Columns

A more equitable and pragmatic system needed to reduce Lanka’s fiscal deficit

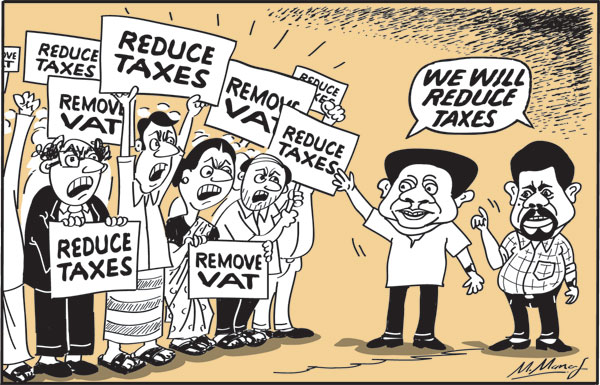

View(s):The widespread discontent and dissatisfaction with the recent increases in personal income taxes and the imposition of the Value Added Tax (VAT) on a number of consumer items have evoked considerable opposition. The reduction of taxes will undoubtedly be a promise opposition parties will give at the upcoming elections.

Protests

Protests and strikes have been held by workers against the new tax regime. The imposition of an 18 percent VAT on a large number of goods and services and the lowering of the income tax threshold to Rs. 100,000 a month have triggered widespread protests that are likely to continue. This raises the question as to whether these taxes are equitable and whether the needed revenue could have been gathered by taxes that were more equitable and effective.

Promise

Opposition parties have promised to reduce these taxes if they form a government. They are likely to promise that they will increase the threshold for taxation and remove the VAT on a large number of essential goods and services.

Will they indicate how they would raise revenue to reduce the fiscal deficit? They are likely to promise that they will tax the rich and decrease government expenditures. This is a popular stance.

Fiscal deficit

There can be no doubt that reducing the fiscal deficit is vital for economic stability and growth. It could be achieved either by increased revenue collection or by reducing government expenditure. A two-pronged strategy of increasing revenue and reducing expenditures must be implemented.

IMF approach

The IMF has advocated a revenue-increasing strategy rather than an expenditure reducing one. The rationale for this is that our revenue collection is as low as 8 percent of GDP. This is due to tax avoidance and tax evasion by high-income earners.

On the other hand, expenditure is in the region of 19 percent of GDP, which is an acceptable level. However, this analysis has not taken into account the large number of unnecessary, extravagant, and wasteful government expenditures.

Revenue

The current revenue collection of 8 percent of GDP is one of the lowest revenue-to-GDP ratios in the world. Countries with our level of per capita income collect about 12 percent of GDP in revenue. Undoubtedly, we too must achieve such a target. This is quite apart from the requirement to comply with the IMF’s conditions for the Extended Finance Facility (EFF).

Equitable taxes

This column has argued for a more equitable system of taxation, whose incidence falls on the rich and affluent and reduces the vast extent of tax evasion and tax avoidance that is the main cause of the low tax-to-GDP ratio of 8 percent. As far as the IMF is concerned, the achievement of a lower fiscal deficit is what matters.

Deaf ears

The proposal to reduce the fiscal deficit by high expenditure taxes in these columns has fallen on deaf years of the government. As it may be acceptable to opposition parties, we repeat these proposals.

Objective

The objective of these proposals is to reduce the fiscal deficit in an equitable and pragmatic manner. Revenue must be increased by increasing taxes, whose incidence falls on the rich and the large number who evade and avoid taxes. It must be complemented by reducing government expenditures.

Rationale

The thrust of our argument is that tax avoidance and tax evasion could be reduced and revenue enhanced substantially by indirect taxes on the expenditure of the rich. This would include much higher annual fees on high-value motor car licences, progressive property taxes, and higher taxes on articles of luxury consumption. In addition to the revenue-enhancing strategy, it should be complemented with a reduction in government expenditure. The current strategy for fiscal consolidation is a revenue-increasing strategy. It should be a two-pronged strategy of increasing revenue and reducing government expenditure.

Government expenditure

The curtailment of government expenditure would not only reduce expenditure but also make taxation more acceptable to people. There is a popular view that taxes are spent wastefully by the government, and therefore evading and avoiding taxes is morally justified. If government expenditures are reduced, there will be a greater willingness to pay taxes.

Wasteful

A clear indication of popular dissatisfaction has been the large defence expenditure, high expenditure on foreign missions, ceremonies, and perquisites (perks) of ministers and parliamentarians. The reduction of the large expenditure on a bloated public service, though necessary, is difficult.

Curtailing these is undoubtedly difficult owing to the country’s political culture, but imperative.

Professionals

The increased income tax measures have been opposed by professionals, especially doctors and university academics. Professions contended that their incomes were inadequate to meet the escalating prices of food, petrol, gas, electricity, and other essentials. This, no doubt, is the reason for a high number of professionals leaving the country, paralysing, especially, the health and university education sectors.

Dilemma

The government is no doubt in a serious dilemma. On the one hand, the higher taxation measures are not yielding adequate revenue. On the other hand, the recent increases in taxes are creating hardships for the people and are opposed by political parties. Even the SLPP, which supports these measures in Parliament, is opposed to the higher taxes.

Inadequate revenue

It has been repeatedly pointed out that Sri Lanka’s revenue collection is one of the lowest in the world, at around 8 percent of GDP. On average, other countries with the same level of per capita income collect about 12 percent of GDP.

The reason for this shortfall is widespread tax avoidance and tax evasion, corruption, and an inefficient tax administration. These have been pointed out in the recent IMF Governance Diagnostic Review. This is a long-term challenge. Therefore, the realistic option is to introduce a system of expenditure taxes that impose heavy taxes on the expenditures of the rich and are unavoidable, reducing the fiscal deficit in an equitable and pragmatic manner.

Conclusion

Reducing the fiscal deficit is imperative for economic stability and growth. It must be achieved through a two-pronged strategy of increasing revenue and reducing expenditures. Revenue must be increased by taxing the rich through expenditure taxes on luxury items. This would be a means of collecting revenue from rich people who evade taxes.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment