Columns

Prospects of a further improvement in the external finances this year

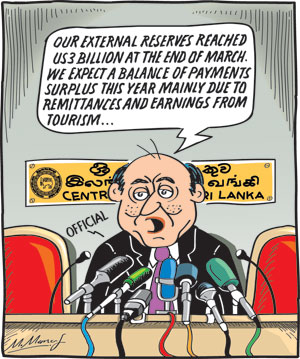

View(s):The external finances of the country have improved and are improving. The improvement in the country’s external finances is expected to be enhanced during the course of the year mainly due to increased remittances from abroad and higher earnings from tourism.

In addition, project loans from bilateral and multilateral sources are expected to boost the reserves during the course of the year.

Foreign reserves

At the end of March, gross foreign reserves were US$ 3 billion. However, this includes a US$ 1.4 billion Chinese credit line that can be used only for imports from China. Therefore, at the end of March, the country’s freely useable reserves were US$ 1.6 billion.

There was a balance of payments surplus of US$ 317 million in the first two months of this year (January-February). This was achieved by a lower trade deficit, increased remittances from abroad and higher earnings from tourism. Remittances and earnings from tourism are expected to increase in the coming months.

Trade balance

The deficit in the merchandise trade account narrowed to US$ 447 million in January-February 2023, from US$ 857 million in the same period in 2022. This was due to the decline in imports being more than the decline in exports.

Inflows

The main reasons for the improvement in the balance of payments in the first two months of this year were the increase in remittances of US$ 850 million and earnings from tourism of about US$ 250 million in January-February.

Expectation

This improvement in external finances in January and February has led to an expectation of an improvement in the balance of payments and an increase in the external reserves by the end of the year. While the trade deficit may widen this year due to reduced exports and increased imports, increases in remittances and earnings from tourism are expected to bring about a balance of payments surplus to boost the foreign reserves. This is quite apart from the first tranche of the IMF credit facility of US$ 333 million that has already been credited in March.

The country’s external finances are expected to improve during the course of the year primarily due to increased remittances from abroad, earnings from tourism and project loans from bilateral and multilateral sources.

Project loans

External reserves are expected to be boosted by inflows of project loans from friendly governments and multilateral institutions, especially the World Bank and the Asian Development Bank (ADB). This inflow is a result of the agreement with the IMF.

Balance of payments

A balance of payments surplus of about US$`1.5 billion could be expected this year, if remittances and tourist earnings continue their uptrend. Furthermore, if foreign developmental assistance flows increase, the balance of payments surplus could be even higher.

Inflows

While remittances are likely to increase, earnings from tourism depend on the conditions in the country being considered safe for tourists.

There is also the possibility of a higher BOP surplus if foreign assistance flows increase as a consequence of the IMF’s Extended Finance Facility (EFF). The confidence generated by the IMF programme is expected to enhance development assistance from multilateral agencies and foreign governments.

Risk

Tourist earnings could be threatened if strikes, political protests, and social unrest and there is a breakdown of law and order. Travel advisories cautioning travellers coming to the country could once again be a serious setback to tourism.

Political unrest

The prospects of an improvement in the external finances this year could be undermined by strikes, political protests, social unrest, and disruption of production. Will political upheavals resume to weaken external finances?

Improvement

Fortunately, at the time of writing, there appears to be a lessening of protests and strikes. Perhaps the end of scarcities and improvements in living conditions have weakened the will for political upheavals and strikes.

Prospects

The balance of payments and the external reserves could improve if the flow of remittances continues and increases and tourist earnings reach around US$ 3 to 4 billion. While remittances are likely to increase to about US$ 5 billion, earnings from tourism are susceptible to the security conditions in the country. If the country is considered safe for tourists and there are no disruptions to travel, tourist earnings could reach US$ 3 to 4 billion to boost the external finances.

Summary and Conclusion

The country’s balance of payments has improved in the first quarter and is expected to improve further by the end of the year mainly owing to increased remittances from abroad and higher earnings from tourism. If the expected foreign assistance for projects materialises, the external reserves would be further strengthened. The external reserves are expected to be boosted by inflows of project loans from friendly governments and multilateral institutions, especially the World Bank and the Asian Development Bank (ADB), and Japan. Many of these projects were halted owing to government decisions and the bankrupt status of the country. With the country’s regained confidence owing to the IMF agreement, much foreign assistance is expected through project assistance.

The bottom line is that our foreign exchange crisis is over.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment