Big Mac and Burgernomics

View(s): After about 25 years of operations since 1998, on March 24, McDonald’s closed down its business in Sri Lanka. The shocking news was reported widely in both local and international media. The closure of the business was a result of a legal battle in the Commercial Court of Colombo regarding the poor hygienic status of the McDonald’s food served in the country by its local franchisee.

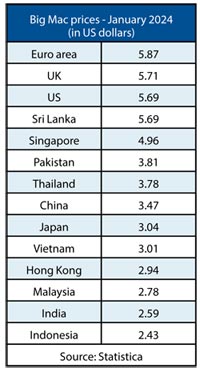

After about 25 years of operations since 1998, on March 24, McDonald’s closed down its business in Sri Lanka. The shocking news was reported widely in both local and international media. The closure of the business was a result of a legal battle in the Commercial Court of Colombo regarding the poor hygienic status of the McDonald’s food served in the country by its local franchisee.McDonald’s is known to be a “cheap” fast-food restaurant all around the world which is also “popular” among the average people in lower income categories. In this respect, Sri Lanka was an exception, however; McDonald’s in Sri Lanka was, perhaps, the “most expensive” in Asia. Locally, it was known to be quite “luxury and expensive” to the local people so that the McDonald’s in Sri Lanka served mostly to the higher-income consumer categories.

“What others want”

Businesses as well as the countries where such businesses are located grow and prosper when they think of producing “what others want”. In contrast, some businesses and their countries struggle to grow and prosper, simply because they attempt to produce “what they want” and try to sell to the others.

Obviously, they can’t sell such goods and services globally, because there is competition. The only option available to them is to get their governments to control competition in the local market. Then, they can force the local customers to buy them. The local customers have no choice other than buying them.

Obviously, they can’t sell such goods and services globally, because there is competition. The only option available to them is to get their governments to control competition in the local market. Then, they can force the local customers to buy them. The local customers have no choice other than buying them.

As a result, such businesses hardly grow beyond the local market boundaries. Local customers also hardly find any better and cheaper products for themselves so that they consume sub-standard products at higher prices. Eventually, the country continues to remain poor.

By observing “what others want” and “how they want it”, McDonald’s global fast-food restaurant chain started about 75 years ago as a small, “drive-in” restaurant in San Bernardino, California in the US. It introduced just a handful of fast-food and drink items, in convenient packaging to make it easier to consume, and through a speedy delivery system enabling the customers to grab it on their way. That’s what others in the modern world sometimes wanted.

With continuous innovations along the same line, over the years McDonald’s became an American fast-food icon. Today, McDonald’s restaurant chain serves closer to 100 million customers each day from over 40,000 restaurants located in 120 countries worldwide.

Law of one price

Given the characteristic of the global presence with identical set of fast-food items, The Economist magazine created in 1986 the so-called “Big Mac Index”. The index illustrates a complex economic concept, purchasing power parity (PPP) of different currencies in the world.

Perhaps, initially it was not intended to be a standard tool for measuring complex economic concepts. However, it has gradually elevated to that position; now the Big Mac Index is globally recognised as a simple measure of the relative prices that would determine exchange rate differences between the countries.

In order to understand this index, we must know what the PPP theory in economics is and, of course, what a Big Mac is. According to an old economic law called the ‘law of one price’, when there is market competition and price flexibility, the price of an identical commodity is the same everywhere. It shows the purchasing power parity (PPP) between two countries or, in other words, the buying power of one currency against another.

In order to understand this index, we must know what the PPP theory in economics is and, of course, what a Big Mac is. According to an old economic law called the ‘law of one price’, when there is market competition and price flexibility, the price of an identical commodity is the same everywhere. It shows the purchasing power parity (PPP) between two countries or, in other words, the buying power of one currency against another.

The commodity that we talk about should be identical. There should not be trade frictions and restrictions. Under these conditions, the price of that commodity, converted to one currency should be the same in every country. If there is a price difference, then what does it mean? It means that there must be market distortions (or no free trade), and exchange rate distortions (through interventions), apart from unavoidable cost differences.

Big Mac Index

Instead of taking a basket of numerous goods and services with complex “identical problems” as it was used to be in the application of the law of one price, the Economist magazine took McDonald’s Big Mac hamburger. The Big Mac is an innovative iconic burger from McDonald’s; its main recipe includes burger bun layers, beef patties, American cheese slices, minced onions, lettuce, special sauce, and other ingredients.

The irony is that the Big Mac is identical all over the world as per the McDonald’s policy, meeting the most fundamental condition of the law of one price. It is learnt that the McDonald’s outlets in

Sri Lanka were closed down by the parent company after a court order primarily because the food served were not identical due to poor hygienic conditions.

What does the Big Mac Index say? If the price of a Big Mac in Sri Lanka is Rs. 1,800, and in the US it is 5.69 dollars, then the relative price should be the ratio between the two prices; that is Rs.1,800 over $5.69, which equals Rs./$316. This means that the rupee-dollar exchange rate should be approximately Rs. 316 per $.

Similarly, if a Big Mac costs 840 yen in Japan, then the yen-dollar exchange rate would be approximately JPY 148 per USD. If it is Indian Rs. 401 in India, then Indian rupee – dollar exchange rate is INR 70 per USD.

If the Big Mac price ratio is higher than the actual exchange rate, it means that the local currency is over-valued against the US dollar (and vice versa). If the local inflation is running at higher rate than in the US, then the exchange rate should depreciate (weaken) against the US dollar.

Cost structures

There is a problem, however: We must consider the cost deviations between the two countries. The US cost structure may be compared well with the Japanese production costs, but can it be compared equally with the Sri Lankan or Indian production costs? Compared with the US, in Sri Lanka and in India, labour costs, utility costs, and rents are lower so that the cost-reflective Big Mac price must be lower than that in the US.

Then, we must also consider the differences in profit margin and the government taxes between the two countries. If they are higher in Sri Lanka than in the US, then apparently the local Big Mac price should rise.

Another important source of the price differences is the “economies of scale” problem. What is the size of the consumer market share which determines the number of Big Macs sold during a given time? The more the Big Macs produced and sold, the lower would be the average cost, due to the benefit of economies of scale. The reverse causation is also true, because if the price is too high, then just a fewer number of Big Macs can be sold, constraining the economies of scale benefits.

Apart from all above factors, one final consideration is a productivity difference between the two countries. For instance, the fact that how many Big Macs are sold per employee during a given time period shows the labour productivity differences, which depends on many other factors pertaining to business operations.

Exchange rate determination

The ‘law of one price’ is, actually, the first step to understand exchange rate determination, which has been presented by the Big Mac Index avoiding all its’ forms of complexities. The subsequent developments have gone far beyond the concept of the ‘law of one price’ capturing the determinants of the exchange rate.

These developments can be placed within two categories: The first is the trade-related foreign exchange flows that determine the long-term exchange rate trends. The second is the portfolio investment-related foreign exchange flows including short-term borrowing that determine its short-term movements.

In Sri Lanka, the long-term exchange rate trend has been on a depreciating path over the past four and half decades due to the country’s weak trade performance. Therefore, its short-term movements have been volatile and sharp as it was dependent primarily on short-term borrowings, stock market and bond market flows.

(The writer is Emeritus Professor of Economics at the University of Colombo and can be reached at sirimal@econ.cmb.ac.lk and follow on Twitter @SirimalAshoka).

Hitad.lk has you covered with quality used or brand new cars for sale that are budget friendly yet reliable! Now is the time to sell your old ride for something more attractive to today's modern automotive market demands. Browse through our selection of affordable options now on Hitad.lk before deciding on what will work best for you!