Columns

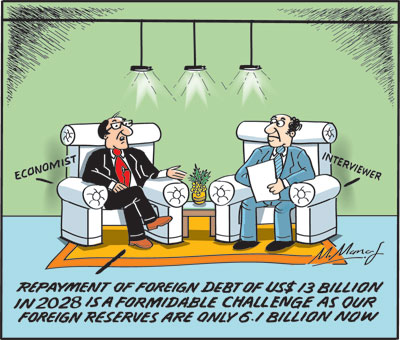

The formidable challenge of foreign debt repayment in 2028

View(s):The repayment of US$ 13 billion of foreign debt in 2028 is a formidable challenge, as we have to increase our foreign reserves from US$ 6.1 billion at the end of September 2025 to over US$ 13 billion in 2028.

How can we increase our foreign reserves that have been around US$ 6 billion for some time to more than double to meet our foreign debt obligations in three years? However, the Central Bank is confident that we can meet our debt repayment obligations.

Debt repayment

Under the agreed debt restructuring agreements, the government has resumed some foreign debt service payments after our default in 2022. However, most debt repayments will begin in 2028, with the country facing annual foreign debt service payments of more than US$2 billion in 2025 and 2026.

Completion

We have achieved the near-completion of restructuring our International Sovereign Bonds (ISB). The first principal payments on these restructured bonds are scheduled for 2028, with maturities extending to 2035.

Bilateral and commercial loans

We have also finalised agreements with major creditors to obtain significant cash flow relief through extended payment periods, reduced interest rates and grace periods for capital repayments until 2028.

Current repayments

Although there is a grace period for repayment of restructured debt, we have made substantial payments in the first half of 2025. External debt servicing amounted to US$ 1.4 billion. A total of $2.2 billion and $2.1 billion in foreign debt service is due in 2025 and 2026, respectively.

Dependence

The country relies on an increasing flow of remittances, tourist earnings and earnings from ICT services to boost foreign reserves. While export earnings have increased, the trade deficit has widened owing to increased imports. Foreign investments have increased modestly, and earnings from services, mostly IT, have increased. Can we expect these to increase substantially to boost our reserves to over US$ 13 billion?

Danger

The inability to meet our foreign debt obligations in 2028 could render the country bankrupt for a second time. This would be financially suicidal. Therefore, ways and means of enhancing the foreign reserves must be found.

End September

At the end of last month, the county’s reserves had risen to a healthy US$ 6.1 billion, adequate to meet import needs. This has made the government liberalise trade. It has even liberalised imports of motor vehicles. There has also been a liberalisation of foreign exchange for travel and to import other consumer items.

Vehicle imports

Amid the liberalisation of vehicle imports, having to accumulate reserves to repay the massive foreign debt is a bigger challenge. The expenditure of US$1.2 billion on vehicle imports, as envisaged by the Finance Ministry, is a significant outflow of foreign funds, given the current context of our external financial liability.

In fact, it is not clear whether this ceiling is still applicable, as there appears to be a continuous flow of vehicle imports.

Increasing revenue

The rationale for vehicle imports was two-fold. First, that the country had not imported vehicles for quite some time and there was a need for vehicles for the tourist trade and other economic activities. The second reason was that vehicle import duties were a source of tax revenue.

Contentious reasoning

Raising revenue through vehicle imports is contentious. Should the government have depleted the country’s foreign reserves that are inadequate to meet its debt obligations to enhance its revenue? Surely there are other taxation measures that fall on conspicuous spending that could have enhanced revenue? Budget The budget to be presented to parliament on November 5 must address this issue. Will it have a strategy to not only contain the fiscal deficit but also to enhance our reserves in the next two years?

Foreign assistance

The country expects to receive financial assistance from the IMF and other multilateral lenders. We expect to receive over $1 billion from the IMF, the World Bank, and the Asian Development Bank (ADB). Although the amount is modest, it will nonetheless assist in meeting the country’s substantial foreign debt obligations.

Aid consortium

Another manner by which we could attempt to secure foreign assistance is from friendly countries like India, Japan, China, Britain, the EU, Australia, Canada, the US and Saudi Arabia. An aid consortium could be formed as in the 1970s and 1980s.

Diaspora Fund

Another fund could be established with contributions from expatriates. The modalities for such a fund could be worked out by the Central Bank.

Summary and conclusion

The repayment of foreign debt of US$ 13 billion in 2028 is a formidable task, as the country’s foreign reserves have to be increased from US$ 6.1 billion at the end of this September to a massive foreign debt of US$ 13 billion. Although foreign reserves are at a comfortable US $6.1 billion at the end of September, they have been at this level for several months. These reserves are adequate to meet the current needs of the country, but they are inadequate to meet the repayment of the mandatory foreign debt of US$ 13 billion in 2028.

There is a need to increase the reserves to enable the repayment of a massive foreign debt of US $13 billion in less than three years. This is a huge challenge, as foreign reserves have been around US$ 6 billion for some time.

There may be a possibility of increasing the reserves by about US$ 4 billion in 2026 and 2027. The question is how would we fund the deficit?

Furthermore, the trade balance continues to widen. Consequently, the country relies on an increasing flow of remittances and tourist earnings, while the trade balance widens. Foreign investments have increased modestly, and earnings from services, mostly IT, have increased. Can we expect these to increase substantially to boost our reserves to over US$ 13 billion? This is a huge task, as the country’s foreign reserves have to be increased from US $6.1 billion at the end of this September to an amount adequate to meet the repayment of a massive foreign debt of US $13 billion in 2028.

Furthermore, the trade balance continues to widen. Consequently, the country relies on an increasing flow of remittances and tourist earnings. Foreign investments have increased modestly, and earnings from services, mostly IT, have increased. Can we expect these to increase substantially to boost our reserves to over US$ 13 billion to meet our foreign debt obligations in 2028? Foreign assistance may be the way out.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment