Israel and Hong Kong and will be apply to all new products and services developed by the new group.

Mannesmann shares have come under pressure because of the size of the Orange acquisition and the level of debt it is taking on as a result.

The group, which had been expected to list the enlarged company in London to appeal to Orange shareholders, said it had already indicated that net income levels for this year would be below the 630 million euros reported in 1998.

New chips work faster

Motorola Inc., the world's No. 2 cellular-phone maker, said it developed a chip that will enable new mobile phones to offer fast data services and work on any kind of wireless network.

The chip will be shipped in new Motorola cell phones by the end of next year, said Paul McAlinden, a manager in the company's Wireless Communication Division. Motorola also will sell the new chip to competitors, such as Nokia Oyj and Ericsson AB, who will be able to use it to make phones that can run on any of the world's disparate cell-phone technologies.

The chip's immediate benefits will be faster wireless data speeds and increased productivity for chip engineers, who previously had to work separately on individual chips for each technology. Motorola is betting that the chip could someday bridge the gap between the world's competing wireless standards, which make it difficult to place calls worldwide with one phone.

U.S. wireless carriers now use three technologies: time- division multiple access or TDMA, code-division multiple access or CDMA, and global system for mobile communications or GSM. European and Asian carriers primarily use GSM, though they may use different frequencies than U.S. carriers.

The new chip is the first that can power TDMA, CDMA, GSM or integrated digital enhanced network, or IDEN, phones, McAlinden said. Each chip is expected to cost cell-phone makers $5 to $30, and the chips could be used in as many as 600 million wireless phones by 2003, he said.

The new chip will let phone makers create standard manufacturing processes and scale production for different standards and areas of the world, Motorola said.

NTT seeks equity partner for global expansion

Executives at NTT, Japan's largest company by market capitalisation, began roadshows in Tokyo yesterday to market the sale of the fifth tranche of the telecommunications group's shares.

At the same time, the joint global co-ordinators - Goldman Sachs, Nikko Salomon Smith Barney and Warburg Dillon Read - provided further details of the issue, which is likely to be the largest secondary share issue this year, worth about $13bn.

The discount range for bookbuilding will be 2 per cent, 3 per cent or 4 per cent to the market close on the day of pricing - likely to be between November 5 and November 9.

The discount will depend on demand in the three regional tranches. The co-ordinators also gave details of the likely proportion of shares in each tranche.

They said 690,000 shares, equivalent to 72.48 per cent of the issue, would be offered to retail and domestic institutions in Japan, and 131,000 shares (equivalent to 13.76 per cent), would be offered in each of the North American and international tranches.

The small size of the foreign tranches, and fears they could be scaled back if domestic retail demand is strong, has led to a strong rally in NTT shares as international institutions, particularly in Europe, have bought the stock.

In the previous issue about 30 per cent was sold overseas.

NTT is also recasting its global strategy in an attempt to jump-start its fledgling international services business.

In a potentially major shift from past strategy the Japanese carrier said it has appointed a group of international financial advisers to help seek out "the most appropriate candidate" for an equity partnership for global expansion.

NTT planners and their unnamed international advisers are carrying out a joint study of the carrier's overseas business and partnership options and expect to submit a paper to the main board within the next few weeks.

NTT's partnership plans have surfaced as a result of the carrier's reorganisation into a holding company structure on 1 July, which signalled its status as a fully fledged international services operation.

NTT's current strategy is to turn its loss-making international business into a profitable enterprise generating Y100 billion ($939 million) per year in revenues by the financial year ending March 2002.

The strategic review will focus on global IP, as well as examining the company's strategy in Asia where it has made substantial equity investments.

There also have been rumors that NTT would take an equity stake in Telekom Malaysia [Bhd], but to invest in a legacy telco like TMB would be a waste of money," analysts said.

Cellular subsidiary DoCoMo is targeting the consumer mobile market and wants to use its IMT-2000 expertise to expand its presence in Asia.

Meanwhile, international wireline services arm NTT Communications Corp. last month completed NTT's largest ever international acquisition by investing Y77.6 billion for a strategic equity stake in Philippine Long Distance Telephone Co.

Closer home, Sri Lanka Telecom's (SLT) stake holder and managers NTT are planning a one billion rupee debenture issue to further its expansion project. Meanwhile, SLT CEO Hideki Kamitsuma has said that he would be vacating his post at the end of this year. NTT International Corporation's President and CEO, Satoru Hashimoto will be replacing Mr. Kamitsuma. Mr. Hashimoto will take up his post within the course of next month.

Is the price right?

By Eagle Eye

Fancy interest rates and blitzy media campaigns heralded Hatton National

Bank's (HNB) non voting shares and Seylan Bank's debentures when they opened

last week. However, these issues have come under intense market scrutiny,

and debt analysts are questioning their real values. HNB's 15 mn non voting

share issue is being sold at a Rs. 60 premium. In its publicity material

the bank says it has  paid

an average 40% as dividends over the past year. But don't get carried away

by the 40% dividends, say analysts.

paid

an average 40% as dividends over the past year. But don't get carried away

by the 40% dividends, say analysts.

