Columns

Impediments to the implementation of the budget for 2024

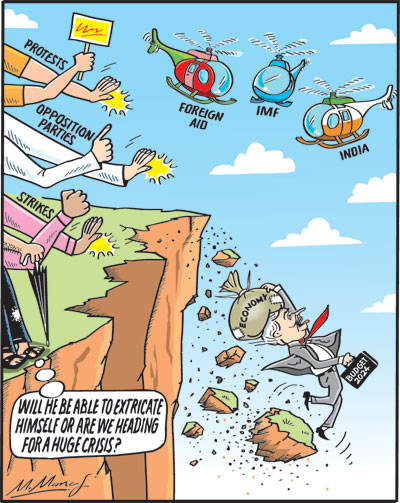

View(s):Although the second reading of the budget was passed in parliament with a clear majority and the third reading will also be passed on December 21, public opposition to it is mounting. There are also difficulties in implementing the complex new tax system. Economic conditions, too, are not favourable for the growth of the economy and increased revenue. External finances, too, are weakening owing to recessionary conditions in Western countries.

Protests and strikes

Trade unions are already protesting, calling for a lower threshold for taxation and asking for a Rs 20,000 increase in salaries. Their agitation may lead to strikes.

Protests

Public protests organised by opposition parties against the budget and privatisation of state-owned enterprises are also most likely. Such protests are likely to grow in the run-up to the elections.

Privatisation

Despite these difficulties, it is likely that several key institutions will be privatised. This would reduce government expenditures and swell the public coffers. Although privatisation proceeds cannot be used directly for budgetary support, they would strengthen government finances.

Implementation

The run-up to the presidential and parliamentary elections is a most unfavourable period for the implementation of fiscal reforms.

Complex tax system

Apart from protests and strikes, the implementation of key tax reforms may face difficulties ow-ing to the complexity of the reforms, inefficient and incompetent tax administration, and inadequate technical skills. New methods of tax avoidance and tax evasion are also likely to be adopt-ed.

Tax system

As discussed in last Sunday’s column, the sophisticated tax system to be introduced could be difficult to implement next year. The technical incapacity and lack of adequate technology could prove a serious disadvantage.

Advanced countries

A complex computerised or digitalised tax system that is suited for developed countries cannot be easily transplanted into a weak tax administration. This does not imply that we should not adopt such a system, but a phased introduction would have been more pragmatic.

For these reasons, the expected increase in revenue may not be realised immediately.

Economy

The slow growth of the economy and low employment and incomes could reduce the taxation capacity. Furthermore, the continuation and expansion of the Israeli-Palestine conflict and the Russian-Ukrainian war have caused global recessionary conditions.

Recession

The contraction of several European economies could severely impact export incomes and earn-ings from tourism and, in turn, depress employment and incomes and reduce tax revenues.

Revenue

All these factors imply reduced revenues, on the one hand, and lower growth or even contraction of the economy. There are few signs of economic growth. A lower GDP would increase the fiscal deficit as a proportion of GDP.

Fiscal deficit

This means that compliance with the IMF condition of a reduction of the fiscal ratio is difficult.

Whether the IMF is likely to recognise these difficulties and continue its Extended Finance Facil-ity (EFF) remains to be seen.

Foreign aid

Consequently, the country would be in need of much higher foreign assistance to tide over diffi-culties.

Debt repayment

This situation is particularly problematic owing to the resumption of debt repayments next year. The repayment of foreign debt obligations next year aggravates the economic difficulties. External reserves could be inadequate to repay debt obligations if the balance of payments deteriorates.

This dimension of the problem will be discussed in a future column.

Summing up

The implementation of the budget proposals, especially concerning higher personal taxation and the implementation of economic reforms, is a tough hurdle to overcome. Political conditions, the complexity of the tax system, and weaknesses in the tax administration are severe difficulties to overcome. The slow economic growth of the economy will reduce tax capacity. Adverse global economic conditions would have serious consequences for exports and external finances.

Prospects

When all these factors are considered, there is little prospect of achieving the reduced fiscal deficit required by the IMF agreement. Some way of convincing the IMF to accept a divergence from the agreed fiscal consolidation path is indeed essential.

Challenging task

The reduction of the fiscal deficit to 8 percent of the Gross Domestic Product (GDP) is a challenging task, as the prospects of economic growth next year have many downside risks. The low-er the economic growth, the more onerous the achievement of a low fiscal deficit as a percentage of GDP.

Economic issues

These significant economic issues need to be understood to comprehend the current difficulties in achieving a lower fiscal deficit and fulfilling the IMF condition of a fiscal deficit of 8 percent of GDP.

Question

Will there be continuity of the fiscal policies under a different regime, and is there a viable alternate economic policy to ensure that the country does not fall into bankruptcy again?

Conclusion

The course of the country’s politics is not conducive to the implementation of the fiscal reforms. We are at the edge of an economic precipice. Can we find a way out of this economic dilemma?

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment