News

VAT calculation causing consumer confusion

View(s):- Even VAT unregistered companies are adding VAT burden on customers

- Tax expert says customers have the right to demand businesses to produce TIN number

By S. Rubatheesan

The confusion was mainly due to the method many retail traders used to invoice the goods, where the 18% tax was separately highlighted rather than declaring it as the final VAT-inclusive price alone, a senior Inland Revenue Department official said.

The two different invoicing methods—commercial invoices (without highlighting the breakdown of VAT) and VAT invoices, which explicitly indicate tax—are commonly in use, with many retailers currently adopting the former since most consumers are not VAT-registered taxpayers.

As per the IRD regulations, the TIN number certificates should be displayed by the businesses. Pic by M.A. Pushpa Kumara

The reason, the official noted, was that many businesses are under pressure from customers who demand answers on price increases. The retailers indicate the tax separately on the invoice.

For example, if a retailer is selling an imported book worth Rs 1,000, the final 18% VAT-inclusive price should be mentioned as Rs 1,180 alone without the breakdown in the commercial invoice given to customers. Whereas VAT-registered taxpayers are concerned, a detailed VAT invoice that indicates tax details can be issued by the business entities since a VAT-registered taxpayer is entitled to claim it later.

The sharp increase in VAT from 8% to 18% within two years in many sectors and the removal of exempted items from nearly 90% of the items had a significant impact on consumers.

In addition, the threshold for VAT-paying business entities was also reduced by one-fifth to Rs 60 million from Rs 300 million per annum.

Meanwhile, many customers also complained of “double taxing” by certain small-scale businesses that are not VAT-registered companies.

“Some traders are misusing the ignorance of the people through these kinds of acts. However, customers can demand the Taxpayer Identification Number (TIN) of such an entity before paying their invoice,” said N.M.M. Mifly, retired deputy commissioner general of the IRD.

As per the IRD regulations, the TIN number certificates should be displayed by the businesses.

Mr. Mifly said the IRD should take the lead in taking legal action against unregistered businesses that levy such taxes from the public with the assistance of the Consumer Affairs Authority.

Acknowledging the difficulties faced by consumers due to the VAT increase, the Government announced that nearly 90 types of items, including educational services, electricity, health, medicine, passenger transport, and all vegetables and fruits, are exempt from VAT. Additionally, VAT does not apply to 65 types of items subject to the Special Commodity Levy as well.

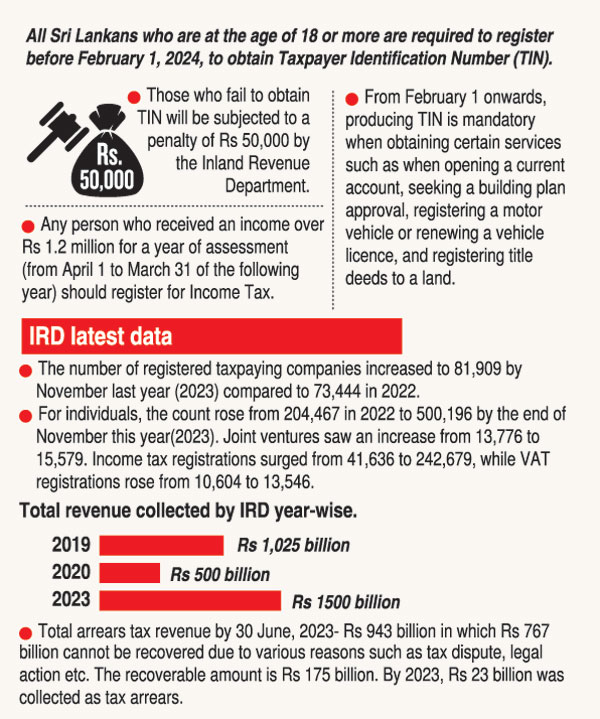

In a recent press briefing at the Presidential Secretariat, Inland Revenue Commissioner A.M. Nafeer said there had been an increase in the number of taxpayers—private companies and individuals.

The number of registered companies grew to 81,909 by November last year, compared with 73,444 in 2022, while the number of individual taxpayers increased from 204,467 in 2022 to 500,196 by the end of November last year.

Joint ventures also saw an increase from 13,776 to 15,579, with income tax registrations rising from 41,636 to 242,679. VAT registrations rose from 10,604 to 13,546 by the end of 2023, according to him.

On total revenue collection, Mr. Nafeer said there was a sharp increase of Rs 1,500 billion through broadening the tax base and modifying tax rates. But revenue had decreased to Rs 500 billion from Rs 1,025 billion in 2019.

| Tax-payment-delaying loopholes to be closed Several amendments will be introduced to the Inland Revenue Act to resolve tax arrears and tax disputes amounting to Rs 943 billion, of which the Inland Revenue Department could only recover Rs 175 billion, a Parliamentary committee was told. At a special meeting chaired by Justice Minister Wijeyadasa Rajapakshe to seek proposals on legal amendments, IRD officials said only Rs 37 billion was collected as tax arrears this year from the total recoverable funds of Rs 175 billion. Mahindananda Aluthgamage, who chairs the Sectoral Oversight Committee on National Economic and Physical Plans, told the meeting that the IRD had been brought before the committee on several occasions and several issues had been identified. Among them was the fact that any person could hold off paying taxes for 15 years. The IRD has 30 months under the existing Act to assess a tax file and another 24 months to consider appeals, according to him. Accordingly, a tax file remains in the department for more than 54 months, and after appealing to the Tax Appeals Commission, they receive two years as per the Act, he said. Thereafter, appeals can be made to the Court of Appeal and the Supreme Court, and that will take up to 15 years, he said.  Justice Minister Wijeyadasa Rajapakshe chairing a special meeting Once the IRD gets the tax report on or before November 30 every year, officials said the relevant officer would enter the information into the RAMIS system and identify cases with problems, and an audit would be done. In some cases, clarifications will be sought, according to a statement from the meeting. In cases where such information is requested, often the tax file holders deliberately delay the information. The officials pointed out that the existing Act allows 30 months for the tax report to be audited by the officer, and after that, there are two more years to hear the appeal after appealing to the Commissioner General. The committee was of the view that the current period of two years for the commissioner to hear appeals is too long, and it is desirable to reduce it to six months. On the powers of the Tax Appeals Commission, the attention of the committee was focused on making amendments to the Tax Appeals Commission Act as well. Currently, the commission has 270 days to hear an appeal, and the minister pointed out the need to give some time for that. The committee decided that the Tax Appeals Commission should consider only the existing questions about the assessment amount or calculations, and if there is any objection to the basic issues, then the necessary amendment to the Act should be brought before the Court of Appeal. | |

The best way to say that you found the home of your dreams is by finding it on Hitad.lk. We have listings for apartments for sale or rent in Sri Lanka, no matter what locale you're looking for! Whether you live in Colombo, Galle, Kandy, Matara, Jaffna and more - we've got them all!