Investors must remember the 40% is paid on a par, at Rs. 10. This would mean Rs. 4 for every Rs. 10 share. Hence when you pay Rs. 70 you get only Rs. 5.71 (4/70) per share as return, analysts warn. Taking another aspect of it consider Seylan Bank's five year Rs. 200 mn unsecured debenture issue at 14.25% annual interest and 13.35% semi annual interest. Compare it with the five year risk free government bond which gives a 13.63% annual return. Seylan Bank just gives 0.62% above the secured government bond. Not fair is it?

In developed markets gilt edged instruments offer lower interest rates simply because they are secured and there is very little room for a government to default. Corporates on the other hand have to offer higher interest rates to cover a higher risk.

However, in undeveloped markets like Sri Lanka the absence of a proper yield curve leaves room for this type of distortion to take place, they said. This is where a rating comes in. Debt analysts say the public should insist companies get a rating from Duff & Phelps Credit Rating Lanka Ltd (DCR). A credit rating is an opinion on the creditworthiness of the issuer. Ratings are forward looking as it captures the future outlook of an issuer's ability to service and repay debt in full and on time. It is also a relative ranking of the default risk for a given instrument or issuer, in comparison with all other rated debt instruments, says a DCR leaflet.

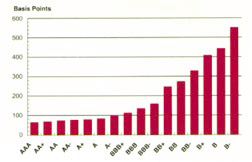

For instance in developed markets like the USA, 'AA+' rated bonds would attract an interest rate of Tbill plus 80 basis points, while 'B-' rated bonds would attract around Tbill plus 560 points (see table). Most recent debenture issues like Seylan Bank, were priced at around 14.2%, just 62 basis points above the five year treasury bond. Note though corporate debentures are listed, neither the rating agency nor the regulators can enhance the issue.

A rating will simply highlight the credit risk so that investors can ask for a higher return. Investors should also be mindful of the risk reward structure - credit risk, liquidity and return. When buying corporate debt, investors should be able to discount the bills before they reach maturity. The government debt market on the other hand is very liquid. A dedicated group of 18 primary dealers are very active quoting two way prices in both primary and secondary issues. However, the corporate debt market lacks trading and they are traded at a discount. If our market was efficient, debentures must trade in correct values at least in the secondary market.

But since our local investors treat a debt instrument like a fixed deposit, the mindset has to be changed. There is also a lack of debt brokers and market makers who will quote two ways.

Seylan Bank officials say the Bank did not opt for a rating under the new debt rules instead went for a reserve fund, which is merely an accounting entry.

Seylan officials said the rating method was not used as DCR has just been set up, since they needed the money fast, they did not want to wait till DCR commenced ratings. Even in the USA, 'AAA' rated bonds need to pay a risk premium of over 75 basis points. But issuers over here get away with paying less, despite our corporate lending rates being proportionately higher.

Most analysts doubt whether any local commercial bank will get a 'AAA or AA+' rating.

With the first round of ratings expected next month, it would be interesting to see investors arguing with issuers to go for a rating with the hope of attracting better returns for their investments.

Inflation down in October

The Colombo District Consumer Price Index (CDCPI base October 1996 to September 1997 = 100) computed by the Central Bank of Sri Lanka indicated an average annual inflation (as reflected by the 12-month moving average), of 4.4 per cent in October.

The point to point increase in the Index (October 1999 over October 1998), was 3 per cent, down from the increase of 5 per cent recorded in September, a Central Bank release said.

In October, prices of several food items increased: rice, low country vegetables, coconuts, green chillies, limes and eggs. These price increases were almost offset by declines in the prices of wheat flour, sugar, up-country vegetables, potatoes, big onions and some varieties of fish. The prices in the liquor, tobacco, betel and arecanuts category increased due to the upward revision of the price of cigarettes.

The Colombo Consumers' Price Index (CCPI base 1952 = lOO) published by the Government Department of Census and Statistics increased by 1.4 per cent to 2386.3 in October. The annual average inflation declined to 4.8 per cent in October from 5.0 per cent in September. The point to point increase moved down to 5.0 per cent from 5.4 per cent in September.

The annual average inflation for 1999 is projected to be less than 6 per cent, compared with 9.4 per cent in 1998. According to the latest figures available for the Greater Colombo Consumers' Price Index (GCPI base January to July 1989 = 100), which is an alternative price index computed by the Department of Census and Statistics, the average annual inflation as at September was 4.5 per cent compared to 4.4 per cent in August.

Singer - People's Bank launch easy payment scheme

Singer (Sri Lanka) Limited and People's Bank, have launched Swarna Vimana a loan scheme with several innovative features.

The scheme enables new customers of Singer as well as People's Bank to buy a wide range of consumer durables and agricultural equipment, under very attractive terms, a press release said.

Singer's product range includes sewing machines, washing machines, refrigerators, TV's, audio and video equipment, kitchen appliances, furniture and agricultural equipment, such as two-wheel tractors, agro scales, water pumps, generators, mammoties etc.

People's Bank will offer loans upto Rs. 100,000 for the purchase of home appliances and Rs. 150,000 for agricultural implements.

The interest rates for loans on home appliances and agricultural equipment is very attractive and competitive with a maximum repayment period for both categories of 24 months.

Loans could be obtained by either individuals or groups of persons, where guarantee and collateral requirements are kept to a minimum.

The Swarna Vimana scheme will be aggressively marketed by the extensive branch network of over 500 of the People's Bank along with the countrywide dealer network of over 200 retail outlets of Singer.

Application forms could be obtained from any of the branches of the Bank or Branch/Approved dealer network of Singer.

HNB is Y2K ready

HNB is fully aware of the millenium Bug and the threat it poses to business continuity. Identifying the issue as a key management priority as early as November 1996 the bank undertook all relevent measures to overcome the problem by appointing a high powered steering committee to look into every aspect of the issue, with the view to resolving the matter within set limits. In its Y2K resolution process the bank adopted the BSI DISC PD -2000- 1 Standard.

Core Banking systems were remediated, using the banks in -house expertise. Remediate systems were tested at both technical and user levels, a bank release said.

Implementation of the Y2K ready core Banking software at all HNB branches was completed by the end of december1998. The bank employed the services of an external auditor to perform an independent assessment of its Y2K activities. This audit was completed in August 1999. The Central Bank also conducted an assessment of the bank's Y2K activities.

Union Bank receives prestigious award

The British Computer Society (Sri Lanka Section) awarded Union Bank " the Best Quality Software Award" for it's on-line Banking service.

UB On-line was an innovative concept developed by Union Bank to enable its customers to interact with the bank through the Web.

This allows Union Bank customers to pay their utility bills, transfer funds from one account to another, get an overall picture of one's relationship with the bank and check one's balances, to name a few.

Union Bank was the first bank to introduce this service to the Sri Lankan banking industry.

The British Computer Society Award recognizes the "excellence" in the software developed. This includes, originality, innovation, commercial success, speed of implementation and social benefit.

Union Bank is the first bank in Sri Lanka to be recognised for its innovative contribution to the Sri Lanka software industry by the British Computer Society, Sri Lanka Section.

New training programmes for apparel industry

Textile Training & Services Centre (TT&SC) and Clothing Industry Training Institute (CITI) - Ratmalana has commenced new training programmes to meet the challenges of quota free trade which is to be effective within the next few years, a news releace said.

TT&SC conducting is courses related to supervisory management to supervisors, foreman, line leaders and similarly grade imparting basic knowledge in management concepts planning, organising, motivation, communication, leadership, group-behaviour and team-work, counselling etc; Courses are conducted in Sinhala and / or English as requested by the client, there is a very good demand for this course from the apparel industry and many industries have already obtained their services.

The other programmes which are in demand, currently are fabric inspection for textile and garment industry, quality and testing, colour matching, stain removal etc: seminars on laboratory testing of textile and garments are also being conducted to industry personnel to understand and interpret test reports in relation to buyer's requirement and intended end- use.

CITI has recently commenced few new training programmes on jigs and attachment technology, computer aided design system lectra system.

General Sewing Data (GSD) and seminars related to productivity, quality, 5S-system etc; to upgrade the knowledge of the industry personnel to modern technology.

CITI is also providing consutancy in collaboration with SIDA to garment industry.

Consultancies has been already provided to eleven organisations. CITI is also in the process of setting up of Quick Response Centre (QRC) for industry to be in line with international market trends and to respond faster to customer requirements of clothing industry.

Nordic mission to Sri Lanka

A group of 30 businessmen, prospective investors and government officials from the Nordic region will be in Sri Lanka from the 13-18 November to explore the possibilities of trade and investment.

The Sri Lanka Export Development Board (EDB, in collaboration with the Board of Investment and the Sri Lanka-Nordic Business Council will coordinate the activities of the mission organised by the Sri Lanka Embassy in Stockholm.

Udaya appointed assembly director

For the first time in history, a Sri Lankan has been appointed as one of the five assembly directors of the prestigious council of universal Federation of Travel Agents association (UFTAA), with its headquarters based in Monaco. A well known personality in the Aviation, Travel and Tourism Industry Udaya Nanayakkara, President of the Travel Agents Association of Sri Lanka was appointed as the assembly director.

Udaya Nanayakkara, counts a vast experience in the field of Aviation, Travel and Tourism and was the Chairman of the organising committees of the two major travel trade events during 1999.

![]()

Front Page| News/Comment| Editorial/Opinion| Plus| Business| Sports| Sports Plus| Mirror Magazine

Please send your comments and suggestions on this web site to